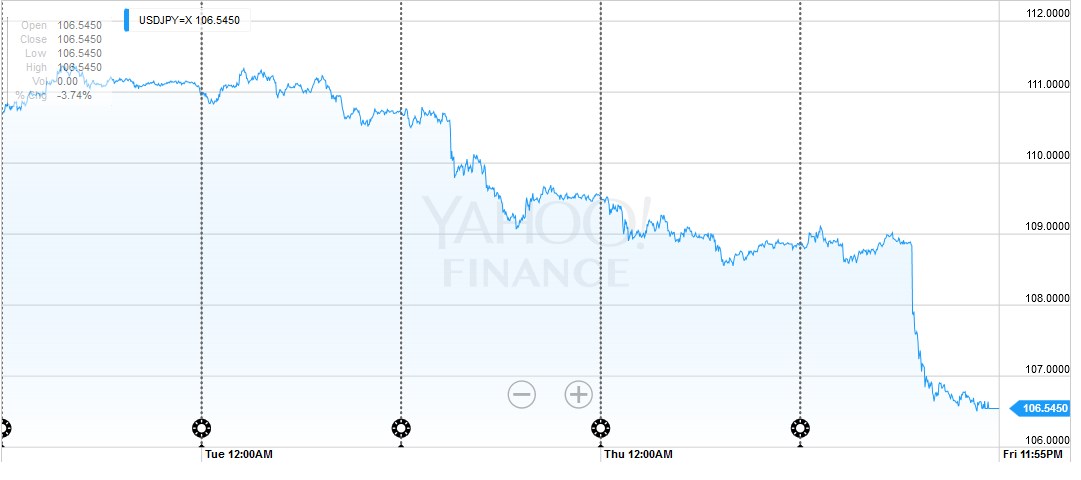

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the shifting view of Fed policy than the expectations in some quarter that the RBA and RBNZ could cut interest rates as early as this week. Indeed, anticipation of Fed policy is shaping the investment climate more broadly than simply the dollar’s exchange rate. The dollar’s setback will likely support a broad array of commodity prices, including oil and gold. It may also support so-called risk assets, emerging market stocks. The market responded dramatically to the shockingly poor jobs growth. At its recent peak in late May, the June Fed funds contract discounted about a 50% chance of a hike this month. Now the pricing is consistent with no chance of a hike. Because the July meeting is so late in the month, the August contract is useful guide, and it too moved dramatically. At the end of May, the August contract had priced in 16.5 bp of a 25 bp hike, or roughly 2/3 or 66%. After the employment data, the market now is pricing in 7.5 bp or 30% of a quarter-point hike.

Topics:

Marc Chandler considers the following as important: Featured, FOMC, FX Trends, JPY, newsletter, USD, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

United StatesYellen speaks shortly after midday in the US on Monday. Most recently she acknowledged that it might be appropriate to raise rates again in the coming months, without being very specific. As a labor economist and an experienced policymaker, she will likely look past the noise of high frequency data and focus on what is the underlying signal. From this vantage point very little changed on June 3. Simply maintaining the assessment, she offered on May 27 would be sufficient to keep the July FOMC meeting live. |

|

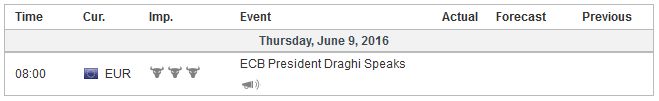

Euro zoneECB President Draghi rendered moot any interest there may have been in the final revision of the eurozone’s Q1 GDP. He noted that Q2 growth is likely slower. The details of Q1 will likely show that the 0.5% expansion was driven by consumer spending and investment. Rather than data, which will not change the investment climate one iota, the most important development in the EMU next week is the beginning of the ECB’s corporate bond purchase program. It is likely to begin off slowly with a few billion euros being bought in the first week. As with the case of the asset-backed bonds, covered bonds, and corporate bonds that are already being purchased, the ECB will provide a weekly update of its efforts.

|

JapanJapanese officials must be frustrated. After bottoming on May 5 near JPY105.50, the dollar strengthened to almost JPY111.50 by the end of May. The dollar eased in the three sessions before the US jobs data. The yen soared after the report more than 2% against the dollar and reached three-year highs against the euro. The yen strengthened 4.3% against the dollar last week, and the five-yen move in four days is likely coming close to the Japanese definition of disorderly market.

However, despite the rhetoric that may be rolled out, the fact that it appears to be more of a dollar move than a yen move may dissuade Japan from intervening. Moreover, the record of unilateral intervention by the BOJ, even when done in size, is not particularly inspiring.

|

|

|

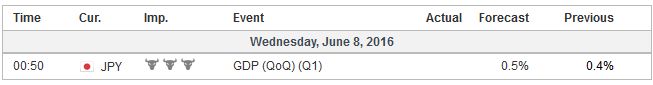

In addition, next week’s economic data, which includes a likely upward revision to Q1 GDP (due to capex) and a large April current account surplus. Recall that the March surplus was the second largest in the past two decades. April is expected to be only a little smaller. The yen finished last week within 0.5% of what by the OECD’s calculation is purchasing power parity.

|

ChinaChina’s new monthly cycle of economic data hits in, earnest in the week ahead. Four pieces of data tend to capture the investors’ attention. Reserves (as a proxy for capital flows), trade, inflation, and new lending. The broad picture that is likely to emerge is one of little improvement, but little evidence that the world’s second-biggest economy is collapsing under the weight of debt that the pessimists have predicted.

If the shifting expectations of Fed policy is one of the key drivers of the investment climate, then the decoupling from China is another important feature of what has transpired in recent months. Consider that over the past 100 sessions, the Shanghai Composite and the S&P 500 are correlated on a directional basis (value) 0.24. In mid-February, that correlation stood near 0.80. On a percentage change basis, the correlation is statistically non-existent at 0.02. Last August is recorded a multi-year peak near 0.45.

|

The dollar peaked near CNY6.59 in the middle of last week. It was sold after the US jobs data, finishing the week, just below CNY6.55. In a softer dollar environment, we expect the yuan to track the dollar as if Chinese officials are reluctant to give the US any advantage for devaluing. In a stronger dollar environment, the yuan may track the basket. The dollar may ease into the CNY6.50-CNY6.52 band.

The US Treasury, even before the Obama Administration, had placed much emphasis on the yuan’s exchange rate. In part due to its own successes in encouraging Chinese officials to accept yuan appreciation, and in part due to policy divergence that underpins the dollar, the yuan’s exchange rate is of less urgency. Also, the PBOC has intervened on both sides of the market, and this weakens the oft-cited accusation that China is seeking wholesale depreciation of the yuan.