While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation, some computer programming expertise and a “research” report, courtesy of Mary Meeker, Henry Blodgett et al. The environmental downside we’re referring to in Bitcoin is, of course, is energy. We alluded to this in a constructive way here when we noted that a new Bitcoin mining hub is developing in

Topics:

Tyler Durden considers the following as important: Alternative currencies, Bitcoin, Blockchains, Bloomberg News, carbon emissions, China, Credit Suisse, Cryptocurrencies, currency, Decentralization, Digital currency, Economics of bitcoin, Featured, Finance, Futures market, goldman sachs, Google, Iceland, Jamie Dimon, JPMorgan Chase, Legality of bitcoin by country or territory, Lloyd Blankfein, Money, newslettersent, SegWit, Themis Trading, Turkish central bank, Twitter, Zurich

This could be interesting, too:

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

investrends.ch writes Bitcoin zieht deutlich an

| While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation, some computer programming expertise and a “research” report, courtesy of Mary Meeker, Henry Blodgett et al.

The environmental downside we’re referring to in Bitcoin is, of course, is energy. We alluded to this in a constructive way here when we noted that a new Bitcoin mining hub is developing in Iceland, where the natural temperature dramatically reduces the cost of cooling computing hardware. The primary energy requirement, however, goes into the computing power to “mine” the Bitcoins. The Bitcoin mining industry can consume 24 terawatt hours of electricity and still be profitable – the Motherboard website provides some context… |

|

| Bitcoin’s incredible price run to break over $7,000 this year has sent its overall electricity consumption soaring, as people worldwide bring more energy-hungry computers online to mine the digital currency. An index from cryptocurrency analyst Alex de Vries, aka Digiconomist, estimates that with prices the way they are now, it would be profitable for Bitcoin miners to burn through over 24 terawatt-hours of electricity annually as they compete to solve increasingly difficult cryptographic puzzles to “mine” more Bitcoins. That’s about as much as Nigeria, a country of 186 million people, uses in a year… De Vries also estimates that the worldwide Bitcoin mining industry is now using enough electricity to power 2.26 million American homes.

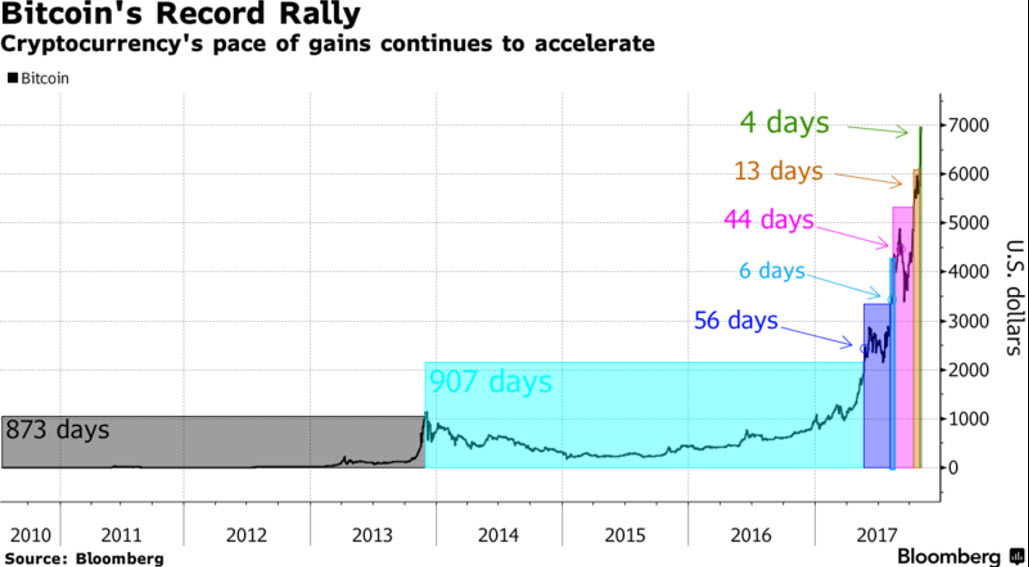

A rapid “Google” later and we discovered that there are 125.8 million American households, so almost 2%. Another way of looking at Bitcoin’s energy consumption is divide the electricity use in Bitcoin mining each day by the number of daily Bitcoin transactions. As the Motherboard notes, each Bitcoin transaction now requires the same amount of electricity needed to power the average American household for one week. Expressing Bitcoin’s energy use on a per-transaction basis is a useful abstraction. Bitcoin uses x energy in total, and this energy verifies/secures roughly 300k transactions per day. So this measure shows the value we get for all that electricity, since the verified transaction (and our confidence in it) is ultimately the end product…This averages out to a shocking 215 kilowatt-hours (KWh) of juice used by miners for each Bitcoin transaction (there are currently about 300,000 transactions per day). Since the average American household consumes 901 KWh per month, each Bitcoin transfer represents enough energy to run a comfortable house, and everything in it, for nearly a week. Since 2015, Bitcoin’s electricity consumption has been very high compared to conventional digital payment methods. This is because the dollar price of Bitcoin is directly proportional to the amount of electricity that can profitably be used to mine it. Unfortunately for the environmentalists, the Bitcoin price – as every bull knows – entered the parabolic phase in 2017. This Bloomberg chart calculates the number of days for each $1,000 rise in price. |

Bitcoin Record Rally, 2010 - 2017(see more posts on Bitcoin, ) |

While Motherboard states that De Vries model isn’t perfect and “makes assumptions about the economic incentives available to miners at a given price level”, the website makes the point that there is clearly a “problem”. According to Motherboard…

That problem is carbon emissions. De Vries has come up with some estimates by diving into data made available on a coal-powered Bitcoin mine in Mongolia. He concluded that this single mine is responsible for 8,000 to 13,000 kg CO2 emissions per Bitcoin it mines, and 24,000 – 40,000 kg of CO2 per hour. As Twitter user Matthias Bartosik noted in some similar estimates, the average European car emits 0.1181 kg of CO2 per kilometer driven.

So for every hour the Mongolian Bitcoin mine operates, it’s responsible for (at least) the CO2 equivalent of over 203,000 car kilometers travelled.

However, you’ve probably been thinking what we’ve been thinking. While the price is going parabolic now, Bitcoin usage might go parabolic in the future, problem solved. While it might help, De Vries pointed out the structural flaw…

As goes the Bitcoin price, so goes its electricity consumption, and therefore its overall carbon emissions. I asked de Vries whether it was possible for Bitcoin to scale its way out of this problem.

“Blockchain is inefficient tech by design, as we create trust by building a system based on distrust. If you only trust yourself and a set of rules (the software), then you have to validate everything that happens against these rules yourself. That is the life of a blockchain node,” he said via direct message.

Motherboard reflects on the cost of Bitcoin’s environmental footprint versus the benefits of a decentralized payment system which avoids the “Too Big To Fails” and their smaller brethren.

This gets to the heart of Bitcoin’s core innovation, and also its core compromise. In order to achieve a functional, trustworthy decentralized payment system, Bitcoin imposes some very costly inefficiencies on participants, for example voracious electricity consumption and low transaction capacity. Proposed improvements, like SegWit2x, do promise to increase the number of transactions Bitcoin can handle by at least double, and decrease network congestion. But since Bitcoin is thousands of times less efficient per transaction than a credit card network, it will need to get thousands of times better. In the context of climate change, raging wildfires, and record-breaking hurricanes, it’s worth asking ourselves hard questions about Bitcoin’s environmental footprint, and what we want to use it for. Do most transactions actually need to bypass trusted third parties like banks and credit card companies, which can operate much more efficiently than Bitcoin’s decentralized network? Imperfect as these financial institutions are, for most of us, the answer is very likely no.

It’s certainly food for thought, even for die-hard libertarians, like ourselves. Then again, perhaps less so for libertarians who’ve been loaded up with Bitcoins in the past few weeks. They would likely be more interested in the bull, bear and neutral cases for Bitcoin in the Bloomberg article linked above. Here is the summary.

With the rhetoric for and against heating up this week amid bitcoin’s barrelling gains, here’s a look at where some big names in finance stand — from those who see it as the natural evolution of money, to the naysayers waiting for the asset to crash and burn.

Bitcoin’s Backers

- The digital currency’s evangelists are led by Roger Ver, known in the industry as “Bitcoin Jesus.” Ver remains optimistic about bitcoin’s sustainability amid attempts from governments like China to curb some of the more speculative elements of trading. “The only way to stop (bitcoin) is to turn off the entire Internet in the entire world and keep it turned off,” he said in a September interview with Bloomberg News.

- Some countries are jumping on the bitcoin bandwagon, with Argentina’s most important futures market considering offering services to investors in digital currencies, while Turkish Central Bank Governor Murat Cetinkaya said digital currencies may contribute to financial stability if designed well.

- Ronnie Moas, who for the past 13 years has made more than 900 stock recommendations via his one-man show at Standpoint Research, upped his 2018 price forecast to $11,000 from $7,500 on Friday. He maintained his $50,000 target for 2027, though he said it was conservative.

Bitcoin’s Detractors

- Severin Cabannes, deputy chief executive officer at Societe Generale SA, was the latest big bank official to weigh in, saying that “Bitcoin today is in my view very clearly in a bubble,” in a Bloomberg Television interview Friday.

- Speculation around bitcoin is the “very definition of a bubble,” Credit Suisse Group AG CEO Tidjane Thiam told reporters in Zurich on Thursday. “The only reason today to buy or sell bitcoin is to make money,” and such speculation “has rarely led to a happy end,” Thiam said.

- Themis Trading LLC raised a red flag this week after CME Group Inc. announced plans to introduce bitcoin futures, saying the world’s largest exchange owner appeared to have “caved in” to pressure from clients. “A bitcoin future would be placing a seal of approval around a very risky, unregulated instrument that has a history of fraud and manipulation,” the firm said in a blog post.

- JPMorgan Chase & Co. CEO Jamie Dimon remains one of Wall Street’s most strident bitcoin opponents, saying in October that people who buy the currency are “stupid” and that governments will eventually crush it.

On the Fence

- While CME’s decision to offer bitcoin futures by the end of the year appears to be an endorsement of the currency’s viability, CEO Terry Duffy demurred when asked whether he’s concerned about a potential bubble. “I’ve seen a lot of different bubbles over the last 37 years,” he said on Bloomberg TV. “It’s not up to me to predict if it’s a bubble or not — what I’m here to do is to help people manage risk.”

- Goldman Sachs Group Inc. CEO Lloyd Blankfein isn’t sure what to make of bitcoin and is unwilling to reject the digital currency just yet. “I know that once upon a time, a coin was worth $5 if it had $5 worth of gold in it,” Blankfein said in another Bloomberg TV interview. “Now we have paper that is just backed by fiat … maybe in the new world, something gets backed by consensus.”

- While Thomas J. Lee of Fundstrat Global Advisors has turned cautious on bitcoin in the short term because of its big gains, he remains a long-term bull on the digital currency — maintaining a 2022 price target of $25,000.

Unfortunately for the environmentalists, we suspect the Bitcoin horse has bolted and only the dreaded hand of government can rein it back.

Tags: Alternative currencies,Bitcoin,Blockchains,Bloomberg News,Carbon Emissions,China,Credit Suisse,Cryptocurrencies,Currency,Decentralization,Digital currency,Economics of bitcoin,Featured,Finance,Futures market,Goldman Sachs,Google,Iceland,Jamie Dimon,JPMorgan Chase,Legality of bitcoin by country or territory,Lloyd Blankfein,money,newslettersent,SegWit,Themis Trading,Turkish central bank,Twitter,Zurich