Overview: The US dollar begins the new month better offered. It is softer against all the major currencies. Short yen positions continue to get unwound, which is leading the move, followed by the Antipodeans, where the Reserve Bank of Australia is expected to hike rates tomorrow. Most emerging market currencies are firmer too, except for a few Asian currencies, the Russian rouble, and, of course, the Turkish lira. Asian and European equities are higher. Japan and...

Read More »A muddled message from The Fed

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went. If you’re still wondering if or how to invest in gold then it might be worth paying attention to what central banks are doing in the coming weeks. After all, how do central banks make their decisions when it comes to monetary policy? In years before it might have been quite straightforward...

Read More »Greenback Softens, but Think Twice about Chasing It

Overview: Aside from political economic risks, three other challenges are emerging. First, the new sub-variant of Covid is spreading rapidly. BA5 reportedly is accounting for around 80% of the new cases. It is better able to evade antibodies from vaccines and earlier infections. Hospitalization rates are also climbing. Dining, retail, and travel may be impacted. Second, the World Health Organization declared monkeypox a global emergency. The US may make a similar...

Read More »Market Pulse: Mid-Year Update

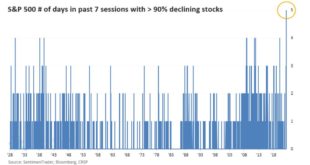

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

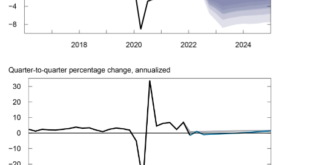

Read More »Sorry Chairman Powell, Even FRBNY Now Has To Forecast Serious and Seriously Rising Recession Risk

At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent. Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament. From there, to try to get the...

Read More »Prices As Curative Punishment

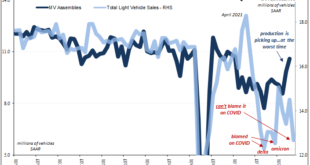

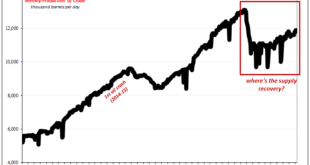

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022. At a seasonally-adjusted annual rate of 12.7 million, it was a quarter fewer than sales put down in May 2021 and 13% below the not-great level from the month prior in April 2022. Such puny results have typically been reserved for those...

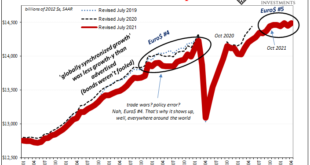

Read More »Peak Policy Error

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US. We’ll simply never know for sure because just when it was happening COVID struck and then governments overrode everything including unfolding history. What anyone can say for sure is that 2019 hit a rough patch where there was only supposed to have...

Read More »‘Unconscionably Excessive’ Denial

What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?” The way the phrase has been inserted, it’s as if Congress today seeks to plant its members on some incorporeal higher plane than mere physical substance, too, diving deep into the moral consciousness of the nation and economy in order justify taking general action. Just last week, the House of Representatives passed a bill which...

Read More »Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him? Whatever the case, there’s truth to what’s written if only because interest rates haven’t been rising based on rising inflation/growth expectations. Quite the contrary, actually. It’s all FOMC and the...

Read More »Collateral Shortage…From *A* Fed Perspective

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods. There was, as I wrote...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org