Overview: The busy week of central bank meetings is off to a mostly slow start. The dollar is narrowly mixed in quiet turnover, except against the Japanese yen. Many participants seemed to exaggerate the risks of a BOJ move next week and dollar continued its recovery that began ahead of the weekend. Among emerging market currencies, central European currencies appear to be aided by the firmer euro. They are resisting the dollar's advance seen against most other...

Read More »Hawkish ECB Comments Boost Risk of a 50 bp Hike Next Month

Overview: The 0.5% decline in US March producer prices pushed on the door opened by the softer-than-expected CPI on Wednesday. The Fed funds futures market sees the year end rate to a 4.33%, while still pricing in a nearly 70% chance of a hike on May 3 to 5.25%. The dollar tumbled to new lows for the year against the euro, sterling, and Swiss franc. The Dollar Index made a new low for the year today, a few hundredths of an index point below the low set in early...

Read More »Investors Shaken by Rising Rates

Overview: The surge in US interest rates and sharp losses in US stocks sent the dollar broadly higher in North America yesterday. The $42 bln of two-year notes auctioned by the US Treasury saw the highest yield in more than a quarter-of-a-century (4.67%) and it still produced a small tail. Sterling, helped by its own surprisingly strong data, was the only G10 currency to have gained against the surging dollar. Still, no important technical levels were breached,...

Read More »US Federal Reserve Sticks To The Script But For How Long?

Those watching the gold price and price of silver will have noticed the sharp uptick following the Federal Reserve’s announcement, yesterday. This was despite the Fed doing exactly what everyone expected them to do. For now, the Federal Reserve is sticking to its relatively well-telegraphed plan but how long will it be until they need to move the goalposts in order to do so? . Gold and Silver prices rose sharply on the Fed’s statement on Wednesday. The change of...

Read More »The Market Appears to Shrug Off the Fed’s Warning

Overview: The US dollar is consolidating in a mixed fashion today. The FOMC minutes drew much attention but failed, at least initially, to spur a significant shift in expectations. The pricing in the Fed funds futures strip is still consistent with a cut later this year, which the minutes were clear, no officials anticipate. Today's US ADP jobs estimate, and November trade balance are being overshadowed by tomorrow's nonfarm payroll figures. The Fed's Harker,...

Read More »Five G10 Central Banks Meet and US CPI on Tap

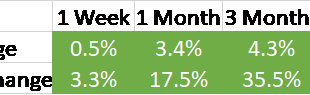

Half of the G10 central banks meet in the week ahead. The Fed is first on December 14, and the ECB, BOE, Swiss National Bank, and Norway's Norges Bank meet the following day. Before turning a thumbnail sketch of the central banks, let us look at the November US CPI, which will be reported as the Fed's two-day meeting gets underway on December 13. The terms of the debate have shifted. It is no longer about when US inflation will peak but how fast it will come down....

Read More »China Shakes Markets, Euro Shakes it Off

Overview: The surging Covid cases in China and the protests in several cities seemed to set the tone for today’s session. Equities are lower. China, Hong Kong, Taiwan, and South Korea were marked down the most. Of the large bourses, only India escaped unscathed. Europe’s Stoxx 600 is off more than 0.8% and US futures are poised to gap lower. Bond markets are quieter. The 10-year US Treasury yield is off a little more than one basis point to around 3.66%. European...

Read More »RBA, FOMC, BOE Meetings Featured while the Greenback’s Recovery can be Extended

The week ahead is important from a macro perspective. The data highlights include China's PMI, eurozone preliminary October CPI and Q3 GDP, and the US (and Canadian) employment reports. In addition, the Federal Reserve meeting on November 2 is sandwiched between the Reserve Bank of Australia meeting and the Bank of England meeting.Let us preview the data before turning to the central banks. Yet the challenge with the data is that the underlying macro views are...

Read More »Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and...

Read More »No One Wants a Recession, but Central Banks are willing to Take the Risk to Demonstrate Anti-Inflation Resolve

The week ahead is busy. Three G7 central banks meet, the Federal Reserve, the Bank of Japan, and the Bank of England. In addition, Japan and Canada report their latest CPI readings, and the flash September PMI are released. There are three elements of the Fed's meeting that are worth previewing. First is the interest rate decision itself and the accompanying statement. Ironically, this seems to be the most straightforward. Even before the August CPI surprise, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org