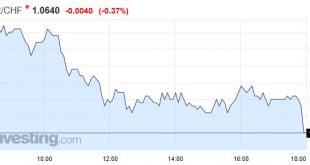

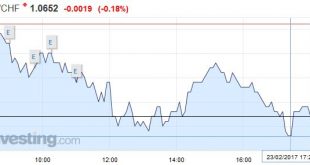

Swiss Franc EUR/CHF - Euro Swiss Franc, February 28(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF GBH CHF continues to see a volatile period with the general global uncertainty which has seen investors favour the safe haven currency. GBP CHF currently sits at 1.25 for this pair and there is resistance at these levels which is preventing the pound from driving higher. Brexit is now...

Read More »FX Weekly Preview: Macroeconomics and Psychology

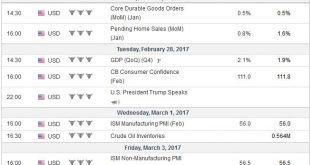

United States There is a broad consensus around the macroeconomic picture. The headwinds slowing the US economy in H1 16 have eased, and above trend growth in H2 16 appears to be carrying into 2017. Q4 16 GDP is expected to be revised to 2.1% up from 1.8%. Many economists appear to accept that a good part, though not all, of the decline in the estimated trend growth in the US, is a function of demographic...

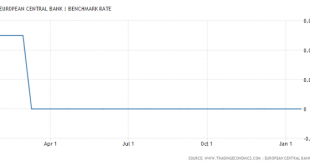

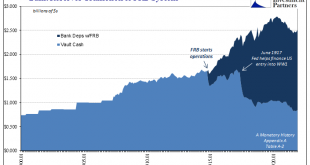

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

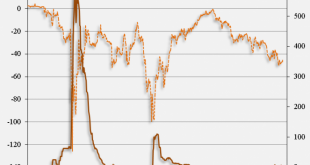

Read More »Are Rate Hikes Bad For Gold?

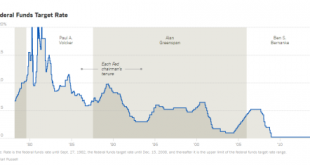

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

Read More »FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

Swiss Franc EUR/CHF - Euro Swiss Franc, February 23(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF This week the House of Lords have been debating the issue of the Brexit bill and assuming there are no amendments made this could see a free run towards the triggering of Article 50 due to take place during March. This helped the Pound to hit its best rate to buy Swiss Francs in 2017 creating some...

Read More »Dollar Index: The Chart Everyone is Talking About

Summary: Many are discussing a possible head-and-shoulders pattern in the Dollar Index. We are skeptical as other technical signals do not confirm. We recognize scope for disappointment over the border tax and the next batch of employment data, but European politics is the present driver and may not be alleviated soon. Here is the chart nearly everyone is discussing. The Dollar Index appears to be carving...

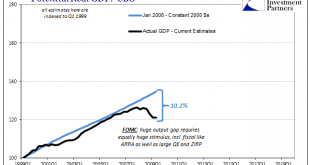

Read More »Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More »A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

Read More »FX Weekly Preview: Yellen’s Path Cleared by Trump’s Moderation

Summary: Trump has moderated in several areas, he is being checked in others, and less impactful in others. This will underscore the focus on Yellen’s testimony this week. At same time, many will be reluctant to short the dollar ahead of the tax reform plans that may be unveiled in Trump’s upcoming speech to Congress. There is a lull in the maelstrom launched by the Trump Administration. His ban on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org