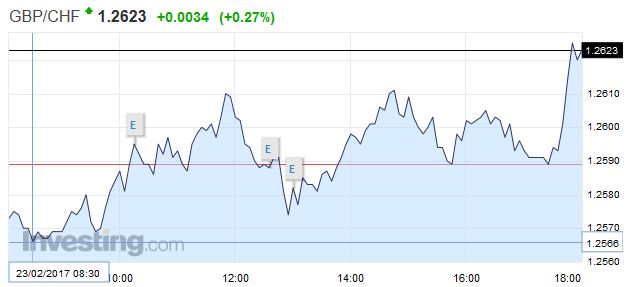

Swiss Franc EUR/CHF - Euro Swiss Franc, February 23(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF This week the House of Lords have been debating the issue of the Brexit bill and assuming there are no amendments made this could see a free run towards the triggering of Article 50 due to take place during March. This helped the Pound to hit its best rate to buy Swiss Francs in 2017 creating some excellent opportunities to send money to Switzerland. However, it is not all plain sailing with the costs to leave the European Union price as high as £50bn according to European Commission president Jean-Claude Juncker. UK economic data has been rather mixed recently with UK GDP for the fourth quarter showing an improvement. However, last week we saw Average Earnings falling and with inflation rising this could cause a longer term problem for the British economy as it means that consumers in theory have less money to spend and we saw the evidence of this only last week with UK Retail Sales showing a fall. Indeed, Retail Sales were at their lowest point in 3 years. There is no real significant data out at the end of this week for either the UK or Switzerland so short term movement is likely to be influenced by what is happening politically in the UK.

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Featured, Federal Reserve, FX Trends, GBP, GBP/CHF, Italy Retail Sales, Jean-Claude Juncker, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 23(see more posts on EUR/CHF, ) |

GBP/CHFThis week the House of Lords have been debating the issue of the Brexit bill and assuming there are no amendments made this could see a free run towards the triggering of Article 50 due to take place during March. This helped the Pound to hit its best rate to buy Swiss Francs in 2017 creating some excellent opportunities to send money to Switzerland. However, it is not all plain sailing with the costs to leave the European Union price as high as £50bn according to European Commission president Jean-Claude Juncker. UK economic data has been rather mixed recently with UK GDP for the fourth quarter showing an improvement. However, last week we saw Average Earnings falling and with inflation rising this could cause a longer term problem for the British economy as it means that consumers in theory have less money to spend and we saw the evidence of this only last week with UK Retail Sales showing a fall. Indeed, Retail Sales were at their lowest point in 3 years. There is no real significant data out at the end of this week for either the UK or Switzerland so short term movement is likely to be influenced by what is happening politically in the UK. If you’re worried about the ongoing uncertainty between Sterling and Swiss Francs and need to make a currency purchase in the next few weeks it may be worth looking at buying a forward contract which allows you to fix an exchange rate for a future date. |

GBP/CHF - British Pound Swiss Franc, February 23(see more posts on GBP/CHF, ) |

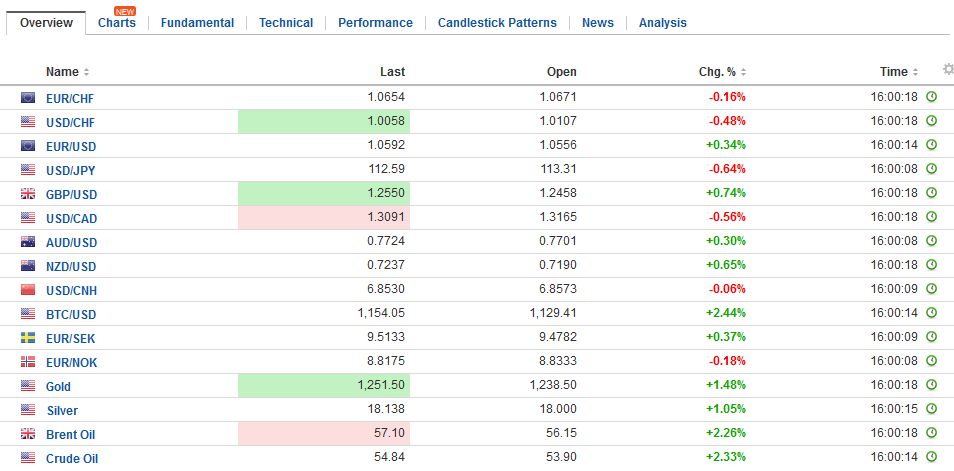

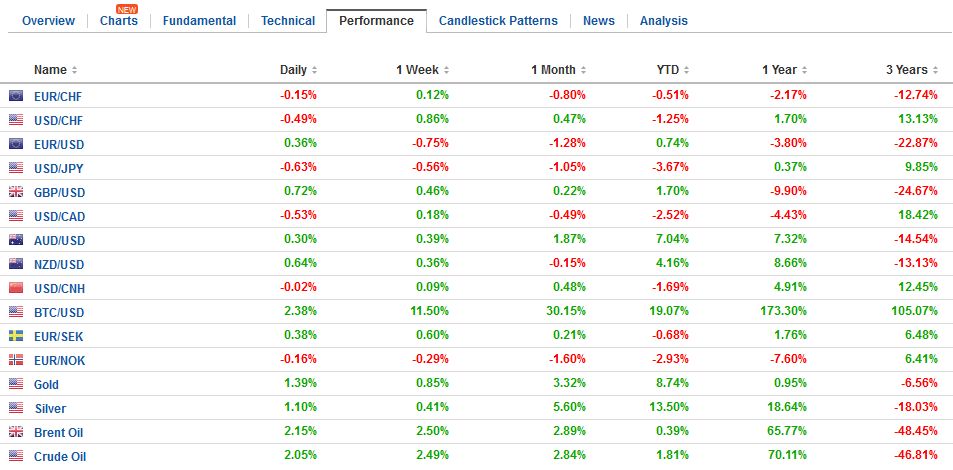

FX RatesThe US dollar is confined to narrow ranges today within yesterday’s ranges. Equity markets posted small gains in Asia and have an upside bias in Europe. Core bond yields are softer, and today this includes France, but peripheral European 10-year benchmark yields are 3-6 bp firmer. Italian bonds are the poorest performer, while the 10-year Dutch bond yields are off the most (3.2 bp to 0.56%) despite the looming election. Industrial metal prices are mostly lower for the third session, while an unexpected decline in the US API oil inventory estimate is helping underpin crude prices. Consider the shift in expectations. Using the Bloomberg calculation of the odds embedded in the Fed funds futures for comparison purposes, there is a 34% chance of a Fed hike in March. A week ago it was 36%. The odds of a May hike have risen to 61.8% from 58.7%. The odds of a June move are unchanged a little above 76% chance. While obviously a significant minority has not given up on a March hike, it is interesting that others are also seeing the merits of a May hike like us. Two regional Fed presidents speak today, Lockhart and Kaplan, but their views are known and will unlikely have much market impact. |

FX Daily Rates, February 23 |

| Look for the focus to shift from the Fed back to the President Trump. In particular, next Tuesday’s speech to a joint session of Congress is seen as key. The Republican tax reform, which had the border adjustment at the center, is unraveling. Look for a post later today that discusses the implications.

In terms of the price action, we note that today is the second day that the euro has spent below $1.06. We suspect it may try again in the North American session to regain a foothold. Yesterday’s roughly JPY112.90-JPY113.75 range looks set to hold. Sterling also is going nowhere quickly and remains in a $1.24-$1.25 range. The dollar-bloc currencies are also little changed. The Australian dollar did manage to recover from its poor capex report. Private capital expenditures fell 2.1% in Q4 16, which is more than four-fold larger than expected. It may have been tempered by the better than expected plans for going forward and the upward revision (-3.3% rather than 4.0%) in Q3. Still, the Aussie struggles near $0.7700. |

FX Performance, February 23 |

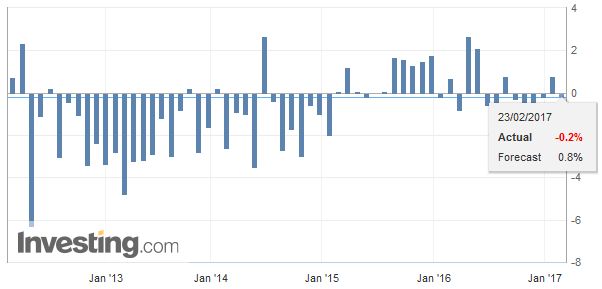

ItalyThe heavy tone of the Italian bonds follows yesterday’s EU warning to Italy, as we had flagged, due to its structural deficit. The center-left PD could decompose, with a few parts of the coalition going running their own candidates. This self-immolation is seen as increasing the likelihood of the populist-nationalist party coming to power. At the same time, the dismal retail sales report is a good reminder that Italy’s debt challenges on the sovereign level are not simply the function of excess spending in the past, though that is part of it, the miserably slow growth. December retail sales were expected to rise 0.2% in December for a 0.9% year-over-year gain. Instead, they fell 0.5% and put the year-over-year rate at -0.2%. The year-over-year rate in December 2015 stood at 0.7% and 0.1% in December 2014. |

Italy Retail Sales YoY, January 2017(see more posts on Italy Retail Sales, ) Source: Investing.com - Click to enlarge |

Politics is also very much in the air in the UK. Yes, the bill to begin negotiating the amputation is making its way through the House of Lords. It is expected to be formally triggered in the next few weeks with the Malta summit being a likely venue in early March. But the issue today is two by-elections. In particular, a defeat for Labour may embolden another challenge to the party’s leadership. Copeland, in Northern England could be won by the Tories. If so, it would be the first time since 1982 that the government took a seat in a by-election from the opposition. If that were not a sufficient insult, UKIP may take the seat in Stoke-on-Trent. It was one of the strongest Brexit votes.

With a light diary today, many participants are still talking about the minutes from the FOMC meeting. A key issue is whether the recent official comments that indicate that March was a live meeting supersede the minutes older minutes. The minutes said that most anticipate a hike “fairly soon.” This does not mean March. In the meetings that preceded the two rate hikes in this cycle, there were mentions in the minutes of the next meeting. There was no such mention this time. “Fairly soon” seemed to be a way to give guidance to the market and distinguish it from “next meeting” but also from waiting for the end of the year as was the case in 2015 and 2016.

This should also make clear, and something the ECB may not quite get with it difficulty in even calling its record minutes. The minutes from the FOMC meeting are not simply an objective report of the meeting, but it is a communication tool. Because it includes voting and non-voting members, we often find that it is noisy, but after the FOMC statement and projections, and comments by the Fed’s leadership, the minutes are the third most important tool in our understanding.

The other revelation in the minutes was the use, starting next month, of fan lines to illustrate the range of uncertainty around economic projections. Many have called for something like this. It will help the investors, many of whom continue to wrestle with the significance of the forecast and confuse them with policy commitments.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,Federal Reserve,GBP/CHF,Italy Retail Sales,Jean-Claude Juncker,newsletter