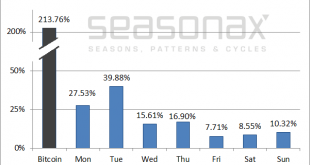

Shifting Patterns In the last issue of Seasonal Insights I have discussed Bitcoin’s seasonal pattern in the course of a year. In this issue I will show an analysis of the returns of bitcoin on individual days of the week. It seems to me that Bitcoin is particularly interesting for this type of study: it exhibits spectacular price gains, it is a very new instrument and it is unregulated. Moreover, it trades around the...

Read More »Plastic bag use continues to drop

A small charge on single-use plastic bags has cut their use by 86% in two years, say food retailers. (Keystone) Consumption of single-use plastic bags in some 30 Swiss food retailers has dropped 86% since they introduced a small charge in 2016. The charge of CHF0.05 (an American nickel) per bag was introduced voluntarily under a sectoral agreement in response to a parliamentary move that would have banned single-use...

Read More »FX Daily, June 05: Dollar Remains on Back Foot

Swiss Franc The Euro has fallen by 0.09% at 1.115 EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve’s patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has...

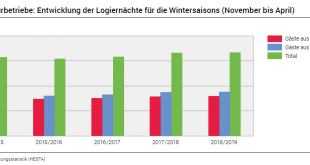

Read More »Overnight hotel stays rose by 0.7percent during the 2018/2019 winter season

05.06.2019 – The hotel industry in Switzerland recorded 16.7 million overnight stays during the winter tourist season (November 2018 to April 2019), i.e. the best result since the winter season of 2007/2008. Compared with the same period last year this represents an increase of 0.7% (+117 000). With 8.8 million overnight stays, foreign demand rose by 1.0% (+83 000). Domestic visitors registered a slight increase of 0.4%...

Read More »A Quiet Revolution Is Brewing

Politics as practiced in a bygone era of stability no longer offers any solutions to these profound disruptions. I recently read a fascinating history of the social, political and economic context of the American Revolution: The Radicalism of the American Revolution by Gordon Wood. What is particularly striking is the critical role played by rapid social changes in the mid-1700s. Conventional histories focus on the...

Read More »Swiss Post processes 800,000 parcels per day

(Ti-press) The number of packages processed by the Swiss Postexternal link office’s three parcel centres has been rising steadily since they opened 20 years ago. During that time, the centres in Härkingen, Daillens and Frauenfeld have handled more than 3.1 billion packages. On average, 800,000 parcels roll along their conveyor belts per day, Swiss Post announced on Mondayexternal link. On peak days during the Christmas...

Read More »FX Daily, June 04: Nervous Calm Settles Over Markets

Swiss Franc The Euro has risen by 0.13% at 1.117 EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between...

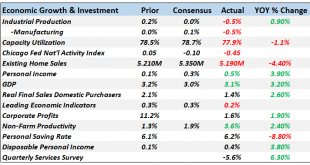

Read More »Monthly Macro Monitor: Economic Reports

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction. But moving in the wrong direction, even deeply, as we discovered in 2015/16,...

Read More »Competition watchdog takes closer look at Sunrise-UPC deal

Sunrise, who is to buy UPC for CHF6.3 billion, expects the deal to go through in Autumn. COMCO, the Swiss Competition Commission, is to intensify its investigation of telecoms operator Sunrise’s takeover of UPC Switzerland, amid fears that the move could create positions of market dominance in several areas. Making the announcementexternal link Monday, COMCO wrote that “initial investigations showed that the buyout...

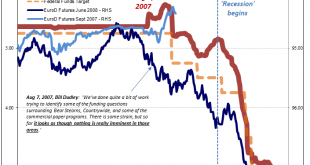

Read More »What Kind Of Risks/Mess Are We Looking At?

The fact that the mainstream isn’t taking this all very seriously isn’t anything new. But how serious are things really? That’s pretty much the only question anyone should be asking. What are the curves telling us about what’s now just over the horizon? I hesitate to use 2008 comparisons too often because many people immediately jump to extrapolations, especially in these more esoteric market indications. If you say...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org