New Focus Article series published on data portal The Swiss National Bank is expanding its offering in the field of statist ics. It is to start publishing articles on selected statistical subjects at irregular intervals. These articles will appear on the SNB data portal (data.snb.ch, Resources, International economic affairs, Focus articles) as so-called focus articles. The first focus article is out now and...

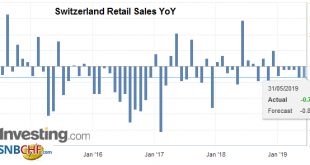

Read More »Swiss Retail Sales, April 2019: -0.1 percent Nominal and -0.7 percent Real

31.05.2019 – Turnover in the retail sector fell by 0.1% in nominal terms in April 2019 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.7% in April 2019 compared with the previous year. Real...

Read More »Switzerland ranked world’s fourth most competitive economy

View of the main building of the Swiss Federal Institute of Technology ETH Zurich. IMD ranked Switzerland highly for its university and management education. Switzerland is Europe’s most competitive nation, coming fourth in the annual global ranking of the Lausanne-based IMD business school. The small Alpine nation climbed from fifth to fourth place in the 63-country competitiveness ranking. It was helped by economic...

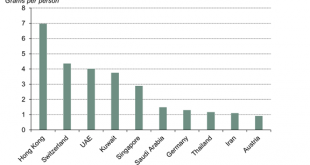

Read More »Gold Investment In Switzerland Remains Very Popular

Investors in Switzerland like gold and it is the second most popular investment after property or real estate 20% plan to invest in gold in the next 12 months Almost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online by Alistair Hewitt of the World Gold Council There’s no doubt about it: the Swiss like gold. Switzerland has the second-highest per capita gold demand in the...

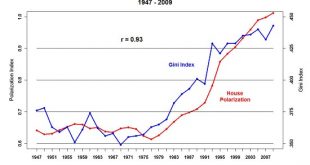

Read More »Why Being a Politician Is No Longer Fun

As a society, we are ill-prepared for the end of “politics is the solution.” It’s fun to be a politician when there’s plenty of tax revenues and borrowed money to distribute, and when the goodies get bipartisan support. An economy that’s expanding all household incomes more or less equally is fun, fun, fun for politicians because more household income generates more income tax revenues and more spending that generates...

Read More »Canada, Mexico, and the USMCA

The US dollar closed today above CAD1.3500 for the first time since January 2. Despite the setback, the Canadian dollar is the strongest of the major currencies year-to-date with a little less than a one percent gain. The yen, in second, has is up about 0.2% (~JPY109.50). Among emerging market currencies, the Mexican peso’s 2.6% gain puts it in in second place behind the Russian rouble’s 7.2% appreciation. It is a...

Read More »FX Daily, May 30: Kill Bull: Intermission

Swiss Franc The Euro has risen by 0.03% at 1.1215 EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After significant moves in equities and interest rates, investors are taking a collective breath, waiting for fresh developments. A nervous calm has settled over the capital market. China, Japan, and Australian equities leaked lower, but...

Read More »Avenues worth exploring in strategic asset allocation

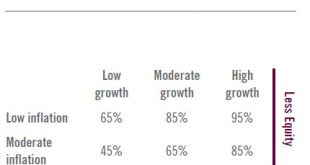

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic...

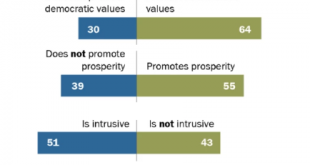

Read More »Europe Comes Apart, And That’s Before #4

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

Read More »Ranking finds Switzerland lagging on wind power

(Keystone / Jean-christophe Bott) In a comparison of European solar and wind power generation, Switzerland ranks near the bottom. Per year and inhabitant, Switzerland produces 250 kilowatt hours of solar (236kWh) and wind (14kWh) power – the amount needed to power a dishwasher, roughly. This puts Switzerland in 25th place when compared with the 28 European Union nations, according to a study published by the Swiss...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org