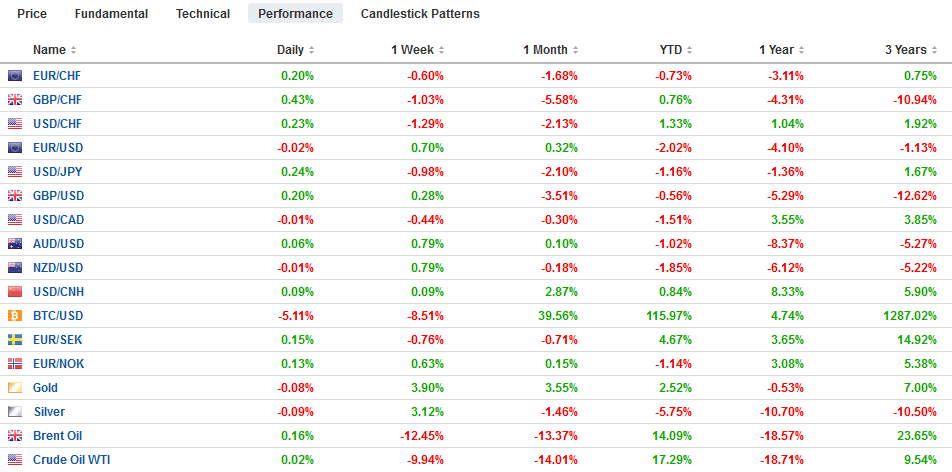

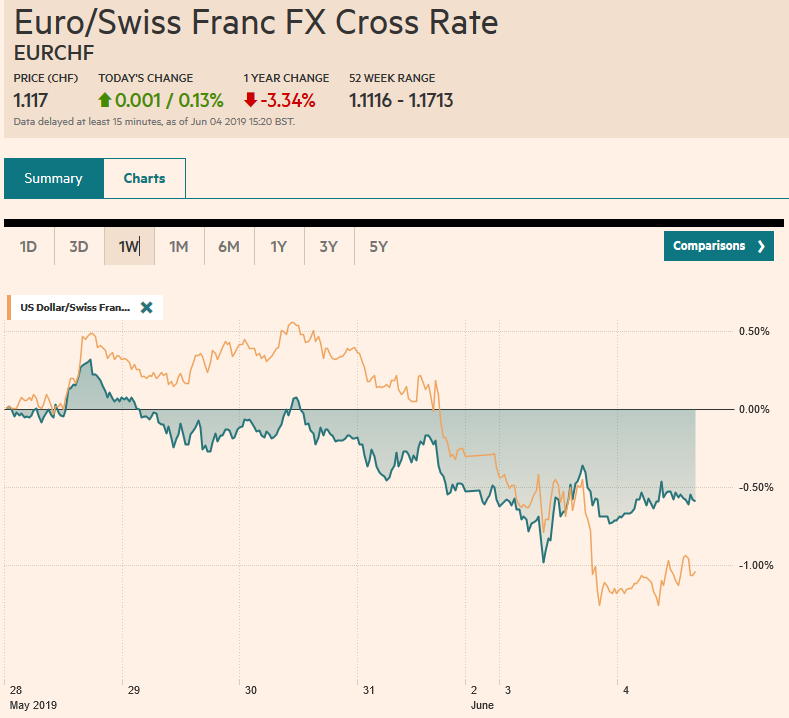

Swiss Franc The Euro has risen by 0.13% at 1.117 EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between the US and China, and the threat of anti-trust action against the largest digital platforms. The decline in equities is moderating today. Most of the large Asian markets were modestly lower, but Singapore, Indonesia, and Thailand gained today and are net gainers over the past week. So is Taiwan, even

Topics:

Marc Chandler considers the following as important: 4) FX Trends, ECB, EUR/CHF and USD/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, MXN, newsletter, RBA, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.13% at 1.117 |

EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between the US and China, and the threat of anti-trust action against the largest digital platforms. The decline in equities is moderating today. Most of the large Asian markets were modestly lower, but Singapore, Indonesia, and Thailand gained today and are net gainers over the past week. So is Taiwan, even though share prices eased today. Australian shares stabilized (~+0.2% vs. -1.2% Monday)) after the central bank delivered its first rate cut in three years. European markets are also firmer. Today is the first six sessions that the Dow Jones Stoxx 600 has risen above the previous day’s high. US shares are trading firmer. The S&P 500 gapped lower last Friday, and that gap, found between roughly 2769.0 and 2776.7 may be of technical importance. The US 10-year is threatening to end the five-day nearly 25 bp plunge, but the sharp drop yesterday kept global yields under pressure. The dollar is narrowly mixed against the majors. The European complex is slightly firmer, but sterling and the Swiss franc. The yen and the Aussie and Kiwi are little changed to marginally softer amid consolidation. |

FX Performance, June 04 |

Asia Pacific

Governor Lowe delivered his first rate as head of the Reserve Bank of Australia and brought the cash rate to a record low of 1.25%. The markets had it fully discounted, and there was not much of a reaction when it came. Lowe did little to sway the market away from expectations that there will likely be a follow-up cut in Q3 and in fact, his statement that expectations for another cut are “not unreasonable” will unpin expectations going forward. The RBA continues to put an emphasis on the labor market, and yesterday’s news of an (8.4%) drop in job postings and news before the meeting concluded today of an unexpected contraction in April retail sales (-0.1% vs. 0.2% median forecast in the Reuters poll) did not help matters. Tomorrow Australia will report Q1 GDP. The quarterly pace may have quickened (0.5% vs. 0.2%), but the year-over-year is likely to have slowed for the third consecutive quarter (1.8% vs. 2.3%).

The African swine flu has forced China to cull its swine herd, though the incentive structure may distort the culling and the slaughter (rush to market). Less feed is necessary, and the decline in soy imports reflect this in part. However, late yesterday, due to what the press described as “atypical mad cow” found in Brazil has forced a halt of beef exports to China. China’s is the largest foreign buyer of Brazilian beef. In 2018, it imported about $1.5 bln of Brazilian beef. To put that in perspective, the cost of US rare earth imports from China were for less than half of that.

The dollar slipped below JPY108 for the first time since mid-January. Weakness in stocks and the rally in bonds was the main pressure. We have highlighted that the JPY107.75 area, which is a (61.8%) retracement of the rally from the flash crash low, and the measuring objective of a chart pattern (double top) is nearer JPY107.00. Yesterday’s high near JPY108.45 may offer nearby cap. On Thursday, there are over $5 bln of in expiring options struck between JPY108.00 and JPY108.50. The Australian dollar marginally extended its recent gains to approach $0.7000 but is consolidating at little changed levels in the European morning. It is holding above $0.6950, where an A$705 mln option is set to expire today. The dollar firmed slightly against the Chinese yuan. AT CNY6.9120 it is at a four-day high.

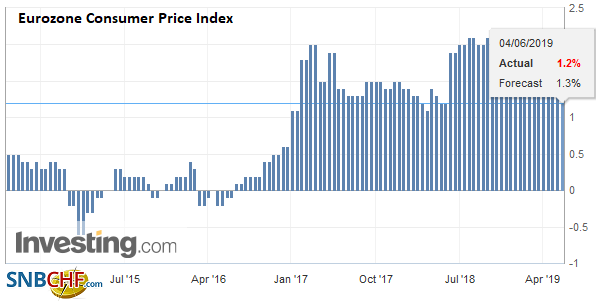

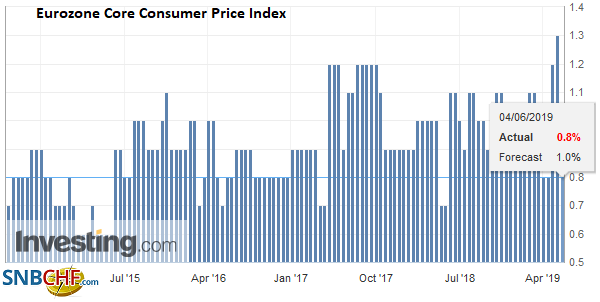

EurozoneA couple days ahead of the ECB’s meeting, the eurozone reported softer than expected May inflation figures. The headline CPI fell to 1.2% from 1.7% in April. Economists had projected a 1.3% pace. The decline is mostly due to core prices (excluding food and energy). |

Eurozone Consumer Price Index (CPI) YoY, May 2019(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The core rate fell to 0.8% from 1.3%. This was also slightly larger move than had been expected. As we noted before, the core rate bottomed in 2015 at 0.6%. The news reinforces expectations that the ECB staff will shave its forecasts and that the ECB will provide generous terms for the new two-year loan facility. |

Eurozone Core Consumer Price Index (CPI) YoY, May 2019(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

In President Trump’s campaign to encourage the UK to leave the EU, he promises “a big trade deal.” Unlike past American Presidents who view an integrated Europe to be in US interests, Trump articulates the concern of others that Europe is free-rider on US defense expenditures and takes advantage of the US on trade. In this rubric, EMU is a small Bretton Woods for German that gives it an economic sphere of influence and dilutes the iron of the old Deutschmark with weaker alloys, giving it a hyper-competitive currency, which it exploits by exporting 47% of its GDP in 2017. One scenario that is being debated is that if the US were to go ahead with Trump’s threatened 25% tariff on autos and then exempts the UK as part of a larger trade deal, EMU car and parts producers and especially German producers would likely have to consider moving production to the UK.

The euro rose by nearly 2/3 of a percent yesterday. It does not sound like much, but it is the biggest single-day advance since January 25. It kissed last month’s high of $1.1265. It extended the gains in Asia, but early European action capped it in front of $1.1280. The $1.1285 area corresponds to a 38.2% retracement of this year’s decline. The 50% retracement is closer to $1.1340., just above the April high of around $1.1325. There are roughly 630 mln euros in an option struck at $1.13 that expires today and 1.4 bln euros at $1.14 that expires shortly after Draghi’s press conference on Thursday. A break of the $1.1200-$1.1215 band now would suggest a high may be in place and a break of $1.1180 would boost that confidence. Sterling’s gains were also extended, and it reached almost $1.2690 before pulling back. It found bids in Europea near $1.2640. A loss of $1.2625 would warn that the 1.3-cent bounce off the end of May lows may have run its course.

United States

St. Louis Fed President Bullard became the first Fed official has mused in public that maybe the case of a rate cut is building. Bullard is regarded as a dove, and it is not so surprising that he is the first to break ranks, so to speak. Still, he is a voting member of the FOMC this year, and the collective wisdom of the market is with him. The implied yield of the July fed funds futures has fallen five basis points since the tariffs on Mexico were threatened to 2.33%, a small chance of a surprise move later this month is beginning to be evident. Bullard suggests that such a move may be needed soon to “prop up inflation” and as an insurance policy against the risks posed by tariffs. Kashkari, the Minneapolis Fed President (non-voter), who is seen to be as dovish as Bullard, said before the weekend, though after President Trump’s tariff threat on Mexico, that he still favored the current wait-and-see stance. There have been no dissents under Powell’s leadership at the Fed. Bullard raises the possibility of one in June. Powell, Williams, and Brainard speak today. Don’t expect much deviation from the “patience” mantra.

With Monday’s loss, the S&P has fallen a little more than 7.5% from its peak on May 1, while the NASDAQ has lost a 10%. Not only is the impact of tariffs and counter-moves weighing on investor sentiment, but fear of anti-trust action (digital platforms) is also hitting the animal spirits. The US 3-month to 10-year yield curve is inverted for the ninth session today. As Jim Bianco noted recently, ten days seems to be a threshold for predicting recessions with an average lead or 311 days (range of the seven episodes since 1968 is 140 days to almost 490 days.

The US reports April factory orders and the final estimate of April durable goods orders. A 2.1% decline in durable goods orders have already been reported, and this drives factory orders, which are expected to have fallen by around 1%. Boeing’s challenges are a big part of the story, but weakness in manufacturing is broader. May auto sales rose nearly twice what the market expected from April’s 16.4 mln seasonally annualized pace to 17.3 mln. It lends credence to the strong consumer confidence readings and indications of household willingness to buy big-ticket items.

The US dollar’s pullback from CAD1.3565 seen last week after the US tariffs on Mexico was tweeted continued earlier today and brought the greenback to about CAD1.3420. The US dollar has not closed below CAD1.34 since the end of April. That said, initial resistance is pegged near CAD1.3460. The peso is also recovering from the worst of its slide. It is trading inside yesterday’s range when the dollar’s surge stalled near MXN19.88 and held above MXN19.60. With the negotiations between the US and Mexico ongoing, the peso remains exposed to headline risks and tweets.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,ECB,EUR/CHF and USD/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,MXN,newsletter,RBA,Trade