Fewer tourists than usual on the Kappellbrücke, Lucerne. (Keystone / Alexandra Wey) The Swiss hotel industry could lose out on up to half a billion francs in 2020 due to the impact of Covid-19, the boss of the country’s tourism body has said. Martin Nydegger of Switzerland Tourism said on Monday that he expects the virus to account for some 2.1 million fewer overnight stays in Swiss hotels this year compared with 2019, amounting to financial losses of CHF532 million...

Read More »Why Sweden’s Negative Interest Rate Experiment Is a Failure

According to the Financial Times’s February 20 article “Why Sweden Ditched Its Negative Rate Experiment,” economists are pondering whether Sweden’s central bank experiment with negative interest rate was a success. Sweden’s Riksbank, the world’s oldest central bank, introduced negative interest rates in early 2015. The reason given by central bank policymakers for the introduction of the negative interest was to counter deflation. Note that for the period November...

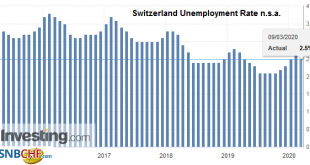

Read More »Switzerland Unemployment in February 2020: Down to 2.5 percent, seasonally adjusted unchanged at 2.3 percent

Unemployment Rate (not seasonally adjusted) Bern, March 9th, 2020 – Registered unemployment in February 2020 – According to surveys by the State Secretariat for Economic Affairs (SECO), 117,822 unemployed people were registered with the regional employment centers at the end of February 2020, 3,196 fewer than in the previous month. The unemployment rate fell from 2.6% in January 2020 to 2.5% in the reporting month. Unemployment decreased by 1,651 people (-1.4%)...

Read More »What Comes After Quantitative Easing?

[In the second part of this interview, Brazilian journalist André de Godoy speaks with Antony Mueller about the relationship between credit and money, the inflationary process, and its relation to the real economy. How will the current debt binge end? What comes after Quantitative Easing?] André de Godoy: Ludwig von Mises mentions in his books that credit expansion is one of the causes of the inflation beyond the monetary expansion. What are the similarities and...

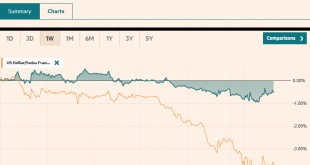

Read More »FX Daily, March 9: Monday Meltdown

Swiss Franc The Euro has risen by 0.07% to 1.059 EUR/CHF and USD/CHF, March 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities plunged, and yields sank as the coronavirus threatens a global recession. The oil price war signaled by Saudi Arabia and Russia aggravates the desperate situation. Equities markets in the Asia Pacific region slumped 3-7%. The Shanghai Composite was fell 3%. The Nikkei was off by...

Read More »USD/CHF Price Analysis: Bears will keep eyes on support trendline from 2015

USD/CHF remains on the back foot despite recovering off-late. 61.8% of Fibonacci retracement will be on the sellers’ radars. Buyers are less likely to take the risk unless revisiting early-2020 levels. USD/CHF registers 1.36% loss to 0.9260 while heading into the European open on Monday. The pair earlier dropped below the longer-term support line, stretched from May 2015, but fails to stay beneath the same off-late. As a result, the bears will await a sustained fall...

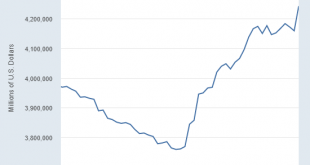

Read More »What the Fed Can Do: Print and Buy, Buy, Buy

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon. Much has been written about what the Federal Reserve cannot do: it can’t stop the Covid-19 pandemic or reverse the economic damage unleashed by the pandemic. But let’s not overlook what the Fed can do: create U.S. dollars out of thin air and use these dollars to buy assets either directly or through proxies. Let’s also not overlook how much the Fed...

Read More »Drivers for the Week Ahead

Risk-off sentiment continues to build as the coronavirus spreads Fed easing expectations continue to intensify; February inflation readings for the US will be reported this week The ECB meets Thursday and markets are split; the stronger euro is doing the eurozone economy no favors The UK has a heavy data release schedule Wednesday; UK government also releases its budget that day Japan has a fairly heavy data week; the yen continues to benefit from risk-off sentiment...

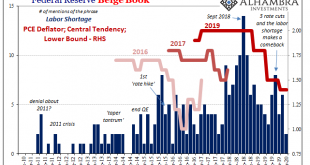

Read More »Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors. The other one has been about this epically tight labor market, which, Jay Powell...

Read More »What Would Murray Say About the Coronavirus?

Murray Rothbard died in January 1995, long before this year’s coronavirus scare. But the principles this great thinker taught us can help us answer questions about the coronavirus outbreak which trouble many of us. Would the US government be justified in imposing massive involuntary quarantines in order to slow down the spread of disease? What about vaccines? If government scientists claim that they have discovered a vaccine for the coronavirus, should we take it? If...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org