The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown. The coronavirus recession is exposing how...

Read More »End the Shutdown

The shutdown of the American economy by government decree should end. The lasting and far-reaching harms caused by this authoritarian precedent far outweigh those caused by the COVID-19 virus. The American people—individuals, families, businesses—must decide for themselves how and when to reopen society and return to their daily lives. Neither the Trump administration nor Congress has the legal authority to shut down American life absent at least baseline due...

Read More »The best Television plans in Switzerland for 2020

I think we can agree that everybody wants to pay as little as possible for their television bills. Even though you may think your current television plan is the cheapest available, there could be new deals since you started using your plan. It is always important to keep up to date with the latest offers. There are many Television offerings in Switzerland. Some are expensive, while some can be cheaper than you thought. In this article, I am going to compare...

Read More »FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

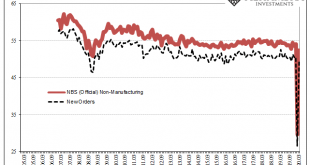

Swiss Franc The Euro has fallen by 0.26% to 1.056 EUR/CHF and USD/CHF, March 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today....

Read More »USD/CHF Price Analysis: Intraday positive move stalls near the 0.9590 confluence region

USD/CHF finds decent support near 0.9500 mark and snaps four days of losing streak. The set-up warrants some caution before positioning for any further recovery move. The USD/CHF pair found a decent support near the key 0.9500 psychological mark and staged a goodish recovery on the first day of a new trading week, snapping four consecutive days of losing streak. The positive move lifted the pair to a short-term descending trend-channel breakpoint, turned resistance,...

Read More »Devisen: Eurokurs im US-Handel nur wenig bewegt – EUR/CHF knapp unter 1,06

Zum Schweizer Franken notierte der Euro am Abend weiterhin unter der Marke von 1,06. Konkret wurde das EUR/CHF-Währungspaar bei 1,0587 gehandelt, nach 1,0566 am frühen Abend bzw. 1,0592 am Morgen. USD/CHF ging zu 0,9607 um nach 0,9578 bzw. 0,9558. Dass der Franken zum Euro nicht stärker geworden ist, dürfte wohl der Schweizerischen Nationalbank (SNB) zu verdanken sein. Die SNB hat wohl auch in der vergangenen Woche weiter mit Devisenkäufen gegen eine Aufwertung des...

Read More »Swiss real estate market suffers fallout from epidemic

The Covoid-19 epidemic has an impact on Switzerland’s real estate market. (Keystone/Ennio Leanza) The Covid-19 crisis could spell an end to the previously rosy situation for Switzerland’s real estate investors. Investors in residential property look back on a successful 2019 both in terms of value increase and of returns. Forecasts for the current year were optimistic until recently, for both property owners and renters. The Swiss National Bank’s negative interest...

Read More »Swiss firms rush to claim emergency coronavirus loans

High street shops have been closed and some production facilities have been ordered to shut down. (© Keystone / Gaetan Bally) A third of a CHF20 billion ($21 billion) fund offering state guaranteed loans to small and medium sized Swiss companies has been used up just four days after being introduced. The loan facility has already promised CHF6.6 billion in funding of up to CHF500,000 to nearly 32,000 firms – an average of CHF207,000 per company. The speed at which...

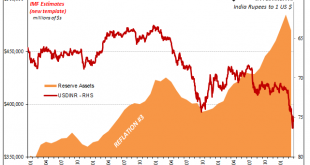

Read More »(No) Dollars And (No) Sense: Eighty Argentinas

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark. Over the last several crisis-filled weeks, officials in India have been fighting against a...

Read More »Oren Cass and the Conservative Critique of Pure Laissez-Faire

Oren Cass is the executive director of American Compass (AmericanCompass.org), a conservative think tank that stresses the importance of family and domestic industry, in opposition to a singleminded devotion to economic efficiency. Cass was previously a senior fellow at the Manhattan Institute for Policy Research, and was the domestic policy director for Mitt Romney’s 2012 presidential campaign. Bob and Oren have a friendly discussion about their disagreements on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637211742211799359-310x165.png)