USD/CHF finds decent support near 0.9500 mark and snaps four days of losing streak. The set-up warrants some caution before positioning for any further recovery move. The USD/CHF pair found a decent support near the key 0.9500 psychological mark and staged a goodish recovery on the first day of a new trading week, snapping four consecutive days of losing streak. The positive move lifted the pair to a short-term descending trend-channel breakpoint, turned resistance, which coincides with 50-hour SMA and 23.6% Fibonacci level of the 0.9902-0.9502 downfall. The mentioned confluence region might now act as a key pivotal point for short-term traders, above which the recovery momentum could further get extended towards 38.2% Fibo., around mid-0.9600s. Given that

Topics:

Haresh Menghani considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF finds decent support near 0.9500 mark and snaps four days of losing streak.

- The set-up warrants some caution before positioning for any further recovery move.

| The USD/CHF pair found a decent support near the key 0.9500 psychological mark and staged a goodish recovery on the first day of a new trading week, snapping four consecutive days of losing streak.

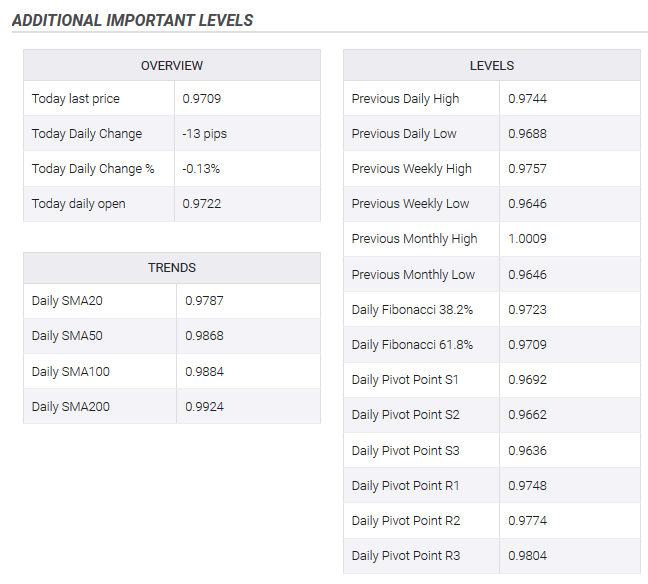

The positive move lifted the pair to a short-term descending trend-channel breakpoint, turned resistance, which coincides with 50-hour SMA and 23.6% Fibonacci level of the 0.9902-0.9502 downfall. The mentioned confluence region might now act as a key pivotal point for short-term traders, above which the recovery momentum could further get extended towards 38.2% Fibo., around mid-0.9600s. Given that oscillators on 4-hourly/daily charts are yet to confirm bullish bias, neutral technical indicators on the 1-hourly chart warrant some caution before positioning for any further appreciating move. Hence, it will be prudent to wait for some strong follow-through buying before confirming that the pair might have already bottomed out in the near-term and stalled the recent pullback from multi-month. On the flip side, the 0.9500 mark might continue to protect the immediate downside, which if broken might be seen as a fresh trigger for bearish traders and set the stage for an extension of the downtrend. |

USD/CHF 1-hourly chart(see more posts on USD/CHF, ) |

Tags: Featured,newsletter,USD/CHF

-637211742211799359.png)