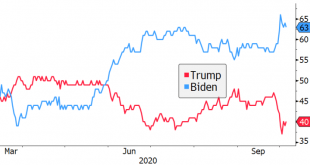

The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises Weekly jobless claims will be reported; like last week, there will be a quirk to this week’s initial claims;...

Read More »Problems with Theories on the Black-White Wealth Gap

The wealth gap between white and black Americans is frequently discussed. Today it’s becoming popular to attribute disparities to black culture. Clearly all cultures are not equal, but can the subculture of some black American communities explain variations within the wealth gap? For instance, fifty people in an inner-city neighborhood may engage in maladaptive activities; however, their actions are atypical of the broader black community. Discussing this issue is...

Read More »FX Daily, October 08: Markets Catch Collective Breath

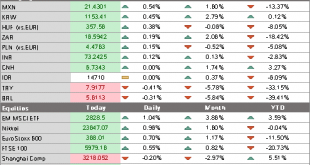

Swiss Franc The Euro has fallen by 0.05% to 1.0781 EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday’s presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before...

Read More »Swiss bank caught in Venezuelan money-laundering scandal

As a Swiss bank gets slapped for breaching money-laundering rules, this sculpture in Caracas pays homage to the oil workers of Petroleos de Venezuela SA (PDVSA). Keystone / Rayner Pena R The Swiss Financial Market Supervisory Authority (FINMA) has found that Banca Credinvest “seriously violated money-laundering regulations” in its handling of Venezuelan client relationships. On Tuesday the watchdog announced that it had ordered the Ticino-based bank to monitor all...

Read More »If the US Adopts Eurozone Policies, the Jobs Recovery Will Suffer

The best social policy is one that supports job creation and rising wages. Entitlements do not make a society more prosperous, and ultimately drive it to stagnation. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros. Original Article: “If the US Adopts Eurozone Policies, the Jobs Recovery Will Suffer“. You Might Also Like Walter Berns and the Cult of...

Read More »FX Daily, October 07: The Day After

Swiss Franc The Euro has risen by 0.18% to 1.0785 EUR/CHF and USD/CHF, October 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s tweet announced that negotiations with the House Democrat leadership had collapsed, and there will be no further talks until after the election. Many economists had been removing it from their Q4 GDP projections, but the market was caught wrongfooted. Risk came off....

Read More »EasyJet reduces fleet and cuts jobs in Switzerland

Easyjet Switzerland says it doesn’t expect a return to pre-Covid 19 business levels until 2023. Keystone / Georgios Kefalas Faced with lower demand and with no recovery expected anytime soon, EasyJet Switzerland is withdrawing two of its 12 planes stationed in Basel. Seventy jobs will be lost. Making the announcement on Tuesday, the airline company said it was consulting staff representatives on the fate of the jobs concerned. “EasyJet Switzerland has so far managed...

Read More »Dollar Softens and US Curve Steepens as Odds of Democratic Sweep Rise

The dollar remains under pressure; the US curve continues to steepen; a compromise on fiscal stimulus before the election still seems unlikely; this is another quiet day in terms of US data President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery; we expect the ECB to increase its PEPP in Q4 German factory orders came in much stronger than expected; Russia reports September CPI RBA delivered a dovish hold; the Australian...

Read More »If We Want to Increase Demand in the Market, We Must First Increase Production

Following the ideas of John Maynard Keynes and Milton Friedman, many commentators associate economic growth with increases in the demand for goods and services. Both Keynes and Friedman held that the Great Depression of the 1930s was due to an insufficiency of aggregate demand and that thus the way to fix the problem was to boost aggregate demand. For Keynes, this could be achieved by having the federal government borrow more money and spend it when the private...

Read More »Silver Falls, We’ve Got #$*&! Mail

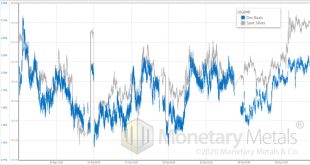

There was a big drop in the price of silver last Wednesday. Then the price moved up, and down, but mostly up. Let’s look at a graph of the silver price and basis showing Sep 30 through Oct 5, with intraday resolution. Let’s take a look: It’s remarkable how the basis tracks the price, until Oct 5. When basis tracks price, this means the action is primarily in the futures market. At times when the price is rising, the basis is rising—which simply means that the spread...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org