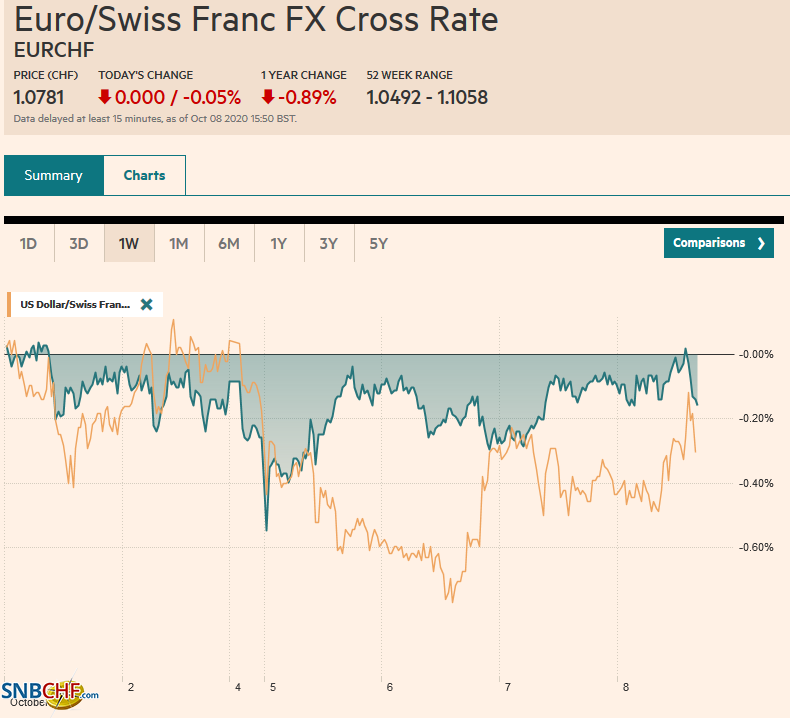

Swiss Franc The Euro has fallen by 0.05% to 1.0781 EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday’s presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before the election, but the near round-trip seen in stocks and bonds was surprising. The dollar surrendered the lion’s share of the gains it had registered, and the US 10 and 30-year yields approached four-month highs. Led by more than 1% gains in Taiwan, Australia, New Zealand, and India, the MSCI Asia Pacific

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, ECB, EUR/CHF, Featured, Federal Reserve, New Zealand, newsletter, trade, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.05% to 1.0781 |

EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

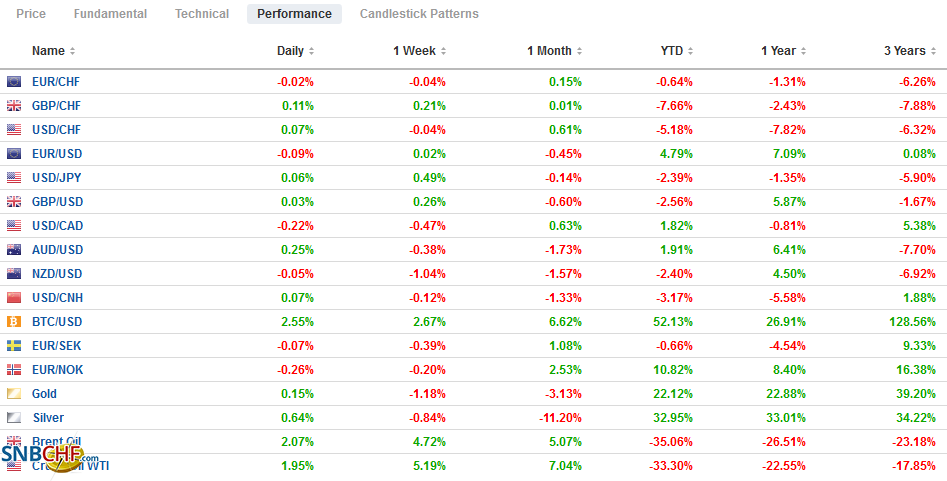

FX RatesOverview: The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday’s presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before the election, but the near round-trip seen in stocks and bonds was surprising. The dollar surrendered the lion’s share of the gains it had registered, and the US 10 and 30-year yields approached four-month highs. Led by more than 1% gains in Taiwan, Australia, New Zealand, and India, the MSCI Asia Pacific Index rose for the fourth consecutive session and reached its best level in about three weeks. Europe’s Dow Jones Stoxx 600 is about 0.5% higher near midday in Europe and is pushing above its 200-day moving average. US stocks are also extending yesterday’s gains. Bond markets were mostly lower in Asia, following the US’s rise yesterday, but US and European bonds are firmer today. The two basis point decline in the US yields brings it back toward 0.76%, while Spanish bonds are taking the lead from Italy. The greenback is narrowly mixed against the major while the Mexican peso is the strongest among emerging market currencies. The JP Morgan Emerging Market Currency Index is rising for the seventh session of the past eight. Gold is firm, but below $1900, and November WTI is trying to secure a foothold above $40 a barrel from which to launch a challenge to the 200-day moving average near $41.20. |

FX Performance, October 08 |

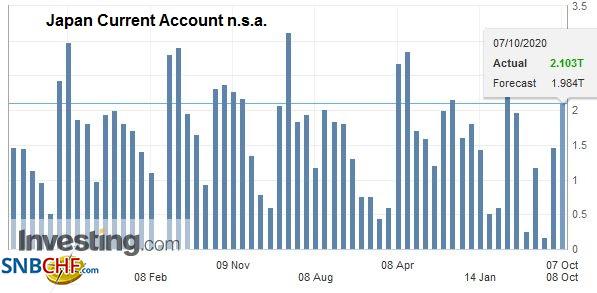

Asia PacificJapan reported a larger than expected balance of payments surplus in August of JPY2.1 trillion. Within it, the trade surplus rose to JPY413 bln, the largest since March. Of note, the BOP surplus is not driven by Japan’s trade balance. It is driven by income from past investments, which includes interest and profits, licensing fees, etc. Within the report, the capital account draws interest. Japanese investors bought a record amount of Italian bonds (~JPY524 bln or almost $5 bln) for the second month (~JPY373 bln in July). Japanese investors were also buyers of Canadian and bonds (record of almost JPY300 bln) and Australian bonds (~JPY555 bln for the sixth month of net purchases). Japanese investors continued to sell Swedish bonds and sold US Treasuries (~JPY733 bln) for the first time in three months. |

Japan Current Account n.s.a., August 2020(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

The Reserve Bank of New Zealand does not meet again until November 10, yet its attitude is what many had expected from the Fed and ECB. The RBNZ recognized that its dual mandate on inflation and employment elusive and would not be met for at least three years. It signaled that this is not acceptable and that it will respond. The Fed and ECB project their mandates are also unlikely to be reached any time soon but were reluctant to provide more support last month. The minutes from last month’s FOMC meeting released yesterday indicated a coming debate about its bond-buying amount and maturity, and the ECB is widely expected to expand and extend its Pandemic Emergency Purchase Progam at its December meeting.

The dollar is in less than a 10-tick range on both sides of JPY106.00. There is an option for almost $400 mln at JPY106.15 that expires today. The JPY106.25 area corresponds to the (38.2%) retracement objective of the greenback’s decline since the early June high just shy of JPY110. Initial support is seen in the JPY105.60-JPY105.80 area. The Australian dollar is firm and has extended yesterday’s gains, but the momentum stalled in late Asian turnover, and it has not re-started in Europe. A move above $0.7170 targets the week’s high and retracement objective near $0.7210. Initial support is seen around $0.7140. We mistakenly thought China’s markets re-open today from the long holiday, but they re-open tomorrow. The offshore yuan is little changed today.

Europe

Germany reported a smaller than expected trade surplus in August. The trade surplus narrowed to about 12.8 bln euros, after 19.2 bln in July. The median forecast in the Bloomberg survey was for a 16 bln euro surplus. Export and imports were stronger than expected. However, exports slowed to 2.5% (median forecast 1.5%) after a 4.7% increase in July. Imports were considerably stronger than expected, rising by 5.8% after rising 1.1% in July. Here too, the median forecast was for a 1.5% gain. Unlike what we noted in Japan, the German trade surplus drives its current account. Germany’s current account surplus fell to 16.5 bln euros from 21 bln in July.

The UK reiterated its threat to abandon talks with the EU at the end of next week yesterday, and sterling initially fell the news. However, it quickly recouped its losses. As we noted, the ultimatum is not over an agreement per se, but that an agreement is possible. This, in effect, steals some thunder from the threat. The EC appears confident that the UK will continue to negotiate after next week’s summit. The UK’s Gove gave the prospect of a deal at 66%.

The euro is little changed, around $1.1760. The market seems hesitant about challenging the $1.18 level from which it came off so sharply earlier this week, and there is an expiring option there for about 640 mln euros. The initial risk seems to be on the downside, and support is seen near $1.1720-$1.1740. An option for about 670 mln euro is at $1.1745 and also expires today. Sterling is firm and is holding above $1.29 after testing $1.2850 yesterday, where an option around GBP200 mln will be cut today. Sterling has been as high as $1.2970, but we expected a probe lower, perhaps toward $1.2920 before the market considers another run at $1.30.

America

The consensus view seems that risk appetites returned because a US fiscal deal is still seen a possible before the election. However, we wonder if the markets realized that there would be a substantial fiscal stimulus regardless of the electoral outcome. Reports suggested that the differences between McConnell and the Pelosi had narrowed considerably before the President’s tweet. On what has become controversial, aid to city and state governments, for example, the Democrats had scaled back to about $435 bln down from the previous $1 trillion. In comparison, the Republicans had offered $250 bln, up from their previous offer of $150 bln. Although the Democrats have rejected a piecemeal approach, Pelosi appeared to signal her willingness to agree to airlines’ relief.

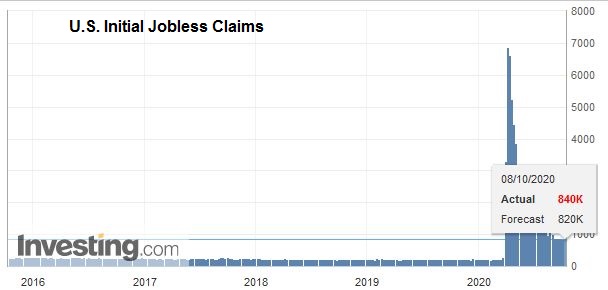

| The US reported an unexpected decline in consumer credit late yesterday. The $7.2 bln contraction defied expectations for a nearly $15 bln increase. The driver was a $7.2 bln reduction of revolving credit (credit cards), the sixth month of paydown. Outstanding revolving credit fell to a three-year low. Non-revolving credit, like auto and student loans, rose by $2.2 bln. Today’s data focus returns to the labor market with weekly jobless claims. The median forecast in the Bloomberg survey anticipated a decline to 820k from 837k previously. Continuing claims are also expected to have fallen (~11.4 mln from 11.77 mln). |

U.S. Initial Jobless Claims, October 8, 2020(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

Canada reports September housing starts. They are expected to have cooled a bit (~240k vs. 262k), reflecting robust activity. Tomorrow is the September jobs report. Mexico reports September CPI. Another reading above the upper end of the 2%-4% target range is likely. Officials want to look through the price pressures and see it has a transitory phenomenon driven in part by food prices. Banxico meets on November 12 and then again December 17. Another 25 bp cut is possible, but the December timeframe looks more likely than next month.

The US dollar is near a three-week low against the Canadian dollar (~CAD1.3235). The CAD1.3200 area corresponds to a (50%) retracement of the greenback’s gains since September 1. The next retracement (61.8%) is around CAD1.3155. Initial resistance is seen in the CAD1.3160-CAD1.3170 area. The Mexican peso is firm, but the dollar remains within the range seen on Tuesday (~MXN21.25-MXN21.76). Continued consolidation seems to be the most likely near-term scenario.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movement,ECB,EUR/CHF,Featured,federal-reserve,New Zealand,newsletter,Trade,USD/CHF