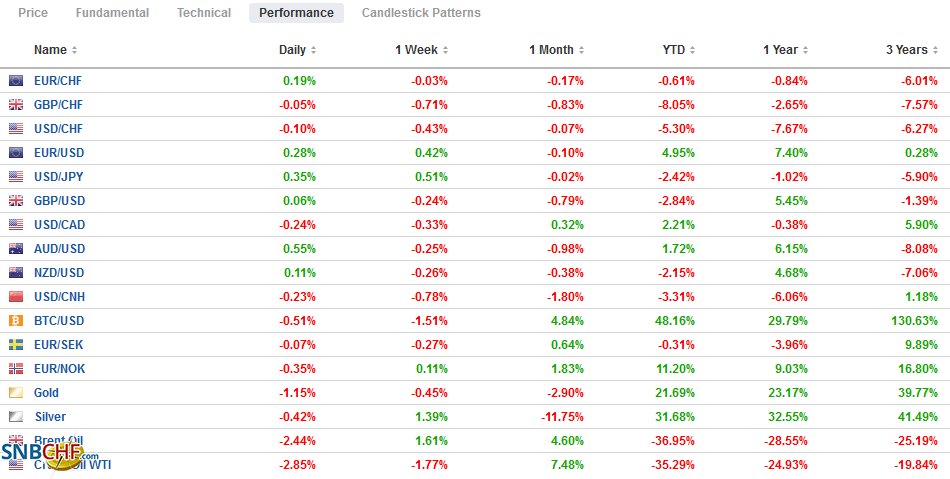

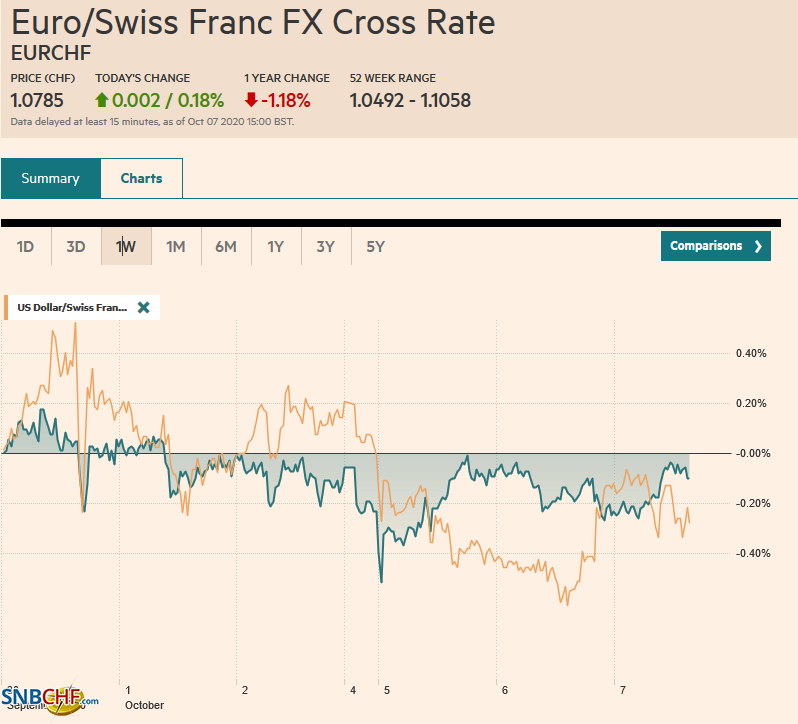

Swiss Franc The Euro has risen by 0.18% to 1.0785 EUR/CHF and USD/CHF, October 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s tweet announced that negotiations with the House Democrat leadership had collapsed, and there will be no further talks until after the election. Many economists had been removing it from their Q4 GDP projections, but the market was caught wrongfooted. Risk came off. Equities were sold. Emerging markets were sold, and the dollar and yen were bought. The S&P 500 and NASDAQ were at session highs and reversed to session lows, and the yield curve stopped steepening. However, the ripple effect has been mild, and the dollar’s gains have been pared. Most equity markets

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, EUR/CHF, Featured, Fiscal, Mexico, newsletter, South Korea, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.18% to 1.0785 |

EUR/CHF and USD/CHF, October 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: President Trump’s tweet announced that negotiations with the House Democrat leadership had collapsed, and there will be no further talks until after the election. Many economists had been removing it from their Q4 GDP projections, but the market was caught wrongfooted. Risk came off. Equities were sold. Emerging markets were sold, and the dollar and yen were bought. The S&P 500 and NASDAQ were at session highs and reversed to session lows, and the yield curve stopped steepening. However, the ripple effect has been mild, and the dollar’s gains have been pared. Most equity markets in the Asia Pacific rose and the MSCI regional benchmark rose for the third consecutive session. European stocks are trading lower, and the Dow Jones Stoxx 600’s four-day advance is at risk. US shares are firmer, recouping around a third or so of yesterday’s loss. The US 10-year yield is a couple of basis points higher near 0.76%, while European and Asia Pacific yields are a little softer. The dollar is seeing yesterday’s gains trimmed against the major currencies but has pushed above the JPY106 level, which it has not closed above in almost a month. Emerging market currencies are almost mostly higher, led by a nearly 1% gain in the Mexican peso. The Turkish lira is an exception, and the dollar rose to a new record high (~ TRY7.87). Gold is trading higher but stalled ahead of $1900. November WTI is straddling the $40-a barrel level. |

FX Performance, October 07 |

Asia Pacific

China’s market re-opens tomorrow. The dollar has fallen by about 0.80% against the offshore yuan since the Golden Week holiday began. If carried over to the onshore market, the dollar may trade around CNY6.7360 after closing near CNY6.79 before the holiday, depending on what happens over the next 12 hours or so.

South Korea reported its reserves grew for the sixth consecutive month in September. The $1.6 bln rises brings the year-to-date increase to about $12 bln to $420.55. The allocation of its reserves is not known, but given its trade, debt, and other practices, it probably has a more than average weight of US dollars. Given the rally in the US Treasuries this year, and the modest dollar depreciation against other likely reserve currencies, valuation can account for the increase in South Korea’s reserves. In fairness, on a pure valuation basis, one would have expected a larger increase in its reserves.

The dollar has risen above JPY106. in the European morning for the first time since September 14. A trendline off the July and August highs comes in near JPY106.25 today. Ahead of that, the JPY106.10 area corresponds to a (50%) retracement of the greenback’s losses since the beginning of Q3. There is an option for nearly $550 mln at JPY106.20 that will be cut today. The intraday technicals are stretched, and the move may not be sustained. The Australian dollar posted a big outside day and closed below Monday’s lows after falling through the neckline of a potential double top near $0.7210. The neckline was near $0.7130 and projects toward $0.7050-$0.7060, but the Aussie found bids just below $0.7100. The bounce to almost $0.7150 in late Asian turnover may have exhausted the short-covering bounce.

Europe

Germany surprised yesterday with a 4.5% rise in factory orders. The median forecast in the Bloomberg survey was for a 2.8% increase. Today’s it disappointed with a 0.2% decline in August industrial production. The median forecast was for a 1.5% increase. That the July series was revised to 1.4% from 1.2% offers little consolation. The disappointment seemed particularly pronounced in the auto sector, which is something to keep an eye on going forward. Separately, Spain also reported disappointing August industrial output figures. It rose by less than half of the 0.9% raise, the median forecast projected. Here too, July’s strength was revised higher to 9.6% from 9.3%. Spain is eclipsing Italy as arguably the most vulnerable among the large EMU members. The economic challenges are exacerbating political tensions. That said, yesterday, France cut its Q4 GDP forecast to zero from 1%.

The EC took the wind from sterling’s sails yesterday as the pound was punching through the $1.30 area, which was an important technical level. The EC is calling the UK’s bluff. Johnson had threatened to walk leave the negotiations unless there was sufficient progress by the end of July then next week’s summit. Johnson has softened his stance, further indicating that as long as an agreement was possible. The EC has long signaled that it will not be the party to pull out of negotiations. There is some suggestion that talks, if necessary, can go extend to the middle of November EU summit. There are fundamental differences between the two sides that could be papered over for most of it, but not state-aid (level playing field). It is not just a question of more talks, but an agreement will remain elusive if the first principles don’t change. Moreover, there is a political culture that Johnson is well aware of, perhaps in a way that Tspiras and Varoufakis may not have been as familiar, and he snubs it, which makes the process more difficult than necessary.

The euro rose above $1.18 yesterday for the first time in a couple of weeks. It struggled to sustain the gains that retraced 50% of its decline from the September 1 high above $1.20 before Trump’s tweet knocked it back to almost $1.1730. It has steadied today and traded a little above $1.1765. There may be scope for limited additional gains, but the $1.1780 should suffice. Sterling posted a big outside down day. After rising marginally above $1.30 yesterday for the first time mid-September, it was sent back to a little less than $1.2870. It recovered to around $1.2930 in Asia but was sold back to around $1.2880 in early European turnover. Consolidation may be the most likely scenario for the North American session.

America

The market seemed to have an exaggerated response to the confirmation that there will be no additional stimulus ahead of the election. The talks between Pelosi and Mnuchin were strained, and like the EC-UK talks, there was no agreement on first principles. That said, one can still be confident that more fiscal stimulus will be provided after the election, and if not in the lame-duck session, then in late January-early February. The delay will undoubtedly cause hardships but do not write-off fiscal stimulus when assessing the policy mix. It is difficult to grasp the political advantage believed to have been secured by the decision to end talks.

Fiscal support, or indeed the lack thereof, sent risk-appetites into a tailspin late yesterday, and many may see Trump’s tweet about willing to sign-off on a new payment to households as keeping the door open to a deal. However, a mini deal that does not include aid to the states and local governments has been rejected. Meanwhile, the focus may shift back to monetary policy. No fewer than five Fed officials speak today, and the FOMC minutes from last month’s meeting will be released late in the North American session. The minutes will be looked at for more insight into the average inflation target, which seems to be more about forwarding guidance than a substantive shift in policy. Investors will also be looking for clues into where the threshold is for a boost in bond buying, especially if the risk is that financial support is 3-4 months away, possibly. The US also reports August consumer credit figures. Recall consumer credit fell by around $100 bln in the March-May period and in June and July recovered by about $23.5 bln. In August, consumer credit may have expanded by around $14 bln.

Canada’s September IVEY survey is on tap for today, but it is rarely a market-mover these days. The US dollar posted an outside up-day against the Canadian dollar yesterday, and follow-through buying lifted it to about CAD1.3340 earlier today. That corresponds to a (50%) retracement of the greenback’s losses since the downside reversal on September 1. Initial support is seen around CAD1.3280. On the upside, a close above CAD1.3350 would improve the US dollar’s technical tone. Mexico was encouraged by the IMF to boost spending by 2.5%-3.5% of GDP, but President AMLO is reluctant to take on more debt. The IMF also wants the central bank to cut rates. Banxico Governor Diaz noted that inflation was to fall faster, it would have more room to cut, but he did keep the door open by noting that the increase in CPI is likely temporary and largely related to food prices. Mexico reports September inflation tomorrow. It is expected to have remained above 4%, the upper band of the target range. The US dollar posted a key reversal against the peso yesterday, but follow-through buying has not materialized. Today’s price action is within yesterday’s, an initial support is seen in the MXN21.30-MXN21.40 area. The 200-day moving average is near MXN21.81. A move above there would lift the greenback’s technical tone.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,Currency Movement,EUR/CHF,Featured,Fiscal,Mexico,newsletter,South Korea,USD/CHF