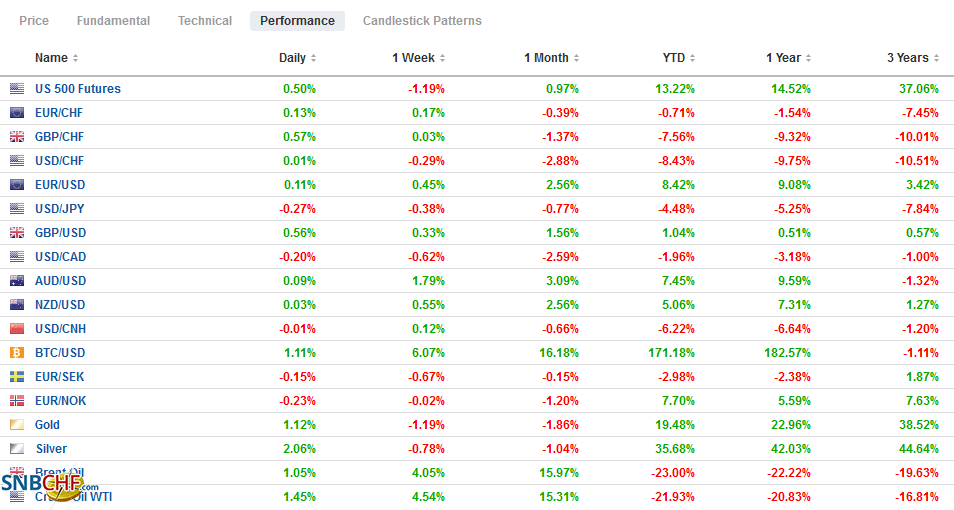

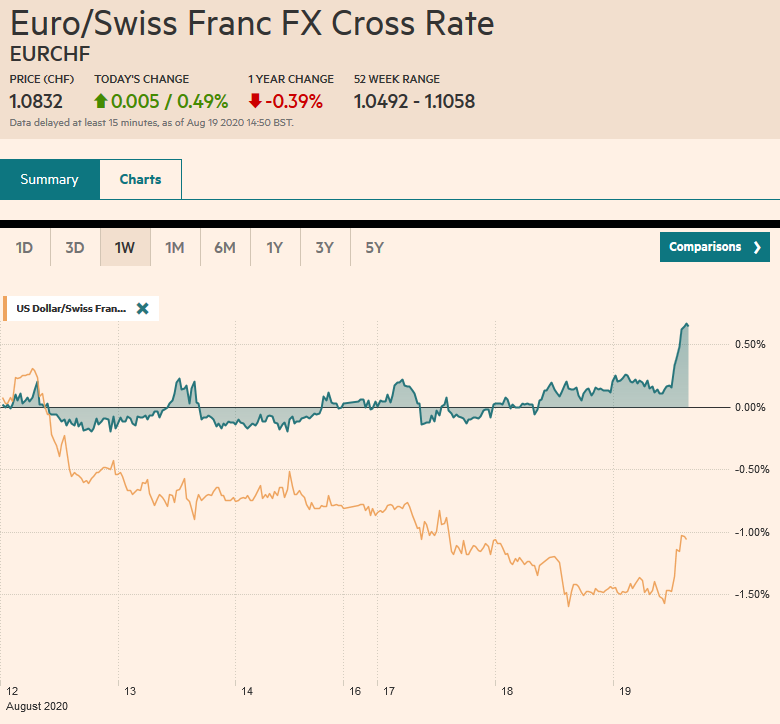

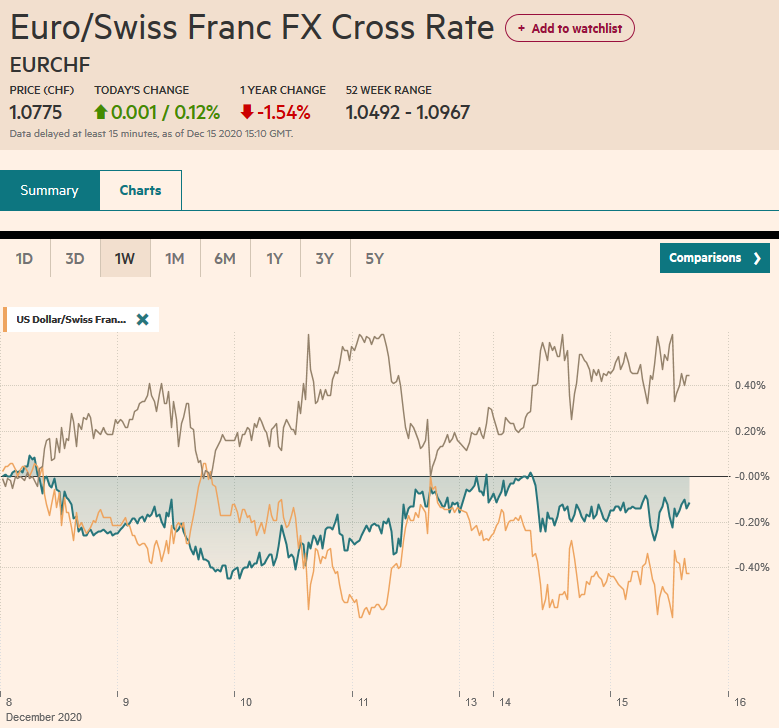

Swiss Franc The Euro has risen by 0.12% to 1.0775 EUR/CHF and USD/CHF, December 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the Chinese recovery failed to lift the Shanghai Composite. The Dow Jones Stoxx 600 in Europe is firmer, led by energy and industrials, while US shares are also recovering from yesterday’s retreat. The US 10-year benchmark yield is steady around 0.90%, while peripheral yields in Europe and France are slipping

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Brazil, China, Currency Movement, Featured, newsletter, Turkey, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.12% to 1.0775 |

EUR/CHF and USD/CHF, December 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the Chinese recovery failed to lift the Shanghai Composite. The Dow Jones Stoxx 600 in Europe is firmer, led by energy and industrials, while US shares are also recovering from yesterday’s retreat. The US 10-year benchmark yield is steady around 0.90%, while peripheral yields in Europe and France are slipping to new record lows. The dollar is mostly softer, though some profit-taking is weighing on the Antipodeans a bit. The Scandis and sterling are the strongest in what has been a quiet forex session so far. Most of the liquid and freely accessible emerging market currencies are higher, and this is allowing the JP Morgan Emerging Market Currency Index to snap a two-day decline. Gold has recovered from around $1811 yesterday to approach resistance near $1850, while oil is consolidating near nine-month highs, with the January WTI contract straddling the $47 a barrel mark. |

FX Performance, December 15 |

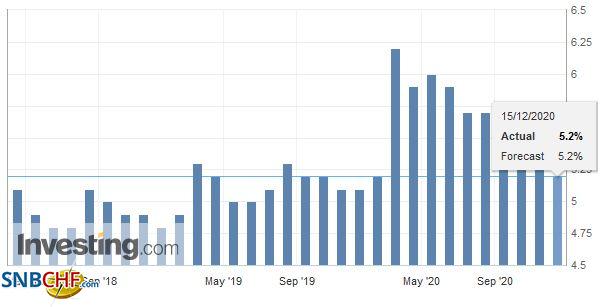

Asia PacificChina’s November economic data matched expectations. Industrial output accelerated to 7.0% year-over-year form 6.5%. Medical supplies, communication equipment, and electric machinery output were strong, while auto output slowed from elevated levels. Retail sales rose 5.0% year-over-year after a 4.3% gain through October. Jewelry and cosmetic sales surged. Fixed investment rose 2.6%, after 1.8% in October. The notable development here was the first increase this year from the private sector (0.2%), while pubic investment accelerated to 5.6% from 4.9%. China is running a fiscal deficit that is expected to be around 6.7% of GDP this year. Its interest rates are well above the zero-bound, and the PBOC has not used its balance sheet to drive monetary policy. No Chinese QE. Capitalism with Chinese characteristics took another step that puts it on a more orthodox footing. Yesterday, the State Administration for Market Regulation levied fines on units of some of the largest internet companies: Alibaba, Tencent, and SF Holdings for taking advantage of their market positions, i.e., anti-trust violations. The fines seem like small potatoes (CNY500k or ~$76.5k), but that is the maximum under current law, which may be amended and lifted next year. |

Chinese Unemployment Rate, November 2020(see more posts on Chinese Unemployment Rate, ) Source: investing.com - Click to enlarge |

Reports suggest dozens of Australian ships have been stranded outside of China. It was understood as a part of Beijing’s protest against Canberra’s foreign policy that puts it firmly in the US camp. Chinese state-owned media reported that power plants have been directed to stop taking Australian coal. The fact that the ships are not allowed to dock at port revealed as much. It is not clear that this signals a formal ban yet. China is Australia’s largest export market and, in recent years, buys the majority of Australia’s coal. Australia is preparing to file a complaint with the WTO over the tariffs imposed on barley. Separately, the minutes from the recent RBA meeting confirm that officials see the need for monetary and fiscal support for some time. The focus is on the labor market and wages (November report due early Thursday local time). Officials did not seem too concerned about the Australian dollar’s recent strength and instead focused on the trade-weighted index, where it is not as strong as the bilateral exchange rate suggests.

Still, it was just last week that Politburo signaled it would step up its anti-monopoly efforts. The fines would seem to have to be dramatically lifted to have the desired deterrence to be effective. This is not to say in any way that China has become the bastion of traditional liberalism. It does suggest a more nuanced view is necessary to understand how the Chinese political economy is evolving. Separately, and also important developments that complicate the picture was the scuttling of the Ant IPO and allowing an increasing number of state-owned-enterprises to fail. The anti-monopoly and Ant moves are consistent with efforts to prevent other centers of power that could rival the Communist Party. How the state relates to state-owned enterprises may be worthy of a Talmudic debate. It is not always clear or obvious, even in the US, where the legal standing of Agency debt, for example, was quite ambiguous, at least until Fannie and Freddie were nationalized, and the US encouraged other countries to consider Agency paper as good as Treasuries for reserve purposes. Last week, foreign central banks held around $361.5 bln of agency securities in their custody account with the Federal Reserve. Also, as TIC data today is a useful reminder, sometimes, when the media reports a country reduced its Treasury holdings, it simply reflects a shift to Agencies, which pay a better yield.

After slumping to a one-month low near JPY103.50 yesterday, the dollar recovered smartly, leaving a hammer candlestick in its wake. Follow-through buying today lifted it to JPY104.15, the 20-day moving average. There is a battle over JPY104 now where a nearly $560 mln option will expire late today. The Australian dollar reached almost $0.7580 yesterday, but the upside momentum stalled. It was sold for nearly $0.7505 today, where new bids were found. Note that tomorrow the A$1.2 bln option at $0.7500 will expire. Nearby resistance today is seen in the $0.7530-$0.7540 area. The PBOC set the dollar’s reference rate at CNY6.5434, a little firmer than expected. The dollar is snapping a five-day advance (modest: from CNY6.5297 on December 7 to CNY6.5510 yesterday on a closing basis). Separately, the PBOC added CNY950 bln (~$145 bln) into the banking system via the medium-term lending facility, and well more than the CNY600 bln expiring from the facility this month. The overnight repo rate dropped 34 bp to 1.34%. The rash of corporate defaults, coupled with year-end pressures, boosts the demand for liquidity.

Europe

As many feared, into the year-end, a crash out of the standstill agreement with the EU looms large, even though talks continue, and the surge in the coronavirus is crushing the recovery seen in Q3. Today the UK reported that job cuts hit a record in the three months through October, rising by 217k. That left the number of people on payrolls in November to be 819k below pre-Covid levels. The hospitality industry accounts for over a third of the loss. Although Chancellor of the Exchequer Sunak’s popularity seemed to rise as fiscal spending increased, he faces stinging criticism over the slowness to extend income-support efforts, which he did finally agree to hours before the program was to expire. The aid was extended through March, but businesses already had to make the tough decisions. The October jobless rate, which is reported with a larger lag, rose to 4.9%, the highest in four years.

The US and Europe took mild measures against Turkey, with harsher moves possible next year. The US announced sanctions on SSB, a key Turkish defense contractor, and several people, including the head of the company. The issue was the purchase of a Russian-made air defense system. US law required sanctions when Turkey received the system (mid-2019), but President Trump waivered, and the defense bill Congres passed last week ordered sanction. Last week, the EU sanctioned some officials and entities (to be named later) for gas drilling in Cypriot waters. Europe chose to defer making a decision to ban arms sales and impose tariffs, which France, Greece, and Cyprus were advocating, pending a discussion with the new US administration. Turkey has gotten off fairly light. Meanwhile, the return to a more orthodox monetary policy has stabilized the lira, with the dollar carving out a range of roughly TRY7.75-TRY8.0. It wrestles with Argentina for the dubious honor of being the weakest currency this year. The peso is about 27.4% this year, while the lira has fallen by about 24%. Bolstered by a weak lira, interest rate cuts, fiscal stimulus, and the government’s push to extend credit, the Turkish economy was the best performer in the G20 in Q3 (seasonally-adjusted and adjusted for the number of working days, the economy grew by 15.6% quarter-over-quarter.

Yesterday, the euro came with 1/100 of a cent of its December 4 high, which Bloomberg puts at $1.2178. It is consolidating today within about a 15 tick range on either side of $1.2150. Two options expirations today draw attention. The first is for about 550 mln euros at $1.2135 and the other, for a billion euros at $1.2175. Note that there is a 1.1 bln euro option at $1.21 that will roll-off both today and tomorrow. For two weeks now, the euro has been trading between $1.2060 and $1.2178. Sterling is also confined to a narrow range of a little less than three-quarters of a cent (~$1.3280-$1.3350). If maintained, it would be the narrowest range this month. The euro had fallen to about GBP0.9045 yesterday after trading as high as GBP0.9230 before the weekend before recovering to GBP0.9120. It extended those gains to almost GBP0.9150 today before sellers reemerged. Initial support is seen near GBP0.9100 now.

America

Sometimes a compromise can be found by splitting the difference. Sometimes it is found by both sides accepting the demands of the other. The hope for more US stimulus this year rests on simply eliminating the elements for which an agreement remains elusive. A bill for almost $750 bln may be the last gasp effort this year. State and local spending and lifting Covid-related liability for businesses have been stripped out and put in a different bill. This may be the closest to an agreement that the US has been in a few months. Failure could lead to a sell-off in stocks and a rally in bonds.

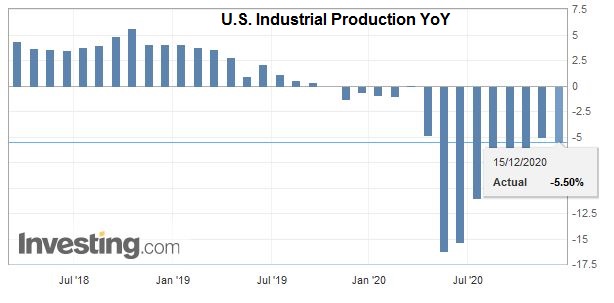

| The US reports the December Empire Manufacturing Survey today (the Bloomberg survey’s median forecast is for 6.2 after 6.3) and the November industrial output figures. After a 1.1% rise in October, industrial production is expected to have cooled dramatically, rising only 0.3% in November. Manufacturing output is expected to also rise by 0.3% after a 1.0% gain in October. The utilization rate of industrial capacity is projected to rise to 73.0% from 72.8%. It stood near 77.6% last November. The slack in capacity and the labor market seem to argue against this potential spur of inflation. The October TIC data due out after the markets close today may draw extra attention. Recall that the US 10-year yield rose 19 bp in October, the largest gain in two years. Canada reports November housing starts, and a small decline is expected. Manufacturing sales (October) and existing home sales (November) are also due. The focus in Mexico is the bill that requires the central bank to buy excess dollars from banks that could have illicit sources. If passed by the lower chamber today in which President AMLO’s party (Morena) enjoys a supermajority, the president is expected to sign it over the objections of Banxico, the largest private banks, and the business lobby. |

U.S. Industrial Production YoY, November 2020(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

As was the case last year, Brazil will likely make a $113 mln payment to the UN before the end of the year. Otherwise, it will lose its vote in the General Assembly. Several countries, including the US, are in arrears, but the UN limits the debt to two years of contributions. Some small countries have claimed and granted exceptions. Brazil’s economic ministry explained that its Congress would soon pass a bill granting new payments to the UN (and other multilateral institutions). Meanwhile, Brazil’s decision to cut the income support measures for informal workers in October sapped the recovery. The economic activity index was nearly halved to 0.86% from 1.68% in September and below expectations. The virus is surging, and unemployment is at record highs. The Selic rate stands at a record low of 2%, and the central bank sees no room to cut further with price pressures firming and CPI rising to 4.3% in November, the highest this year.

The US dollar remains trapped in its trough against the Canadian dollar. It remains in the range set last Thursday (~CAD1.2710-CAD1.2830). It is even in a narrower range of roughly CAD1.2720-CAD1.2790. The greenback has edged higher against the Mexican peso for the past four sessions and reached a three-week high yesterday near MXN20.25. However, the correction may be snapped today. Initial support is seen near MXN20.00. If it holds, it would be the first session this month that the dollar has not traded with an MXN19-handle. The central bank meets Thursday and is widely expected to stand pat, leaving the overnight target rate at 4.25%.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Brazil,China,Currency Movement,Featured,newsletter,Turkey