Swiss Franc The Euro has risen by 0.03% to 1.0802 EUR/CHF and USD/CHF, February 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After reversing higher yesterday, the US dollar sees follow-through gains today, leaving the euro around a cent lower from yesterday’s highs. Sterling’s surge is also being tempered. Most emerging market currencies are lower as well. The jump in bond yields has stalled, but only...

Read More »Swiss competition watchdog to investigate Mastercard

The dispute centres around a Swiss attempt to uniformise functions across ATMs from different providers. © Keystone / Alexandra Wey The competition authority suspects the global credit card firm of using its position to prevent the rollout of a new, more uniform, ATM system across Switzerland. COMCO said on Tuesday it had launched an investigation on February 8 after a complaint by the Swiss financial infrastructure company SIX, which is responsible for developing...

Read More »“Self-control and self-respect have become undervalued”

Interview with Theodore Dalrymple After a year of lockdowns, social isolation, financial uncertainty and extreme political polarization, a lot of people are finding it very difficult to remain optimistic and to see a way back to some kind of normalcy. While the economic, social and political impact of the covid crisis can be easily identified and frequently discussed, the unseen, psychological pressures that millions of people are struggling with often go...

Read More »Down with the Presidency

The modern institution of the presidency is the primary political evil Americans face, and the cause of nearly all our woes. It squanders the national wealth and starts unjust wars against foreign peoples that have never done us any harm. It wrecks our families, tramples on our rights, invades our communities, and spies on our bank accounts. It skews the culture toward decadence and trash. It tells lie after lie. Teachers used to tell school kids that anyone can be...

Read More »Residential property prices continue to rise

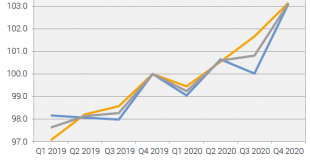

Swiss residential property may offer quality that is high, but so are the prices. Keystone / Arno Balzarini Residential property prices in Switzerland rose sharply in the final quarter of 2020, and by an average 2.5% for the year as a whole, according to the Federal Statistics Office. This is according to the Swiss Residential Property Price Index published for the second time by the FSO on Tuesday. The new index climbed by 2.3% in the fourth quarter compared to the...

Read More »FX Daily, February 16: Greenback Remains Heavy

Swiss Franc The Euro has risen by 0.04% to 1.0799 EUR/CHF and USD/CHF, February 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equity rally appears undeterred by the rise in interest rates or the surge in oil prices. Led by Tokyo and Hong Kong, Asia Pacific equities advanced. China, Taiwan, and Vietnam markets remain closed. After gapping higher yesterday and extended the gains in early turnover today,...

Read More »Hear Swiss stories for the world on The Swiss Connection podcast

Florian Fox © Rob Lewis Photography What’s it like to move back to – or away from – Switzerland during a pandemic? What does gold mined in Peru have to do with Switzerland? Did you know that “nostalgia” is a Swiss invention? Not content to mind her own business, Susan studied journalism in Boston so she’d have the perfect excuse to put herself in other people’s shoes and worlds. When not writing, she presents and produces podcasts and videos. More about the...

Read More »How to manage your finances as a couple?

(Disclosure: Some of the links below may be affiliate links) Today’s post is a guest post by Yasi Zhang from Fast Track, talking about the very important subject of how to manage your finances as a couple. I am very happy to have her as a guest writer today. Money is a topic most people avoid talking about, so do newlywed couples. It is awkward to discuss money with your partner, but it is an essential exercise to do together as a couple because you are building a...

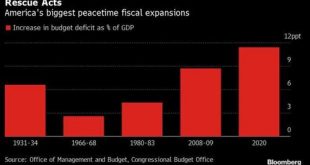

Read More »Unhappy Endings: Deception Has Gone Global

Looking Behind the Labels Regardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles. Not all those of the extreme left, for example, are all that “woke” and not everyone on the far right, to be fair, is a “domestic terrorist.” Nevertheless, words are often misused and abused to place, as well as burry, otherwise nuanced realities behind simple phrases, as we’ve seen in everything from the “Patriot...

Read More »Average annual inflation rate for residential property in 2020 was 2.5 percent

16.02.2021 – The Swiss residential property price index (IMPI) increased in the 4th quarter 2020 compared with the previous quarter by 2.3% and reached 103.1 points (4th quarter 2019 = 100). Compared with the same quarter of the previous year, inflation was 3.1%. The average annual inflation rate for residential property in 2020 was 2.5%. These are some the results from the Federal Statistical Office (FSO). The average annual inflation rate of the IMPI for 2020 of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org