Abstract: Economics has long history of “rehabilitations,” including W.H. Hutt’s rehabilitation of Say’s law, and Alfred Marshall’s attempt to rehabilitate David Ricardo. The rehabilitation of Frank A. Fetter should be as important as either of these, especially for economists working in the contemporary Austrian tradition. The historical records reveal that for the last century there has been underway a nearly unbroken series of efforts, especially by Austrian...

Read More »Bitcoin Lightning Tips auf Twitter jetzt auch für Android verfügbar

Die Social Media Plattform Twitter hat ihr Bitcoin Projekt ausgeweitet. Bisher war das sogenannte Bitcoin Lightning Tips Feature nur über iOS verfügbar – es wurde vor wenigen Monaten gelaunched. Doch nun wurde es auch für Android freigeschaltet. Bitcoin News: Bitcoin Lightning Tips auf Twitter jetzt auch für Android verfügbar Das Feature nutzt Jack Maller’s Strike Lightning Wallet auf der Social Media Plattform seit September 2021. Doch Twitter CEO Jack Dorsey gilt...

Read More »How the bubble house movement took hold in Switzerland

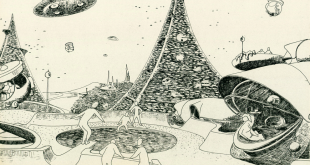

Futuristic architecture sketches from Pascal Häusermann, 1970. Competition in Cannes, private urban atmosphere. Collection Frac Centre-Val de Loire / Donation Pascal Häusermann Swiss architects were swept up in the movement to build bubble houses out of concrete and plastic in the 1960s. While the bubble movement burst decades ago, many of the original structures are still standing to this day. Need more space? Why not just build an extra room on the side of your...

Read More »Swiss franc highest against Euro since July 2015

© Skovalsky | Dreamstime.com On 19 November 2021, the Euro went below 1.05 Swiss francs, the lowest it has been since July 2015. The Swiss franc is viewed as a safe haven currency and tends to rise when markets are bearish. However, this week the shift in exchange rate may have had more to do with the situation in Euro zone than a shift to safety. The Euro has recently weakened against a number of currencies including the Yen, US dollar and Pound. Currency traders...

Read More »Covid Surge Compounds Monetary Divergence to give the Euro its Biggest Weekly Loss in Five Months

Strong US consumption and production figures kept the greenback well supported last week on the heels of the jump in CPI to 6.2%. Meanwhile, the surge of Covid cases in Europe underscores the divergences with the US, sending the euro to new lows for the year. At the same time, oil prices headed south for the fourth consecutive week, matching the longest decline in more than two years. It did not favor the Norwegian krone, the weakest of the majors, with a 2.15%...

Read More »How the pandemic has widened inequalities in Swiss watchmaking

Audemars Piguet is one of four independent brands that dominate the global luxury watch market. Thomas Kern Driven by strong Chinese demand, Swiss watchmaking is recovering after suffering one of its biggest economic shocks in 2020. But the crisis has further widened the gap between the few brands that take the lion’s share of the profits and the rest of the industry. My specialty is telling stories, and decoding what happens in Switzerland and the world from...

Read More »Is Price Stability Really a Good Thing?

One of the mandates of the Federal Reserve System is to attain price stability. It is held that price stability is the key as far as economic stability is concerned. What is it all about? The idea of price stability originates from the view that volatile changes in the price level prevent individuals from seeing market signals as conveyed by changes in the relative prices of goods and services. For instance, because of an increase in the demand for apples, the prices...

Read More »56 Millionen Dollar: DOJ verkauft von Bitconnect beschlagnahmte Kryptowährung

Das US-Justizministerium (DOJ) verkauft Kryptowährungen im Wert von 56 Millionen US-Dollar, die bei der “Nummer eins der Promoter” von Bitconnect, dem größten jemals strafrechtlich angeklagten Krypto-Betrugssystem, beschlagnahmt wurden. Die Anleger wurden in betrügerischer Absicht dazu gebracht, über 2 Milliarden Dollar zu investieren. Dem Bitconnect-Promoter droht eine Höchststrafe von 20 Jahren Gefängnis. Das US-Justizministerium gab am Dienstag bekannt, dass es...

Read More »Milliardär: Man kann Gold und Bitcoin nicht miteinander vergleichen

Der ägyptische Milliardär Naguib Sawiris hat erklärt, dass er nach wie vor auf Gold setzt und nicht beabsichtigt, in Kryptowährungen wie Bitcoin zu investieren, da solche Investitionen sehr riskant sind. In seinen Äußerungen, die von The National News veröffentlicht wurden, erklärt der Milliardär, dass er es für falsch hält, wenn Menschen Vergleiche zwischen Gold und Bitcoin anstellen. Sawiris, der auch geschäftsführender Vorsitzender der in Kairo ansässigen Orascom...

Read More »Leaving behind the Labor Theory of Value

The labor theory of value has long undermined people’s understanding of the miracles created by markets and rationalized various incarnations of socialism which mangle those miracles. Leonard Read understood why undoing that misunderstanding by all who hold to it, as well as those who just use it as an excuse for what they want government to impose on unwilling citizens, is of immense value to each of us. And in his December 1956 Freeman article, “Unearned Riches,”...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org