Swiss supermarkets offer a wide choice of alternatives to animal-based milk © Keystone / Gaetan Bally Plant-based dairy products continue to gain in popularity in Switzerland, with sales of plant-based milk more than doubling since 2017. However, dairy substitutes still occupy a niche in the overall market. Last year dairy substitutes generated sales of CHF172 million ($175 million) in the retail trade, the Federal Office for Agriculture (FOAG) said on...

Read More »Like the Old McCarthyism, the New McCarthyism Targets Russia

In January 1956, the iconoclastic leftist American poet Allen Ginsberg wrote “America,” a prose poem that laments the state of the country and the poet’s place in it. “America” was included in the short poetry collection entitled Howl, published by Lawrence Ferlinghetti’s City Lights Publishers in November of the same year. In 1957, Howl became a cause célèbre as the centerpiece of People of the State of California v. Lawrence Ferlinghetti, an obscenity trial that...

Read More »The Industrial Revolution and the West Indies: Did the Colonies Spark Progress in the Metropole?

There is a renewed interest in the West Indian colonies' relevance to the British industrial revolution and the subsequent economic transformations that substantially altered Western society's fortunes. This literature has been provoked by the urge to challenge earlier interpretations that underestimate colonies' value to Western countries by showing how interconnected global economies were. Colonies were expensive for Britain, and economists contend that there would...

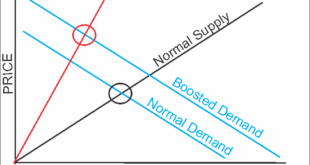

Read More »Giant Corporations Are Causing Inflation?

“Giant corporations are using inflation as cover to raise their prices & boost their profits. In industry after industry, we have too little competition & companies have too much power to increase prices. I’ve been calling out this corporate profiteering & price gouging” – Sen. Elizabeth Warren Another version of this argument as of late is accusing “Big Oil” of price-gouging consumers to make record-profit margins at a time when consumers are struggling....

Read More »Half of flights delayed at Zurich Airport

Dreaming of being on holiday Keystone / John G. Mabanglo Almost every second flight from Zurich Airport has been delayed since the beginning of June, with travellers facing more delays this summer. Between June 1 and July 10 an average of 46% of aircraft took off from Zurich with a delay of more than 15 minutes, according to an analysis by the news agency AWP. On average, passengers had to wait around 40 minutes. Most delays were of an operational, technical or...

Read More »Gold traders on trial: Only buy physical

Followers of the gold and silver price will have long been aware of the cases brought against large banks for manipulating the precious metals markets. This week has brought the issue to the fore as three former JP Morgan employees stand trial for “racketeering conspiracy as well as conspiring to commit price manipulation, wire fraud, commodities fraud and spoofing from 2008 to 2016”. JP Morgan Chase & Co. has long been known to have an oversized influence on...

Read More »4 Social Security Changes to Expect in 2023

Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening. Cost of Living Increase In 2022, Social Security recipients received a 5.9% cost-of-living adjustment (COLA). It was the biggest increase in 40 years. Inflation continued to pick up speed and the 2023 COLA will almost certainly be higher. Social Security sets the...

Read More »New Research Finds Centralization Risks in Public Blockchains, Cryptocurrencies

Despite claims of immutability and decentralization, cryptocurrencies and public blockchains, including Bitcoin and Ethereum, are not quite delivering on their promises and are seeing a concentration of power in the hands of a few players. A new report, commissioned by the US Defense Advanced Research Projects Agency (DARPA) and produced by software security research company Trail of Bits, examines the fundamental properties of blockchains and the cybersecurity risks...

Read More »Market Prices in More Aggressive Fed AND is more Confident of Rate Cuts by the End 2023

Overview: The higher-than-expected US CPI and the strong expectation of a 100 bp hike by the Fed in two weeks is propelling the dollar higher. It jumped to almost JPY139.40 and the euro is off more than cent from yesterday's high (though holding above parity). Even where there has been favorable economic news, like the strong jobs report in Australia, is failed to dent the greenback. Most of the large bourses in the Asia Pacific regions advanced. Hong Kong is a...

Read More »Swiss Producer and Import Price Index in June 2022: +6.9 percent YoY, +0.3 percent MoM

14.07.2022 – The Producer and Import Price Index rose in June 2022 by 0.3% compared with the previous month, reaching 109.8 points (December 2020 = 100). Petroleum products in particular were more expensive. Compared with June 2021, the price level of the whole range of domestic and imported products rose by 6.9%. These are the results from the Federal Statistical Office (FSO). In particular, higher prices for builders’ and interiors’ joinery as well as petroleum...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org