This article is the second in a two-part series. Check out part 1 here. Even though the downhill trajectory we’ve seen over the last decades in terms of property rights is bad enough, nothing could have ever prepared us for what the covid-19 crisis would bring. Even those of us who have read enough history to know that there’s really no line that the state will not cross in its fervent pursuit of absolute power were sincerely surprised. How could the ruling elite...

Read More »Markt erholt sich, doch haben wir die Talsohle wirklich durchschritten?

Die Signale sind in den letzten Tagen wieder auf Grün gesprungen. Im gesamten Markt gibt es ein klares Kursplus. Bitcoin legte im Wochenvergleich 10 Prozent zu. Doch ist dies der Anfang eines Bullenruns oder könnte es in naher Zukunft wieder runtergehen? Bitcoin News: Markt erholt sich, doch haben wir die Talsohle wirklich durchschritten?Seit Donnerstag letzter Woche ging es für den BTC stetig nach oben. Gestern erreichte der Kurs dann sogar ein Monatshoch von mehr...

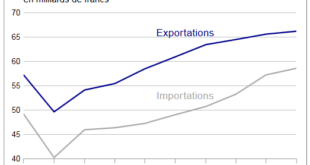

Read More »Swiss Trade Balance 2nd quarter 2022: 8th consecutive quarterly increase

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

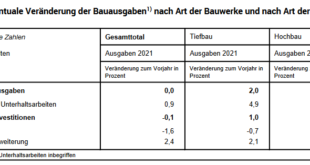

Read More »Construction expenditure remains at the same level in 2021 for the second time in a row

17.07.2022 – Construction expenditure again remained stable in 2021 compared with the previous year. Investments in civil engineering rose by 1.0% and those in building construction fell by 0.4%. As a result, total investment in construction showed a decline of 0.1%. These are the provisional findings from the Construction Statistics from the Federal Statistical Office (FSO). Percentage change in construction expenditure by type of building and by type of work...

Read More »Ukraine war hits Swiss asset management industry

The Ukraine war has heightened volatility and reduced client appetite for risk. © Keystone / Gaetan Bally The ongoing war in Ukraine has been partly blamed for losses at a prominent Swiss asset management company. The entire Swiss industry suffered a dip in fortunes in the first six months of year as extreme market volatility reduced the value of investments and caused clients to play safe with their money. Independent asset manager GAM Group warns that it expects to...

Read More »The Only Real Solution Is Default

The destruction of ‘phantom wealth’ via default has always been the only way to clear the financial system of unpayable debt burdens and extremes of rentier / wealth dominance. The notion that the world could always borrow more money as long as interest rates were near-zero was never sustainable. It was always an unsustainable artifice that we could keep borrowing ever larger sums from the future as long as the interest payments kept dropping. The only real solution...

Read More »Soho Forum Debate: Gold vs Bitcoin

The Soho Forum is a monthly debate series held in Soho/Noho, Manhattan. A project of the Reason Foundation, the series features topics of special interest to libertarians and aims to enhance social and professional ties within the NYC libertarian community. Moderated by Gene Epstein, former economics editor of Barron’s, The Soho Forum features some of the most highly regarded speakers across varied fields. At each event, the audience actively engages with the...

Read More »How the World Embraced Nationalism, and Why It’s Not Going Away Soon

Perhaps one of the more astute observers of Russian foreign policy in recent decades has been John Mearsheimer at the University of Chicago. He has spent years warning against US-led NATO enlargement as a tactic that would provoke conflict with the Russian regime. Moreover, Mearsheimer has sought to explain why this conflict exists at all. Why, for example, doesn’t the Russian regime just accept US-led expansionism in the region? Or perhaps, more precisely, why have...

Read More »Parity hysterics: What it means and what it doesn’t

Part I of II, by Claudio Grass, Hünenberg See, Switzerland There’s been a flurry of articles, news stories and headlines lately over the developments in the FOREX market, specifically over the moves of the EUR/USD currency pair. As headwinds on all levels, economic, geopolitical and social, got a lot worse in recent months for the Eurozone, the news-breaking, headline-dominating “parity” event finally came about, with the euro even breaking below parity on July 13,...

Read More »If Government Can Take from One Group, It Can and Will Take from Everyone

It wouldn’t be an exaggeration to argue that private property rights, as understood by classic liberal thinkers, by those who embrace Austrian economic theory, and by all members of an enlightened society, are not only the cornerstone, but also the last defense of human civilization and the Western way of life in particular. Nothing stands a chance without this premise. No prosperity can ever come about or even be maintained, none of the civil liberties and human...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org