Der Ethereum Merge war erfolgreich, doch der Markt zeigte keine positive Reaktion. ETH verlor im Wochenvergleich deutlich. Währenddessen zeigte die Hashrate des Ethereum Classic eine klare Reaktion. Ethereum News: Ethereum Merge erfolgreichDer ETH verlor mehr als 17 Prozent im Wochenvergleich. Der größte Verlust geschah aber noch vor dem Merge. In den letzten 24 Stunden kamen weitere 3 Prozent Kursverlust hinzu, so dass der ETH das Wochenende mit weniger als 1.500...

Read More »Powell’s Pivot to “Pain” but No Gain: Triggering the Coming Recession

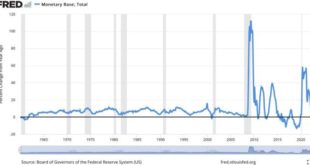

Jay “The Inflation We Caused Is Transitory” Powell finally did it. On Friday, the Fed chair finally mustered the courage to say that he is going to do the job he has been hired to do: the Fed will not “pivot” to cut interest rates until inflation slows meaningfully and persistently—even if the stock, bond, and housing bear markets become much worse and the economy goes into recession. Powell’s Speech Translated Below we provide key quotes from Powell’s Jackson Hole...

Read More »US CPI Data Release Update

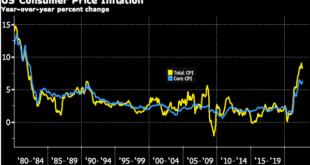

It is easy to get caught up in data releases. The media is keen to read a lot into them, hoping it will offer some sense of what is really going on, so often the news is about numbers just announced or expectations for what one economic measure will show from one month to the next. However, as we outline below, many of the numbers that are released on a frequent and regular basis (CPI and employment, for example) can be misleading. Whether it’s down to the inputs or...

Read More »The Fed Is Wrong to Make Policies Based upon the Phillips Curve

Speaking at Jackson Hole, Wyoming, on August 26, 2022, the chair of the Federal Reserve, Jerome Powell, said the Fed must continue to raise interest rates—and keep them elevated for a while—to bring the fastest inflation in decades back under control. Powell said that a tighter interest rate stance is likely to come at a cost to workers and overall growth. However, he holds that not acting would allow price increases to become a more permanent feature of the economy...

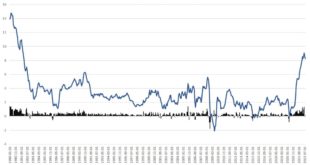

Read More »The Dollar Heads into the Weekend Well Bid

Overview: The dollar is well bid. It has risen to new two-year highs against the dollar bloc and Chinese yuan. Aided by worse than expected retail sales, sterling, on its anniversary of leaving the European Exchange Rate Mechanism fell to its lowest level since 1985. This fits into the broader risk-off move. The S&P 500 fell to new two-month lows yesterday, and FedEx warnings after the bell yesterday add to the string of worrisome comments from leading US...

Read More »Insatiable Government

[This essay, which exposes the big-government policies of the Hoover administration, was first published in the Saturday Evening Post, June 25, 1932.] In the minutes of the Chicago City Council, May 12th last, is the perfect example of how commonly we regard public credit. From bad taxation, reckless borrowing and reckless spending, the city of Chicago had so far prejudiced its own credit that for months it had been unable to meet its municipal payrolls either out...

Read More »The many perils of “Stockholm syndrome” politics

It’s been a tumultuous couple of months in UK politics. After a troubled time in office, plagued by scandal, internal party frictions and much public embarrassment, Boris Johnson exited the stage leaving behind a big old mess for his successor to clean up. An economy in tatters, inflation at record highs and an energy crisis the likes of which this generation hasn’t seen before. It’s a miracle that anyone in the kingdom could be found that would be...

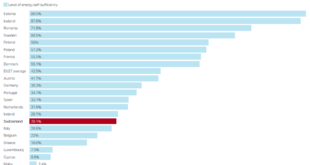

Read More »Switzerland braces for winter energy crunch

Despite being one of the world’s richest countries, Switzerland also faces the threat of an energy shortage in the coming months. The authorities are scrambling to prepare. SWI swissinfo.ch has gathered answers to some of the most pressing questions on electricity supply, Switzerland’s dependence on Russian gas, and measures being taken to get the country through the winter. Is Switzerland self-sufficient in meeting its energy needs? No. Domestic electricity...

Read More »Swiss parliament okays purchase of F-35 jets from US

Switzerland’s House of Representatives has approved the purchase of new F-35 fighter jets from the United States. The decision clears the path for Bern to sign the purchase contract, even though an initiative to prevent the deal has not been voted on by Swiss voters. Keystone-SDA news agency reported on Thursday that the majority was convinced the contract should be signed by the bid closing date: March 30, 2023. The jet purchase is part of the Army’s 2022 budget,...

Read More »August’s Price Inflation Soared, and That Means Earnings Fell Yet Again

The federal government’s Bureau of Labor Statistics released new price inflation data today, and the news wasn’t good. According to the BLS, Consumer Price Index (CPI) inflation rose 8.3 percent year over year during August, before seasonal adjustment. That’s the seventeenth month in a row of inflation above the Fed’s arbitrary 2 percent inflation target, and it’s six months in a row of price inflation above 8 percent. Month-over-month inflation rose as well, with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org