As September winds down, three sets of economic reports will draw the most attention. We will review them and then offer a snapshot of the emerging market central bank meetings. As we have seen in the UK and Norway, several emerging market countries raised rates early (beginning in the middle of last year) but still experienced an acceleration of inflation. It obviously begs the unanswerable question about the impact on US inflation if the Fed had taken its foot off...

Read More »The Fed Is Finally Seeing the Magnitude of the Mess It Created

When asked about price inflation in his Sunday interview with 60 Minutes, President Biden claimed that inflation “was up just an inch…hardly at all.” Biden continued the dishonest tactic of focuses on month-to-month price inflation growth as a means of obscuring the 40-year highs in year-over-year inflation. This strategy may yet work to placate the most ignorant voters, but people who are paying attention know that price inflation continues to soar. Thus, while...

Read More »The positives and negatives of Swiss interest rates

By normal standards, interest rates of 0.5% are considered low. But Switzerland has just emerged from a long period of negative interest after the Swiss National Bank (SNB) raised rates from -0.25% to +0.5%. When not covering fintech, cryptocurrencies, blockchain, banks and trade, swissinfo.ch’s business correspondent can be found playing cricket on various grounds in Switzerland – including the frozen lake of St Moritz. More from this author | English...

Read More »Work to begin on Swiss backup power plant

The Swiss government has given the green light to begin the construction of a temporary reserve power plant due to be operational from February next year. The executive body signed off on two decisions on Friday to speed up the approval of planning regulations for the eight-turbine plant in Birr, in the north of the country. The government had already signed a contract with the GE Gas Power company earlier this month for the CHF470 million ($480 million)...

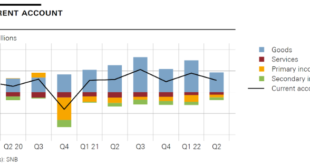

Read More »Swiss Balance of Payments and International Investment Position: Q2 2022

Overview In the second quarter of 2022, the current account surplus was CHF 11 billion, almost CHF 1 billion lower than in the same quarter of 2021. The receipts surplus in goods trade, especially merchanting and traditional goods trade (foreign trade total 1), declined. The expenses surpluses in services trade, primary income and secondary income were each lower than in the same quarter of 2021. . In the financial account, reported transactions recorded a net...

Read More »What Economics Is

[This article is chapter 1 from Bylund’s new book How to Think about the Economy: A Primer.] Economics is an exciting field. The economics of old sought to uncover how the world works. It showed, or even proved, that there is a natural order to it. There is structure to the apparent chaos. The economy has something of a life of its own: it has a nature. This means not only that we can study it and learn about its ways, but also that we are not free to tamper with it...

Read More »Thomas Jordan: Sixth Karl Brunner Distinguished Lecture – Introduction of Benjamin M. Friedman

Ladies and Gentlemen I am very pleased to welcome you all to the sixth Karl Brunner Distinguished Lecture. The Swiss National Bank established this annual lecture series in honour of the Swiss economist Karl Brunner, one of the leading monetary economists of the last century. Our aim with these lectures is to reach a broad audience, and to contribute to the public debate on issues related to central banking and economics more broadly. This year’s Karl Brunner...

Read More »Cryptomarkt verliert zwei Drittel seiner Marktkapitalisierung

Im November 2021 hatte der Markt fast die Marke von drei Billionen erreicht. Seitdem ging es jedoch steil bergab. In den letzten Tagen ging es sogar unter eine Billionen US-Dollar, so dass der Markt in weniger als einem Jahr zwei Drittel seines Gesamtwertes verloren hat. Crypto News: Cryptomarkt verliert zwei Drittel seiner MarktkapitalisierungFür Bitcoin ging es im selben Zeitraum sogar etwas mehr als zwei Drittel nach unten. Dies zeigt wieder einmal, dass Bitcoin...

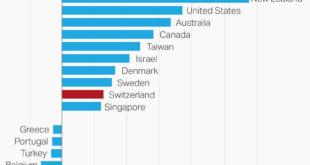

Read More »Wealthy echelons thrive amid economic volatility

The world’s richest people saw their wealth expand last year as stock markets and real estate gained in value, according to Swiss bank Credit Suisse. When not covering fintech, cryptocurrencies, blockchain, banks and trade, swissinfo.ch’s business correspondent can be found playing cricket on various grounds in Switzerland – including the frozen lake of St Moritz. More from this author | English DepartmentMatthew Allen Total global wealth increased by...

Read More »Does Capitalism Itself Create Economic Instability or Is Central Banking the Culprit?

Instability in financial markets has brought back the ideas of post-Keynesian school of economics (PK) economist Hyman Minsky. Minsky held that the capitalist economy inherently is unstable, culminating in severe economic crisis, accumulation of debt being the key mechanism pushing the economy toward a crisis. During “good” times, according to Minsky, businesses in profitable areas of the economy are well rewarded for raising their level of debt. The more one borrows...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org