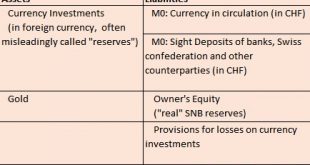

Headlines April 2016 Speculative position: Speculators are even longer CHF: +9410x 125K contracts.Sight Deposits: SNB intervenes for 6.4 bln. CHF in only three weeks. Sight deposits (aka debt) are rising by 1% per month, this is 12% per year. The SNB can never achieve such a yield on investment, her yield is between 1 and 2 percent.6.4 billion is the highest level since January 2016. Why the SNB is driving the EUR/CHF so high is a question, given that both real money and speculators are...

Read More »Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the labor market, with weekly initial jobless claims at their lowest level since 1973 and continuing claims at their lowest level since 2000, it is difficult to get too negative the US...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note. Perhaps the main driver was rising US yields, as markets become wary of a more hawkish Fed this Wednesday. Perhaps it was technical, as the EM rally became over-extended. Whatever the reasoning, the correction continued into the weekend and is likely to carry over to this week as well. While we remain cautious on EM at such rich valuations, a significant correction (which we have not seen in quite some time) could make some assets more attractive. ...

Read More »FX Daily April 25: Dollar Pares Pre-Weekend Gains Against Euro and Yen

The US dollar starts what promises to be an eventful week giving back some the gains score in second half of last week against the euro and yen. Equity markets are extending their pre-weekend losses. Commodities are also trading with a heavier bias. Markets in Australia, New Zealand, and Italy are closed for national holidays. The consolidative tone may not be very surprising give the data to be released in the coming days and the FOMC and BOJ meetings. Investors will see the first...

Read More »Affairs of State: Erdogan and Böhmermann

Insulting Mr. Erdoğan Can Be Dangerous Most of our readers are probably aware by now that the German government finds itself in a rather awkward situation over its relations with Turkey’s government again – with which the EU has just struck a widely criticized and very expensive deal to help it stem the flood of refugees. One thing is absolutely certain about Turkey’s president Recep Tayyip Erdoğan: He has no sense of humor whatsoever. As of early March 2016, 1,845 lawsuits were pending...

Read More »Silver is on Fire

The Prices of Gold and Silver Drift Apart Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%. Inside the Sierra silver mine in Wallace, Idaho Photo credit: silverminetour.org We get the trading thesis, that if the precious metals are in a bull market, then silver should go up more than gold. Silver is the high-beta gold. It’s a smaller market, less liquid, and at the same time it’s the...

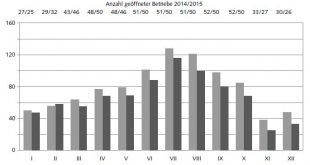

Read More »Statistics on tourist accommodation in 2015: Significant decrease in overnight stays in youth hostels, moderate decline for campsites

25.04.2016 09:15 – FSO, Tourism (0353-1604-50) Statistics on tourist accommodation in 2015 Significant decrease in overnight stays in youth hostels, moderate decline for campsites Neuchâtel, 25.04.2016 (FSO) – Switzerland’s 51 registered youth hostels generated 814,000 overnight stays in 2015, i.e. a decrease of 14.4% compared with 2014. As for the 410 campsites surveyed, 2.7 million overnight stays were recorded, representing a decline of 0.6% compared with the previous year. These...

Read More »Standard of living in Switzerland remains one of the highest in Europe

25.04.2016 09:15 – Eurostat; FSO, Income, Consumption and Living Conditions (0353-1603-00) Standard of living in Switzerland remains one of the highest in Europe Neuchâtel, 25.04.2016 (FSO) – In 2014 Switzerland was one of the countries with the highest living standards in Europe. This does not exclude financial difficulties, as 6.6% of the population, i.e. approx. 530,000 people were affected by income poverty. Roughly one person in ten cannot afford a week’s holiday away from home...

Read More »The Week Ahead: FOMC, BOJ and More

The last week of April is eventful. The Reserve Bank of New Zealand, the Federal Reserve and the Bank of Japan hold policy meetings. The UK, eurozone, and the US provide the first estimates of Q1 GDP. Japan, the eurozone, and Australia report consumer prices, while the US updates the Fed’s preferred (targeted) inflation measure, the core deflator of personal consumption expenditures. These events will not take place in a vacuum. The backdrop is an improving tone in the global capital...

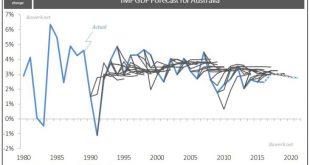

Read More »Chinese Dragon: Breathing Credit Fumes

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate. However, spending millions of dollars to do the job of a ruler doesn’t seem like wise...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org