Myths That Just Won’t Die Gold just had its best quarter in 30 years. Not surprisingly, gold bears are coming out of the woodwork en masse in the mainstream media and the analyst community (see e.g. this recent write-up by Mish on the Goldman Sachs analyst who has been screaming “short gold” since right before it started rocketing higher in early February). Below we will discuss a specific assertion that tends to be repeated over and over again. Gold had a very strong quarter, but skepticism over the durability of the advance remains quite pronounced – click to enlarge. If there is anything in this world that definitely has more lives than a cat, it is bad economics. Just think about it: Here we are, nearly 300 years after John Law drove France and most of continental Europe into utter ruin, and our central bankers are still doing the exact same things Law did. The only difference between John Law and the trifecta of Draghi, Kuroda and Yellen is really the modern-day level of obfuscation and the fact that there is far more wealth that can be destroyed, so it is taking a lot longer. In terms of economic principles and the goals allegedly achievable by their policies, the difference between Law and today’s central bankers is precisely zero.

Topics:

Pater Tenebrarum considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Myths That Just Won’t Die

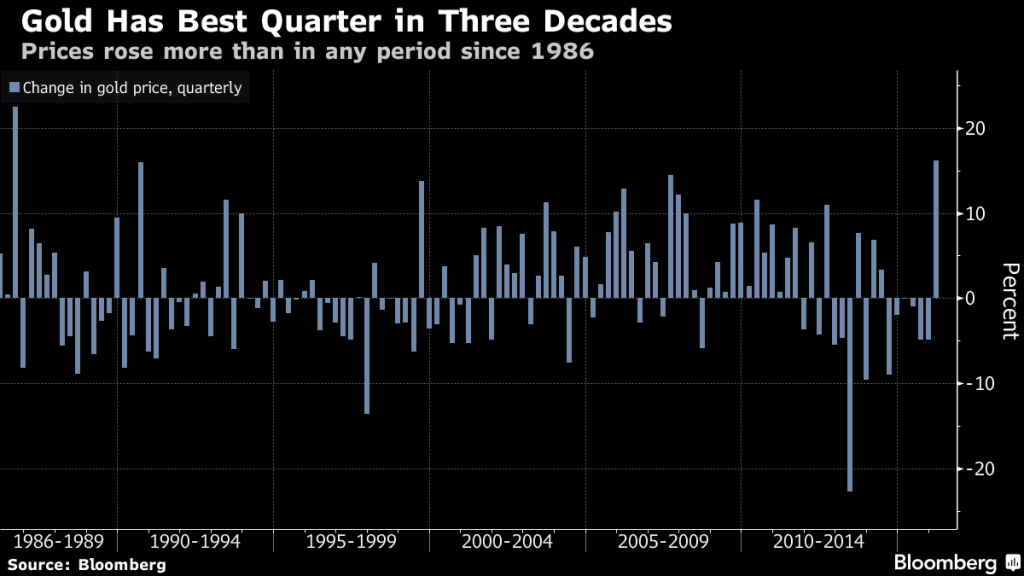

Gold just had its best quarter in 30 years. Not surprisingly, gold bears are coming out of the woodwork en masse in the mainstream media and the analyst community (see e.g. this recent write-up by Mish on the Goldman Sachs analyst who has been screaming “short gold” since right before it started rocketing higher in early February). Below we will discuss a specific assertion that tends to be repeated over and over again.

| Gold had a very strong quarter, but skepticism over the durability of the advance remains quite pronounced – click to enlarge. |  |

If there is anything in this world that definitely has more lives than a cat, it is bad economics. Just think about it: Here we are, nearly 300 years after John Law drove France and most of continental Europe into utter ruin, and our central bankers are still doing the exact same things Law did. The only difference between John Law and the trifecta of Draghi, Kuroda and Yellen is really the modern-day level of obfuscation and the fact that there is far more wealth that can be destroyed, so it is taking a lot longer.

In terms of economic principles and the goals allegedly achievable by their policies, the difference between Law and today’s central bankers is precisely zero. It is astonishing that after 300 years of supposed scientific progress, atrociously bad economics has shown such persistence in surviving. We were reminded of this agan when reading a recent comment on gold in the Wall Street Journal. No matter how often and how convincingly they are refuted, unsound economic ideas keep being resurrected with unwavering regularity, as if they were a horde of zombies.

The article in question is entitled “A Warning for Gold Bugs: This Rally Won’t Last”, by one Steven Russolillo. One can certainly debate whether gold’s recent rally will or won’t last – reasonable arguments can be made for both outcomes. One would think though that such a debate is conditional on some rudimentary understanding of gold. Russolillo first discusses the current state of sentiment on gold, which we will return to in a follow-up post. Here we will skip ahead to another part of his argument, which appears central to his “warning”. He writes:

“Gold often thrives as a haven in times of turmoil, or acts as a hedge against inflation. Devotees love pointing to negative interest rates around the globe as evidence that has recently made gold glitter more than usual.

The problem is these theories don’t take into account a fundamental analysis of gold’s intrinsic value: It doesn’t really have any. Unlike many financial assets such as stocks, bonds, real estate and others, gold doesn’t generate any income. Valuing it is virtually impossible.”

(emphasis added)

We are continually coming across variations of the assertion highlighted above, which to our knowledge has inter alia been uttered by Warren Buffett at some point in the past. This may well be why so many people keep regurgitating it as if it were gospel.

To begin with, it is absolutely correct that gold has no “intrinsic value”. However, this is not a characteristic unique to gold. It certainly isn’t differentiating gold from other things in this world. There simply is no such thing as “intrinsic value”.

All value judgments are subjective, something that has been known since at least 1873, when Carl Menger’s Principles of Economics was published. Value theory was one of the greatest problems classical economists had failed to solve, and Menger’s insight that all value judgments are subjective and depend on individual value scales (a theory later refined further by Mises) cut through the Gordian knot. Apparently this piece of good news hasn’t reached everybody yet.

As an aside to this, the only context in which the combination of the terms “intrinsic” and “value” could be said to at least make some sort of technical sense, is when describing the price components of an in-the-money option. The extent to which such an option is in the money can be said to represent its “intrinsic value”, while the remainder of its price is due to other factors, such as its time premium and volatility premium. Of course the latter partly reflects the subjective perceptions and value judgments of market participants as well.

So when “these theories don’t take into account a fundamental analysis of gold’s intrinsic value” as Russolillo puts it, that is perfectly fine, because there would be no point in taking non-existent things into account. He then implies though that while gold is apparently lacking in “intrinsic value”, other things such as stocks, bonds and real estate, are supposedly in possession of same. Well, no, they are not. As noted above, there simply is no such thing as “intrinsic value”.

Valuing Investment Assets

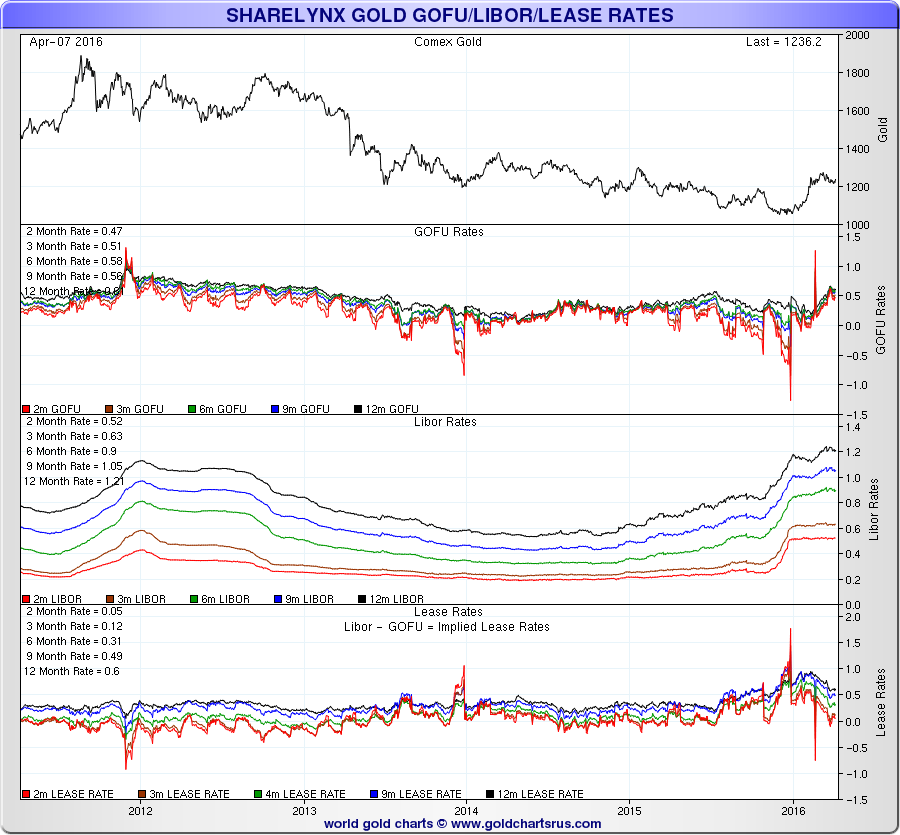

The source of his error is evidently the point about “income generation”. It is certainly true that gold has no yield, although it is not entirely true. If one holds a sufficient amount of gold, one can actually lend it out and obtain the so-called lease rate, which is the interest rate paid on gold.

Most investors won’t get any income from their gold holdings though, and most would be loath to lend it out anyway, even if they could. After all, one of the main reasons for holding gold nowadays is as insurance against the current monetary system’s flaws and tail risks (it is definitely not the only reason, but it is a good bet it motivates a great many gold holders). Keeping possession is essential in this case.

Anyway, let us agree that gold has no yield and that this does create difficulties in valuing it. The first question that needs to be asked though is: Why should one compare gold to stocks and bonds? Does this even make sense? In one sense it does, as all these assets represent viable alternatives for investors pondering how to allocate their funds. In another sense it doesn’t, as gold is more akin to a currency than a stock or a bond. So it would be more sensible to compare it to other currencies, or other forms of cash if you will.

In other words, for a gold investor the question “should I rather buy stocks, bonds or gold” is just one thing worth thinking about. Once that is decided, he needs to ask “which currencies should I choose to keep my cash holdings in” – and that is actually the question that seems more pertinent to gold. Gold should be seen as part of one’s cash savings – and as a matter of fact, the waxing and waning of the desire to save is one of gold’s fundamental drivers.

Of course, gold is not money nowadays, since it is not used as the general medium of exchange. However, it is highly likely that gold would be used as money in an unhampered free market economy, and we know for a fact that the market treats it as if it were money. If demand were solely driven by the metal’s industrial use value, its price would likely be far lower and almost all production would cease immediately, as ceteris paribus, existing gold inventories would suffice to satisfy jewelry and industrial demand for gold for about the next 70 years.

In fact, the entire annual industrial demand for gold is roughly equal to the amount of gold that is traded in London every single week (based on 2015 figures, and that was actually a slow year in terms of trading volume). In the forex trading universe, gold is currently the fourth-most liquid currency in the world. It seems obvious that monetary, resp. investment demand has to be the main driver of gold demand.

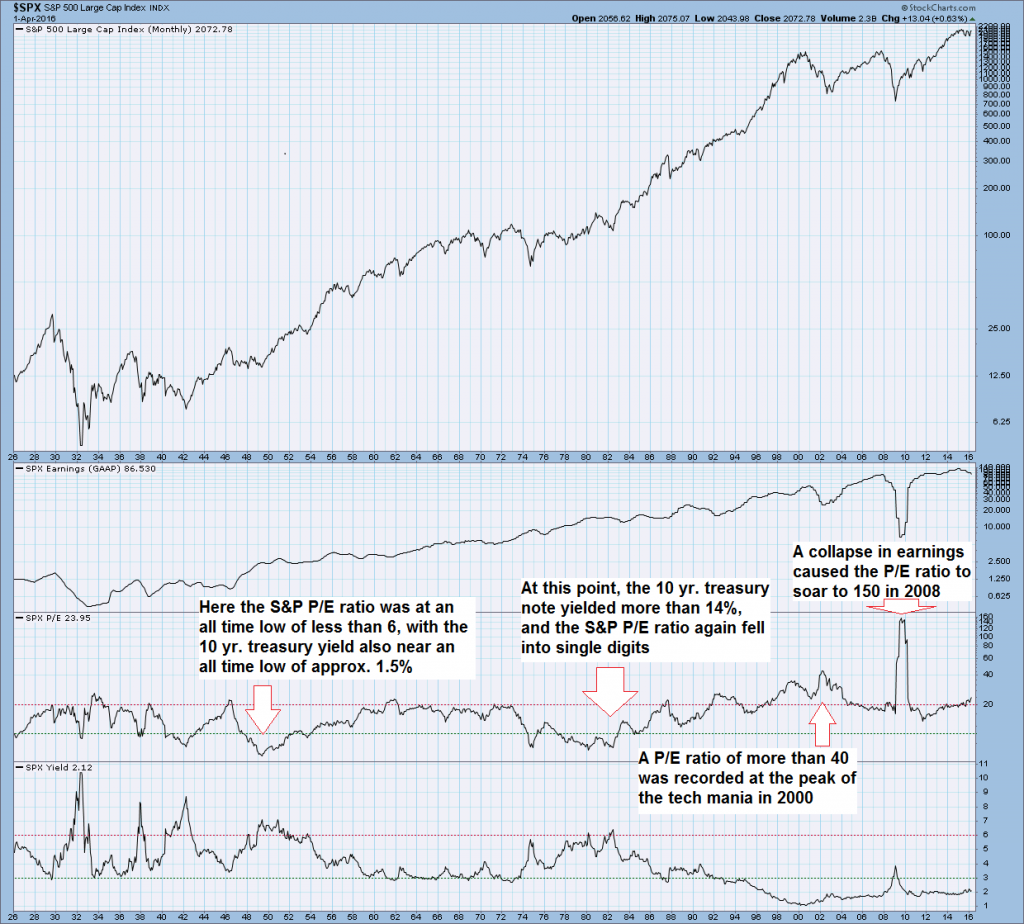

But what about the argument that their income stream makes stocks and bonds easier to value? In part this is true, but it does not alter the fact that their value is ultimately still the result of subjective value judgments. While the income an asset can generate is an important aspect of economic calculation, especially in the context of prevailing interest rates, it can be easily verified that valuations have historically fluctuated in an extremely wide band that seems to have little correlation with income or interest rates.

Over the past century, the stock market-wide P/E ratio has fluctuated between less than 6 and approx. 150, and we have seen single digit P/E’s both when interest rates were at generational lows and when they were at generational highs, so the value judgments of investors have evidently not only solely depended on earnings and the level of interest rates.

Our point here is not that earnings and interest are unimportant in assessing the valuation of stocks: our point is only that there is no way to use them as “measuring devices” to determine the non-existent “intrinsic value” of stocks. In other words, the problems one encounters in trying to determine the value of an ounce of gold are not made easier in the case of stocks by the fact that there are more data points available which one can use to calculate their current level of valuation. Their valuation at any given point in time will still depend on the subjective value scales of investors. These in turn depend on a nigh infinite multitude of factors that are making up what we refer to as “contingent circumstances”.

What is Driving the Price of Gold?

We have discussed the most important fundamental drivers of gold on several previous occasions (see e.g. “Gold and the Federal Funds Rate”). Here is the list again, which is not necessarily complete. Also, several of the factors are obviously interrelated and are not necessarily listed in order of importance here:

- real interest rates, as determined by the difference in market-derived inflation expectations and nominal interest rates

- the trend in credit spreads

- the steepness (and trend) of the yield curve

- the waxing and waning of economic confidence in general

- faith in the banking system’s solvency

- the relative performance of financial stocks vs. the broad market

- faith in monetary authorities

- faith in government more generally (with a special focus on fiscal trends)

- the trend in risk asset prices

- the rate of change in money supply growth

- the demand for money and the desire to increase precautionary savings

- the trend in the US dollar vs. other fiat currencies

- the trend in commodity prices

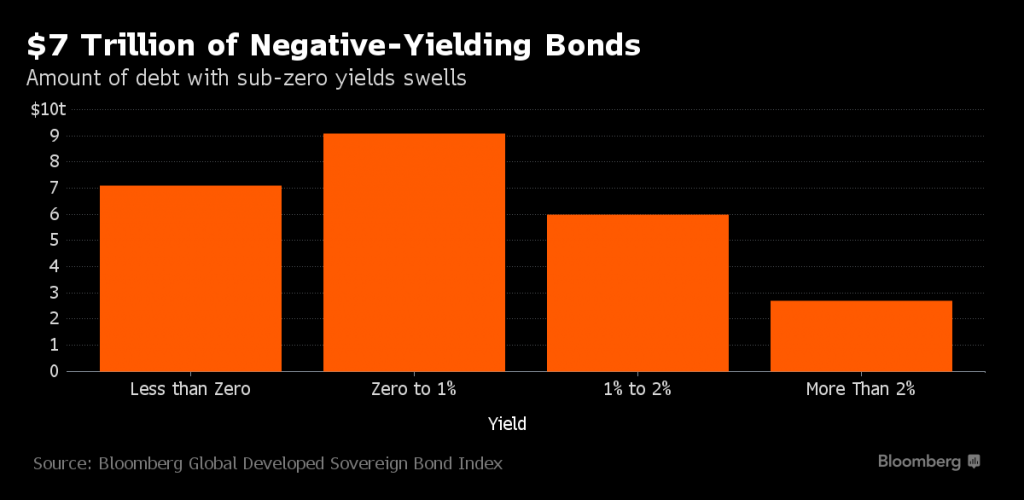

Which of these drivers predominates in the minds of investors varies depending on circumstances, but given that gold usually offers no yield, the level of real interest rates is definitely always of great importance. It is actually quite funny in this context that Mr. Russolillo mentions bonds in his list of things that are presumably superior investments compared to gold because they “generate income”.

In reality, the effect of central bank intervention on bond yields is one of the main reasons why gold is extremely attractive at the moment – more than $7 trillion in government bonds are no longer providing an “income” but instead are providing a guaranteed loss if the bonds are held to maturity. How does this kind of “income” help one in “valuing” bonds? Just asking, maybe Mr. Russolillo can explain.

| Sovereign bonds – the state of affairs in mid February – in the meantime, the amount of negative-yielding bonds has swelled to nearly $7.8 trillion! |  |

When comparing nominal rates to the Fed’s preferred inflation measure of core PCE (which currently stands at a 1.8% annual rate) real interest rates have just turned negative in the US for all maturities from overnight interbank lending rates to the 10-year treasury note.

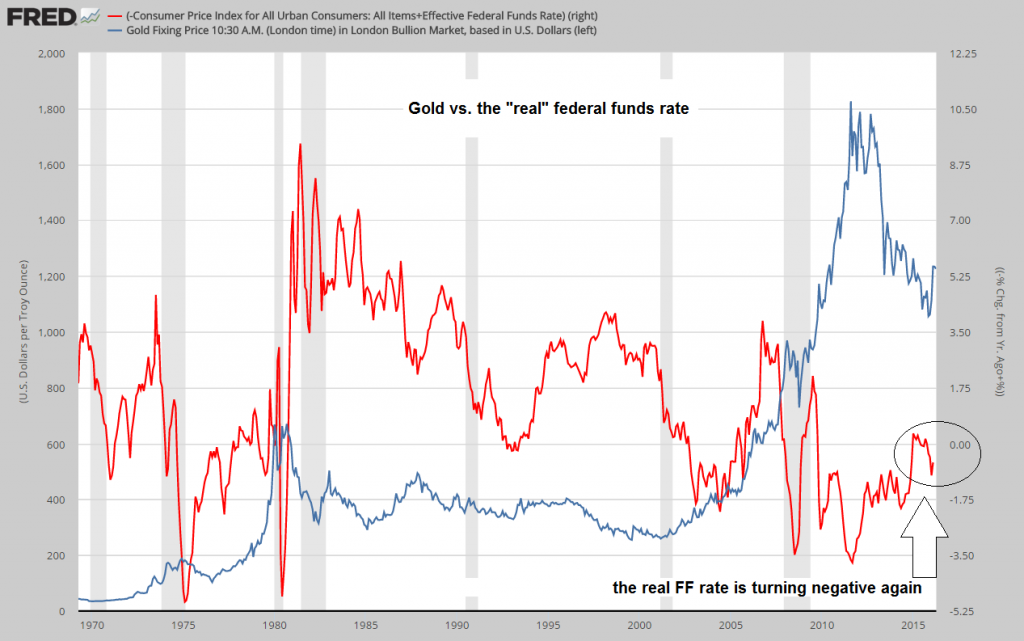

If we look at a chart of the federal funds rate compared to headline CPI, we can see that a trend change has just taken place. The previous trend resulted in a brief peek into positive real interest rate territory, but recently real interest rates have begun to turn increasingly negative again:

| Gold (blue line) vs. the “real” federal funds rate – click to enlarge. |  |

As we noted in “Gold and the Federal Funds Rate”, this is actually quite an imperfect way of determining the level of real interest rates. However, we think it is good enough to be considered serviceable for our purposes here. What it is telling us at the moment is that what is arguably one of the most important drivers of the gold price has just turned bullish again.

Conclusion

Current positioning and sentiment data do indicate that gold is short term overbought, or at least was short term overbought at its recent interim peak. It is easily possible that a deeper correction still lies ahead (as mentioned, we will discuss this in more detail shortly).

It is also true that it is not “easy” to determine what gold should be worth at a given time, although there are sensible methods to arrive at approximations. For instance, one can certainly determine gold’s relative price compared to other assets or relevant magnitudes such as the money supply with great accuracy. By bringing this into context with the macroeconomic backdrop and the likely trend of the fundamental gold price drivers listed above, one can then come to conclusions over whether or not it is a propitious time to invest in gold.

However, if one discusses the prospects for gold, one should definitely not ever mention “intrinsic value” or declare it as essentially useless based on the fact that it generates no yield. Its lack of yield undoubtedly influences its relative attractiveness as an investment asset. However, for bond speculators not even negative yields are nowadays a deterrent, as long as central banks are promising to take the bonds off their hands again by monetizing more and more debt.

A number of gold’s fundamental price drivers are currently gold bullish or in the process of turning bullish, and others are not, or at least not yet. However, the great monetary experiment in the John Law tradition that today’s central bankers have launched is certainly a very good reason not only to hold gold, but to actually overweight it relative to other assets – especially after it has already corrected quite a bit from its 2011 peak.

The mainstream loves to hate gold, but then again, these are the same people who were bearish on gold all the way up from $250 to $1,900 (some turned bullish shortly before it topped, but that’s another story). What actually explains all this contempt for gold is the fact that it remains the main antagonist of the current statist centrally planned fiat money system. It’s as simple as that.

Charts by: Bloomberg, ShareLynx, StockCharts, St. Louis Federal Reserve Research