Frauke Petry, leader of the Alternative for Germany (AFD) Frauke Petry, leader of the Alternative for Germany (AfD), believes Germany “needs more Switzerland … more democracy” and that Switzerland is some way ahead of her country when it comes to a “culture of democracy”. Petry, who in January suggested German police should be allowed to shoot refugees trying to enter Germany, was a guest speaker at the general meeting of the Campaign for an Independent and Neutral Switzerland (CINS, in...

Read More »Switzerland Readies Military In Preparation For A New Wave Of Migrants

According to The BBC, the most asylum claims in 2015 occurred in Germany, which saw >500,000... With the main route (reportedly shut down) being from Turkey to Greece, and up through the Balkans... With Syrians making up the bulk of migrants trying to enter Europe. But now, in response to Balkan countries closing down traditional migrant routes to Europe, Switzerland's military is taking steps to prepare for a potential new wave of immigrants in case it becomes part of a new route....

Read More »Weekly Speculative Positions: Reduction of US Dollar Exposure at What may be the Bottom

Speculators in the futures market continued to press a bearish view of the US dollar the CFTC reporting week ending April 19.According to the Commitment of Traders report, speculators added to their gross long currency futures position in seven of the eight currencies we track. The exception was the British pound, where speculators liquidated a minor 1.1k contracts, leaving them with 32.8k gross long sterling future contracts. That said, most gross currency adjustments were small, but...

Read More »FX Weekly: Dollar’s Technical Tone Improves

It is not that the US dollar had a particularly good week. It was mixed. The best performers were sterling and the Canadian dollar. The pound led with a 1.5% gain, followed closely by the Canadian dollar. The latest polls suggest that those who want the UK to remain in the EU have generally seen some gains in the polls. Also, unwinding short cross positions against the euro, helped sterling get better traction against the greenback. Firmer oil, better data, and a central bank that...

Read More »Russian Aggression Unmasked (Sort Of)

Provocative Fighter Jocks Back in 2014, a Russian jet made headlines when it passed several times close to the USS Donald Cook in the Black Sea. As CBS reported at the time: “A Pentagon spokesperson told CBS Radio that a Russian SU-24 fighter jet made several low altitude, close passes in the vicinity of the USS Donald Cook in international waters of the western Black Sea on April 12. While the jet did not overfly the deck, Col. Steve Warren called the action “provocative and...

Read More »Rational Insanity

Intel Employees Get RIF’d Dark storm clouds gather along the economic horizon. They multiply ominously with each passing day. The recovery, weak as it has been, has run for nearly seven years. Now it appears to be sputtering and stalling out. Intel (INTC), monthly. The stock has performed fairly well since 2009 (most stocks have), but has yet to regain its bubble peak made 16 years ago. Its recent earnings report (“beating expectations”, natch) reminded us strongly of the accounting...

Read More »A Historic Rally in Gold Stocks – and Most Investors Missed It

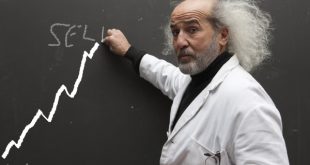

Buy Low, Sell High? It is an old truism and everybody has surely heard it more than once. If you want to make money in the stock market, you’re supposed to buy low and sell high. Simple, right? As Bill Bonner once related, this is how a stock market advisor in Germany explained the process to him: Thirty years ago, at an investment conference, there was a scalawag analyst from Germany. He showed a chart where a stock had gone up steadily for 10 years. He pointed to the bottom, left...

Read More »The State of the Bull

(here is a draft of my monthly column for a Chinese paper) The US dollar has had a rough few months. It has fallen against most major and emerging market currencies this year. A critical issue for global investors and policymakers is whether the dollar’s uptrend is over, or is this just a respite. Much is at stake with the answer. The variability of exchange rates could account for a third of the total return of a basket of international equities and twice as much for a basket of...

Read More »Emerging Markets: What has Changed

(from my colleague Dr. Win Thin)China’s central bank may be leaning less dovish Turkey has a new central bank governor Argentina issued external debt for the first time since it defaulted 15 years ago Brazil's lower house voted to impeach President Rousseff by a 367-137 vote In the EM equity space, Russia (+2.7%), Indonesia (+1.9%), and UAE (+1.8%) have outperformed this week, while China (-3.0%), Taiwan (-1.9%), and Hungary (-1.2%) have underperformed. To put this in better context, MSCI...

Read More »FX Daily, April 22: Capital Markets Mostly Consolidate, Yen Drops

Equity markets are seeing this week's gains trimmed after the S&P 500 fell 0.5% yesterday, recording its biggest loss in two weeks. Disappointing earnings in some tech leaders spurred profit-taking, The US 10-year Treasuries are consolidating the week's nine basis point increase in yields after nearing 1.90% yesterday. Asian bonds yields tracked US Treasury yields higher while European bonds are narrowly mixed as they consolidate yesterday's increase. The US dollar recovered from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org