Tetra Pak crumpled - Click to enlarge According to Reuters, following an investigation, China’s State Administration for Industry and Commerce (SAIC) said, it found out that Tetra Pak violated some provisions in China’s anti-trust law and will impose a fine of 668 million yuan ($97 million) on Tetra Pak for “abuse of dominant market position”. The Shanghai Daily said, SAIC found that Tetra Pak had broken anti-monopoly...

Read More »Swisscom promises to put an end to unwanted sales calls

© Marcovarro | Dreamstime.com - Click to enlarge Swisscom’s fixed line (remember those) customers will be given the option of blocking unwanted calls from 28 November. The service will be free and can be activated by checking a box online or by calling the Swisscom hotline (0800 800 800). Sunrise and UPC are expected to follow Swisscom by mid 2017, according to 24 Heures. The new system automatically filters out...

Read More »Are Emerging Markets Still “A Thing”?

By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn’t spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think...

Read More »You’ll Only Understand Trump and Brexit If You Understand the Failure of Globalization

[See also The Numbers Show Trump Win NOT Due to Racism and Sexism] You can only understand the victory of Donald Trump and Brexit once you understand the failure of globalization … Trump Trump made rejection of globalization a centerpiece of his campaign. In his July 21st acceptance speech as the Republican nominee, he said: Americanism, not globalism, will be our credo. The Boston Globe bannered this headline on...

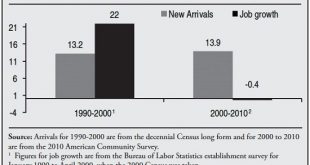

Read More »Rising Immigration but no Jobs

Perceptions may well change when the global illusions of solvency and “growth” collapse in a heap. The list of pundits jostling for air time to add their two cents to discussions of hot-button issues such as immigration is endless. The airwaves and social media are overflowing with people wanting to comment on hot-button social issues, but when it comes to the the one truly critical dynamic that will shape the...

Read More »Swiss National Bank won’t cut record low interest rate again, survey shows

© Valeriya Potapova | Dreamstime.com - Click to enlarge The Swiss National Bank, which has the lowest interest rate among the world’s major central banks, may be done cutting. SNB President Thomas Jordan and his fellow policy makers will keep the deposit rate unchanged at minus 0.75 percent until at least the end of the first quarter of 2019, according to the median forecast in Bloomberg’s monthly survey of...

Read More »European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

Submitted by Ronan Manly, BullionStar.com The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB...

Read More »FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

Swiss Franc EUR/CHF - Euro Swiss Franc, November 17(see more posts on EUR/CHF, ). - Click to enlarge UK Retail Sales figures are released this morning at 09.30 and could have an impact GBP/CHF exchange rates. The Pound has gained ground against the CHF over the past month but have levelled out over the past week, as the markets digest the unexpected election results in the US. The Pound has benefitted from...

Read More »Swiss Unemployment Rate (ILO-based) behind Iceland, Germany and Czech Republic on position 4: All Four Countries Are Currency Manipulators

With 4.8%, the Swiss unemployment rate based on the ILO concept is higher than the rates in Iceland (2.6%), Czech Republic (4.0%) and Germany (4.1%), but lower than the ones of the remaining 25 countries in the data provided by Swiss Statistics. As for youth unemployment, the Swiss are on position three with a rate of 11%, this is half the rate of the Eurozone, or a fourth of the rate in Spain or Greece. All Four...

Read More »Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org