As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. Simply, with an economy failing to gain traction there is little ability for the Fed to...

Read More »What If We’re in a Depression But Don’t Know It?

If it isn’t a Depression, it’s a very close relative of a Depression. Just for the sake of argument, let’s ask: what if we’re in a Depression but don’t know it? How could we possibly be in a Depression and not know it, you ask? Well, there are several ways we could be in a Depression and not know it: 1. The official statistics for “growth” (GDP), inflation, unemployment, and household income/ wealth have been...

Read More »World markets rally as cheap money policy continues

SMI The Swiss Market Index is set to finish the week notably higher, although under-performing global stocks amid optimism that central banks will continue to support equities by keeping interest rates at historic lows and providing markets with additional liquidity. Click to enlarge. Economic Data Global equities experienced a “relief rally” after crucial central bank policy meetings in Japan and the US indicated...

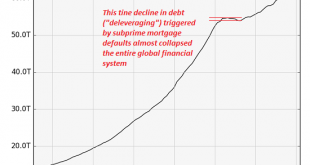

Read More »Why the Coming Wave of Defaults Will Be Devastating

Without the stimulus of ever-rising credit, the global economy craters in a self-reinforcing cycle of defaults, deleveraging and collapsing debt-based consumption. In an economy based on borrowing, i.e. credit a.k.a. debt, loan defaults and deleveraging (reducing leverage and debt loads) matter. Consider this chart of total credit in the U.S. Note that the relatively tiny decline in total credit in 2008 caused by...

Read More »Julius Baer CEO says Asia revenue may excede Europe’s in 5 years

Julius Baer Group Ltd. said Asia may overtake Europe as its biggest revenue-generating region, as the Swiss wealth manager steps up hiring in Hong Kong and Singapore. “In the next five years, Asia could be the biggest region for us if we grow at double-digit” rates, Chief Executive Officer Boris Collardi said Wednesday in an interview in Singapore. More than half of about 200 new bankers that Julius Baer plans to hire...

Read More »Swiss still the world’s wealthiest, says report

Largely due to a flood of central bank liquidity, global private financial assets have grown by 61% over the seven years since the financial crisis, almost twice the growth rate of economic output, says a report from the German Insurance giant Allianz. This has boosted the wealth of those who own shares. Those relying on interest, on the other hand have seen their wealth stagnate. The report goes on to say “after seven...

Read More »FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

Swiss Franc The EUR/CHF accelerated its decline since yesterday’s strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged. We know that the Swiss Franc has similar “counter-dollar” status as gold. Click to enlarge. Japan Much of what the Bank of Japan announced today had been largely leaked. While there was a sizeable response in the asset markets, the dollar’s...

Read More »Swiss economy slowly gains momentum but risks remain

In a report published by SECO, a group of economy experts working for Switzerland’s federal government, says it anticipates an acceleration in economic growth in Switzerland from 0.8% in 2015 to 1.5% in 2016 and 1.9% in 2017. Along side this they expect unemployment to rise from 3.3% in 2015, to an annual average of 3.6% in 2016, before falling again to 3.4% in 2017. However, they also see risks. © Flynt |...

Read More »Negative govvies: why would ya?

A question worth asking considering the rather large amount of them knocking about at the moment. According to JPM, the total universe of government bonds traded with a negative yield was $3.6tr last week or 16 per cent of the JPM Global Government Bond Index. It’s an answer in itself, really. Anyway, here’s a list of those willing/ forced to buy those negative yielding government bonds from JPM’s Niko...

Read More »Swiss watch exports fall for fourteenth straight month

Swiss watch exports fell in August as demand weakened from Japan to the U.S., extending the industry’s slump to fourteen months. The Swiss watch industry is strongly correlated with the growth in Asia. While the chemical and pharmaceutical industry (the “Basel companies”) export a lot into the United States. The firmer is currently weakening, while the latter profits on the stronger dollar and “Obamacare demand”. As...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org