Wicked and Terrible After touting her pro-labor union record, the Wicked Witch of Chappaqua rhetorically asked, “why am I not 50 points ahead?” Her chief rival bluntly responded: “because you’re terrible.”* No truer words have been uttered by any of the candidates about one of their opponents since the start of this extraordinary presidential campaign! Electoral map, Donald Trump(see more posts on Donald Trump,...

Read More »Donald’s Electoral Struggle

Wicked and Terrible After touting her pro-labor union record, the Wicked Witch of Chappaqua rhetorically asked, “why am I not 50 points ahead?” Her chief rival bluntly responded: “because you’re terrible.”* No truer words have been uttered by any of the candidates about one of their opponents since the start of this extraordinary presidential campaign! Electoral map, Donald Trump(see more posts on Donald Trump,...

Read More »Switzerland, UBS Consumption Indicator

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS Consumption Indicator rose to 1.53 points in August from 1.45. This development was fueled by resurging tourism and above-average car sales for the month. However, the situation on the labor market casts...

Read More »Switzerland stays most competitive nation as WEF warns on trade

© Palinchak | Dreamstime.com The World Economic Forum named Switzerland the most competitive nation for an eighth straight year as it warned less open trade was threatening economic growth globally.Switzerland was ahead of Singapore and the U.S. in the annual rankings of 138 countries, with Netherlands overtaking Germany to take the fourth spot. The Geneva-based organization used the report to highlight its concern...

Read More »Great Graphic: Stocks and Bonds

Summary: The relationship between the change in Us 10-year yields and the change in the S&P 500 has broken down. The 60-day correlation is negative for the first time since late Q2 2015. It is only the third such period of inverse correlation since the start of 2015. As market participants, we are sensitive to changing inter-market relationships. This Great Graphic, from Bloomberg shows the correlation...

Read More »Are The ‘Invisible Americans’ the Key Players in This Election?

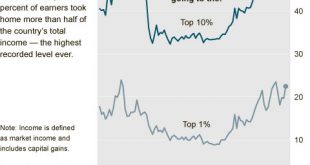

Memo to the D.C. Beltway/mainstream media apologists and propagandists: the 25 million Invisible Americans are no longer buying your shuck-and-jive con job. Just as the Vietnam War was built on lies, propaganda, PR and rigged statistics(the infamous body counts–civilians killed as “collateral damage” counted as “enemy combatants”), so too is the “recovery” nothing but a pathetic tissue of PR, propaganda and lies. I...

Read More »Switzerland, UBS Consumption Indicator

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS Consumption Indicator rose to 1.53 points in August from 1.45. This development was fueled by resurging tourism and above-average car sales for the month. However, the situation on the labor market casts...

Read More »FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee. While Draghi’s...

Read More »FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Swiss Franc Click to enlarge. FX Rates The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the debate. Snap polls immediately following the debate gave the edge to Clinton. FX Performance, September 27Source Dukascopy. Click to enlarge....

Read More »The Undemocratic Nature of TTIP

Mounting Resistance Thousands of people recently demonstrated in Brussels against free trade deals negotiated by the EU. This happened just days before a meeting of EU trade ministers in Bratislava last Friday, which was considered the last push to salvage the Transatlantic Trade and Investment Partnership (TTIP) between the EU and the United States. Not only is Europe divided on the deal, but the talks have been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org