Marc Chandler speaks of the volatility of the CHF speculative positioning. For us this was window dressing by the SNB that wants to improve the quarterly results. Traders react to the strong market movement caused by the SNB and they close their long CHF positions. If it was really the SNB, we will see on Monday with the SNB Sight Deposits. In the week after the BOJ and FOMC meetings, speculators made several...

Read More »The Italian Dilemma

Panic Pause The sudden panic about a potentially imminent Italian banking sector collapse back in July has somewhat subsided for now, but sooner or later the issue will inevitably rear its ugly head again. The impressive headquarters of the world’s oldest surviving bank, Monte dei Paschi di Siena, Piazza Salimbeni Photo credit: Stefano Rellandini / Reuters - Click to enlarge Two months after Italian bank stocks...

Read More »Renzi and the Italian Referendum: Disruption Potential Minimized

Italian Prime Minister has set the date for the constitutional referendum as late as practically possibly. It will be held on December 4. The issue is the perfect bicameralism that gives as much power to the Senate as the Chamber of Deputies. Renzi’s argument is that the political reform is necessary to make Italy governable. Italy has had 63 governments since the end of WWII. In order to address the economic...

Read More »FX Daily, September 30: SNB Intervenes to Polish Q3 Results

Swiss Franc During the day the EUR/CHF has fallen to a low of 1.0819. We know that the in-official new floor lies at that level. Moreover, the SNB had to polish the Q3 results. With interventions she lifted the EUR/CHF to 1.0893 and the euro continued rising thanks to speculators that jumped on the train.There was no economic data that could have justified the sudden increase. EUR/CHF, September 30. FX Rates True...

Read More »Divergence: Norway and Sweden

Summary: Sweden has one of the weakest of the major currencies this year. Norway has one of the strongest of the major currencies this year. The key driver is divergence of monetary policy and that divergence is likely continue into next year. The euro is trading at its lowest level against the Norwegian krone since August 2015. The euro is near its best levels against the Swedish krona in nearly as long....

Read More »Swiss stocks slump on Deutsche Bank trouble

SMI The Swiss Market Index is set to finish the week notably lower, underperforming global stocks, as financial sector stocks sell off on questions over Deutsche Bank’s solvency. . - Click to enlarge Economic Data Global equities edged lower this week with European financials among the biggest losers after the share price of Deutsche Bank hit a 30 year low on mounting concerns about the survival of the struggling...

Read More »FX Daily, September 29: Dollar Quietly Bid, while Market is Skeptical of OPEC Deal

Swiss Franc The EUR/CHF has fallen to 1.0862, the downwards tendency since one day before the SNB monetary assessment meeting has continued. Click to enlarge. FX Rates The US dollar has firmer against most major and emerging market currencies. It remains well within its well-worn ranges, which continue to be narrow. A notable exception today is the yen’s weakness. While the majors are mostly off marginally and now...

Read More »Quick Look at Why the September Jobs Data will Likely Be Strong

Summary: There are several economic data points that suggest a healthy gain in jobs in September. College educated unemployment is 2.5% with high school graduate unemployment at 5.5%. The jobs report we expect is consistent with a Fed hike in December. Let’s admit that the monthly non-farm payroll report is among the most difficult for economists to forecast. The are not many reliable inputs as it is the first...

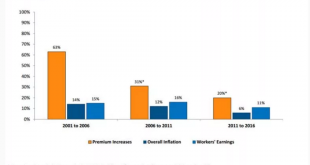

Read More »Great Graphic: Growth in Premiums of Employer-Sponsored Health Insurance

Upward pressure on US consumer prices is stemming from two elements. Rents and medical services. Due to the differences the composition of the basket of goods and services that are used, the core personal consumption deflator, which the Fed targets, typically lags behind core CPI. At is time of year, the concern tends to be on health care costs and premiums. Many US employees are given “open enrollment” when they can...

Read More »You Want to Fix the Economy? Then First Fix Healthcare

We don’t just deserve an affordable, sustainable healthcare system–we’re doomed to bankruptcy without one. What is blindingly obvious to employers but apparently invisible to the average zero-business-experience mainstream pundit is this: if you want to fix the economy, you must first fix healthcare. If you want to pinpoint a primary reason why U.S. enterprises shift jobs overseas, you have to start with skyrocketing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org