Summary:

Our society does not make it easy to control what you can control.

One of the aphorisms to live by here at Of Two Minds is control what you can.We don’t control the erosion of our money from inflation, the state’s vast criminalization machinery, the nation’s foreign policies or the central bank’s free money for financiers policies.

So what do we control? Amazingly enough, we still control a few things. We control what we eat (at least those of us who aren’t institutionalized do), what fitness/ stretching/ bodywork routine we do or don’t do, and we still control what we do with our surplus money: we can salt it away as savings rather than spend it, and we control where to invest our savings.

Here’s a couple of thoughts on productively controlling what we can control.

1. Don’t count on bailouts, debt forgiveness, debt jubilees, guaranteed minimum income or any other form of free money. The Federal Reserve, the Treasury and the Justice Department have made it very clear: free money is for financiers, banks and corporations, and bailouts are for too-big-to-fail banks and financial institutions.

As for debt forgiveness and debt jubilees: every of debt that’s forgiven (i.e. written off) is that’s removed from some investor’s balance sheet.

Topics:

Charles Hugh Smith considers the following as important:

Featured,

newslettersent,

The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Our society does not make it easy to control what you can control.

One of the aphorisms to live by here at Of Two Minds is control what you can.We don’t control the erosion of our money from inflation, the state’s vast criminalization machinery, the nation’s foreign policies or the central bank’s free money for financiers policies.

So what do we control? Amazingly enough, we still control a few things. We control what we eat (at least those of us who aren’t institutionalized do), what fitness/ stretching/ bodywork routine we do or don’t do, and we still control what we do with our surplus money: we can salt it away as savings rather than spend it, and we control where to invest our savings.

Here’s a couple of thoughts on productively controlling what we can control.

1. Don’t count on bailouts, debt forgiveness, debt jubilees, guaranteed minimum income or any other form of free money. The Federal Reserve, the Treasury and the Justice Department have made it very clear: free money is for financiers, banks and corporations, and bailouts are for too-big-to-fail banks and financial institutions.

As for debt forgiveness and debt jubilees: every $1 of debt that’s forgiven (i.e. written off) is $1 that’s removed from some investor’s balance sheet. If we jubilee $1 trillion in debt, that’s $1 trillion in assets that are destroyed.

As the saying goes, there’s no free lunch (except for friends of the Fed), and since every dollar of debt is someone else’s asset, don’t expect bailouts or debt forgiveness. If it happens, great, but there will will be catches–including Catch 22, 23 and 24.

Our diet, fitness and weight have enormous impacts on our health. The best estimates suggest no more than 1/3 of our health is the result of our genetic makeup; the rest is environmental/lifestyle.

“…at least 2½ hours a week of moderate-intensity aerobic activity such as walking, or one hour and 15 minutes a week of vigorous-intensity aerobic activity, such as jogging, or a combination of both. The guidelines also recommend that adults do muscle-strengthening activities, such as push-ups, sit-ups, or activities using resistance bands or weights. These activities should involve all major muscle groups and be done on two or more days per week.”

Between a third and half of adult Americans are meeting one of the guidelines, but only 20% are meeting both aerobic and muscle-strengthening guidelines.

These statistics are self-reported, so we have no way of knowing the actual fitness level of the 20% who claim a high level of fitness. As a baseline, I use the

Army Physical Fitness Test (APFT), which anyone can take themselves, as it measures sit-ups, push-ups and the time required to run two miles.

(NOTE: Do not attempt the test if you have not been training regularly for at least a year and have not had a thorough check-up by your personal physician recently.)

There may be other baselines of fitness that are less strenuous. The point is, choose an objective baseline and monitor your progress. Be patient and self-disciplined; overdoing it will result in injuries, not fitness.

I personally aim to do the minimum required to stay fit, because I’m basically lazy. As fitness guru Jack LaLanne said, “I hate exercise, but I like the results.”

Eating well is equally challenging, and Drew Sample and I discuss diet, fitness, weight and controlling what we can in this podcast:

The Sample Hour with Charles Hugh Smith (1:30 hrs). (Drew is 31, I’m 62, so we cover quite a bit of ground in the podcast.)

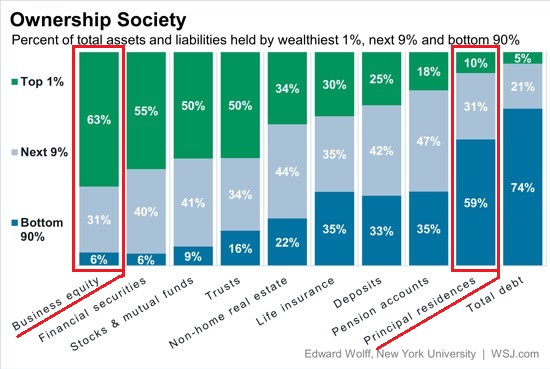

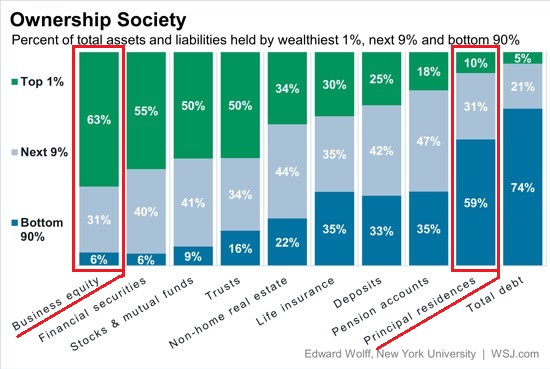

3. If you want to invest wisely, invest in what the wealthy own: they own enterprises, which are assets that produce income–unlike McMansions or “stuff.”

| Our society does not make it easy to control what you can control. Temptations abound, and we’re told we need expensive gym memberships, personal trainers, investment advisors, etc. to take control of what we can control. Various rules limit where we can invest our retirement savings, and reams of paperwork inhibit us from owning assets overseas. |

Ownership Society Percent of total assets and liabiliries held by wealthiest 1%, next 9% and bottom 90%.

|

If we set out to design a society in which people feel poorly (due to poor diet, fitness and mental health), feel poorly about themselves, and are emotionally, physically and financially impoverished, you’d end up with the society we have now.

It doesn’t have to be this way. Liberation starts by taking control of whatever we can control. Taking control of our health and finances is a darn good start.

My new book is #9 on Kindle short reads -> politics and social science For more, please visit the book's website.