Summary: Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution. The Bank of Japan is unlikely to change policy. Its current policy of targeting 10-year bond yields and expanding the balance sheet by JPY80 trillion is aimed at boosting core inflation to 2%. However, the risk is that BOJ Governor Kuroda surprises the...

Read More »Consumer Sentiment Stands Near its Average

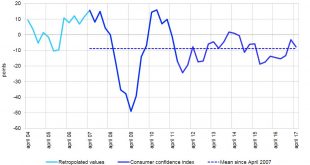

Bern, 04.05.2017 – With an index value of -8 points, Swiss consumer sentiment in April 2017 is virtually at its long-term average, having been slightly more optimistic in January (-3 points). While expectations for overall economic developments are above average in April, they are less positive than they were in January. Expectations concerning the financial situation and savings possibilities of domestic households...

Read More »FX Daily, May 03: Marking Time

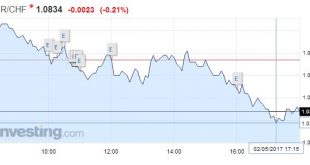

Swiss Franc EUR/CHF - Euro Swiss Franc, May 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact...

Read More »Silver Takes the Elevator Down – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Election Effect Debate Last week, we talked about the effect of the French election on the gold and silver markets, and noted: Of course, traders want to know how this will affect gold and silver. As we write this, we see that silver went down 30 cents before rallying back up to where it closed on Friday. Gold went down...

Read More »Euro Drivers

Summary: Correlation between the change in the US-German two-year differential and euro remains robust. The German two-year yield has jumped in recent weeks but looks poised to slip back lower. US two-year yield has eased but is knocking on 1.30%, an important level. There is one variable that explains the euro movement better than any other single variable we have found. The US-Germany two-year interest...

Read More »Clickbait: Bernanke Terrifies Stock Investors, Again

If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it. In an interview with Charles Schwab, the former Fed Chairman says not to worry: Dr. Bernanke noted that corporate earnings have risen at the same...

Read More »FX Daily, May 02: Dollar and Yen Heavy, Equities Trade Higher and Bonds Lower

Swiss Franc EUR/CHF - Euro Swiss Franc, May 02(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is sporting a softer profile against most of the major and emerging market currencies. The Japanese yen is the main exception. The greenback is rising against the yen for the fourth session and the sixth of the past seven. The dollar’s gains against the yen coincide with the 10-12 bp recovery...

Read More »New Swiss company tax reform plan well received in Brussels

© Miriam Doerr | Dreamstime.com The Swiss government’s company tax reform plans have been reborn after the last plan met with defeat in a popular vote on 12 February 2017. The new plan, dubbed “Tax proposal 17”, aims to avoid issues that bedeviled the last project. Last time many were concerned by the potential financial impact of lower company tax rates, and the proposal was rejected by 59.1% of voters. This time the...

Read More »Why Good Economics Matters Now More Than Ever

In a newsletter published in 1970, economist Murray Rothbard wrote, “It is no crime to be ignorant of economics, which is, after all, a specialized discipline and one that most people consider to be a ‘dismal science.’ But it is totally irresponsible to have a loud and vociferous opinion on economic subjects while remaining in this state of ignorance.” This is an oft-quoted platitude within circles of libertarian...

Read More »Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org