– Davos elite hear warnings of complacency akin to 2007 as economic risks grow – Toxic mix of infallible belief, arrogance, megalomania and economic ignorance – Some express concern economies are vulnerable due to imbalances, trade, geo-political tensions– Soros: Trump creating ‘mafia state’ & ‘set on a course towards nuclear war’ with N Korea– Bond bear market, rising interest rates and massive $233 trillion...

Read More »US chart of the week – Texas rebounds

One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local taxation regimes. But which one’s ahead when it comes to employment growth? The two states were...

Read More »Can We Finally Have an Honest Discussion about the Opioid Crisis?

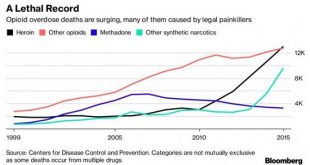

The economy no longer generates secure, purposeful jobs for the working class, and so millions of people live in a state of insecure despair. The opioid epidemic is generating a lot of media coverage and hand-wringing, but few if any solutions, and this is predictable: if you don’t face up to the causes, then you can’t solve the problem. America is steadfastly avoiding looking at the causes of the opioid crisis, which...

Read More »Tax Reform and Trump’s Chinese Trade Deficit Conundrum

Trade Deficit with China Widens on Trump’s Watch Most things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again. Photo credit: Jonathan Ernst / Reuters - Click to enlarge We are often...

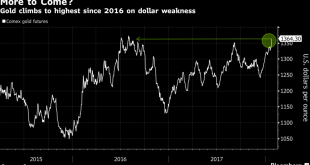

Read More »FX Daily, January 25: And Now, a Word from Draghi

Swiss Franc The Euro has fallen by 0.59% to 1.1656 CHF. EUR/CHF and USD/CHF, January 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events...

Read More »Switzerland still competitive despite US tax reforms, says economics minister

The economics minister said the relaunch of its own tax reform plans could help Switzerland stay competitive with the US. (Keystone) - Click to enlarge Swiss Economics Minister Johann Schneider-Ammann says he does not think sweeping US tax reforms will drive American firms from Switzerland. In an interview with the Schweiz am Wochenende newspaper on Saturday, he said Switzerland also has competitive...

Read More »New poll on vote to axe Swiss broadcast fee suggests rejection

A poll run by the media group Tamedia shows a clear majority in favour of rejecting the initiative, dubbed “No Billag”, which aims to end Switzerland’s broadcasting fee. This poll follows one done in December 2017, which showed a majority in favour of the initiative. © Jakkapan Jabjainai | Dreamstime.com - Click to enlarge In December 57% were either fully or quite in favour of voting yes. This time the same percentage...

Read More »Is This The Greatest Stock Market Bubble In History? Goldnomics Podcast

GoldNomics Podcast (Episode 2) Is This The Greatest Stock Market Bubble In History? In our second GoldNomics podcast, we take a look at one of the important financial questions of our day – is this the greatest stock market bubble in history? Listen on iTunes, SoundCloud and BlubrryWatch on YouTube below [embedded content] GoldCore CEO Stephen Flood and GoldCore’s Research Director and world renowned precious metals...

Read More »The Dismal Boom

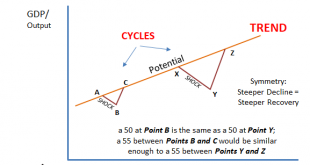

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction. But is every 50 the same? That’s ultimately at...

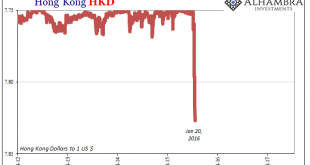

Read More »Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed. Representative Toby Roth (R-WI) quizzed the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org