Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment. The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years,...

Read More »Economics minister praises Swiss tax system

Schneider-Ammann (right) is holding talks with various business leaders on the sidelines of this year’s WEF meeting in Davos. Among them was Nestlé Vice President Marco Settembri Swiss Economics Minister Johann Schneider-Ammann has downplayed concerns that Swiss-based American firms might relocate to the United States in the wake of tax reform. Speaking in Davos ahead of a visit by US President Donald Trump,...

Read More »Forget It, China’s Not Booming

Jeffrey Snider Jeffrey Snider, head of global investment research at Alhambra Investments, says China is in fact not growing rapidly, which sounds disheartening for commodity investors. He reckons a crucial investment metric has weakened, pointing to slower economic expansion: https://www.bnn.ca/video/forget-it-china-s-not-booming-money-manager~1310003...

Read More »Swiss president says Trump meeting was productive

All smiles: Swiss President Alain Berset, right, and US President Donald J. Trump, left, shake hands during a bilateral meeting Swiss President Alain Berset says his meeting with US President Donald Trump at the World Economic Forum in Davos was productive and frank. Trump took credit for making Switzerland “even richer”. “You have a lot of our stock in the United States so I have helped to make Switzerland even...

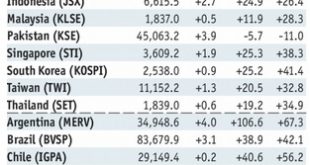

Read More »Emerging Markets: What Changed

Summary Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia’s central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate...

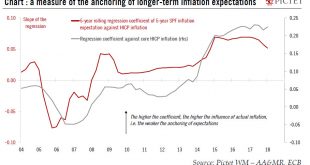

Read More »Initial Thoughts on Draghi

ECB President Draghi was unable to arrest the US dollar’s slide and euro’s surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar’s slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy. The economy is the strongest it has been in more than a decade, but the US is no slouch. The US reports the...

Read More »Did Mnuchin Signal a Policy Shift Today?

Did US Treasury Secretary Mnuchin signal a change in the US dollar policy? Probably not. As Mnuchin and President Trump have done before, a distinction was drawn between short- and longer-term perspectives. In the short-term, a weaker dollar says Mnuchin, is good for US trade and “other opportunities”. In the longer-term, Mnuchin explicitly acknowledged, “the strength of the dollar is a reflection of the strength of the...

Read More »China: 2018 GDP forecast revised up

The Chinese economy ended 2017 on a strong note. In Q4 2017, China’s GDP amounted to Rmb23.4 trillion (about USD3.7 trillion), rising 1.6% over the previous quarter and 6.8% year-over-year (y-o-y) in real terms. Full-year GDP came in at Rmb82.7 trillion (about USD12.9 trillion), growing by 6.9% in real terms and beating the consensus forecast as well as our own estimate (both at 6.8%). The strong 2017 growth number...

Read More »FX Daily, January 26: Trump-Inspired Dollar Short Squeeze Fades Quickly

Swiss Franc The Euro has fallen by 0.33% to 1.1624 CHF. EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It was dramatic. Following the BOJ and ECB’s rather mild rebuke of dollar’s depreciation, US President Trump cautioned that his Treasury Secretary comments were taken out of context, and in ant event, he, the President ultimately favored...

Read More »Income inequality in Switzerland remains stable after redistribution

Income inequality in Switzerland has remained stable according to a report published by Switzerland’s Federal Statistical Office. © Arturo Osorno _ Dreamstime.com - Click to enlarge A key measure of inequality involves dividing the income share of the top 20% by that of the bottom 20%, a measure known as S80/S20. 1 is complete equality. In 2015, the latest figure, the S80/S20 for Switzerland was 38.2, which means the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org