Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months. Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline. The services PMI declined to 54.4, but this followed a 1.4 points jump last month to 55.8. The details were somewhat mixed. The rise in manufacturing was mainly due to stronger output growth, while new orders and export orders growth slowed, with the latter reaching a 27-month low. Job creation

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, euro area composite PMI, Euro area GDP growth, euro area PMIs, Featured, Macroview, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months.

| Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.

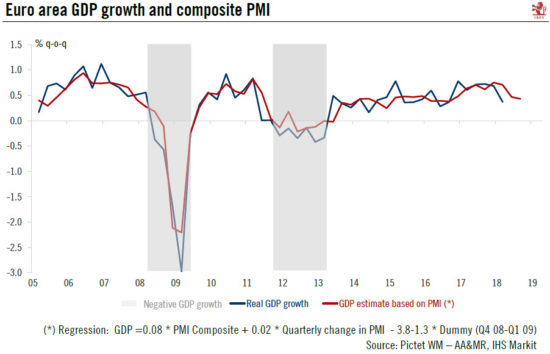

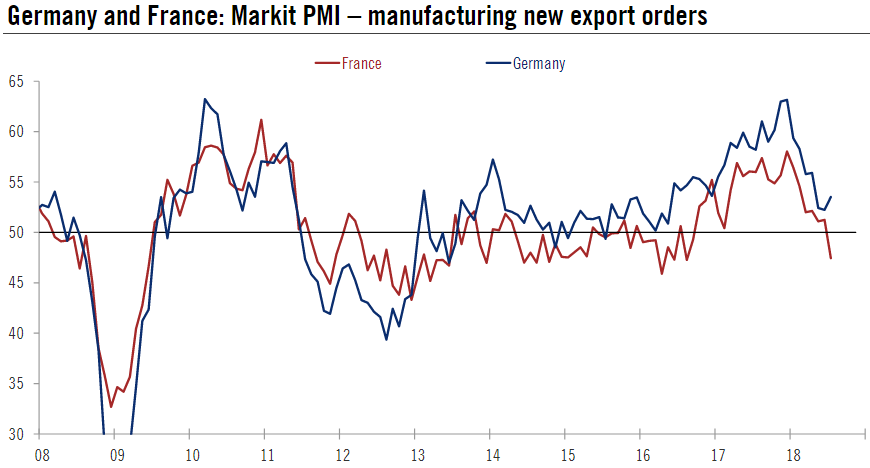

The services PMI declined to 54.4, but this followed a 1.4 points jump last month to 55.8. The details were somewhat mixed. The rise in manufacturing was mainly due to stronger output growth, while new orders and export orders growth slowed, with the latter reaching a 27-month low. Job creation remained strong by historical standards. Finally, input price inflation accelerated due to higher prices for raw materials and wages. Markit noted that “price hikes for raw materials were also again often linked to tariffs, trade wars, supply chain delays and shortages, with supplier delivery times widely reported to have lengthened again, notably from China”. Part of the rise was passed on in the form of higher sales prices. Evidence of heightened global trade conflicts in the July data was mixed, with contrasts between the two largest euro area economies. While surveys showed some worries about trade wars in France, there was no mention of them in Germany, where new export orders grew at their fastest pace in three months. Overall, July’s composite PMI is consistent with GDP growth of 0.4% q-o-q in Q3, down from the 0.5% expansion indicated by the PMI surveys for Q2 (first estimate to be published on July 31). Economic fundamentals remain solid and the euro area economy is expected to continue to grow at an above-trend pace over the coming quarters. That said, the decline in some forward-looking indicators such as new orders and new export orders signals downside risks for the coming months. |

Euro Area GDP Growth and Composite PMI, 2005 - 2018 |

| In Germany, flash PMIs for July beat market expectations. The flash composite PMI rose to 55.2 from 54.8 in June, posting the second increase in а row. The manufacturing index rose by 1.4 points to 57.3 in July, bringing to a halt the downward trend that started six months ago. Meanwhile, the services sector index was broadly stable at 54.5. The details showed that the increase in the manufacturing index was broad based. In contrast to France, exports orders quickened at “their fastest pace in three months”, according to Markit. Job creation remained strong in both sectors, maintaining the pace from last month. In addition, price pressure intensified in July.

Overall, German composite PMI is on track for a slight increase in Q3, assuming that it can hold on to its July level. In France, the flash composite PMI decreased to 54.5 in July from 55.0 in June, below consensus expectations (54.9). The manufacturing PMI rose to 53.1, rebounding from a 16 -month low of 52.5 in June. The services index decreased to 55.3 from 55.9 in June. The breakdown by sub-indexes showed that new export orders contracted for the first time since September 2016, with firms complaining that “global trade tensions were hampering foreign demand”. Markit highlighted that some services providers cited France’s World Cup success as a driver of above-average growth. Employment growth was robust in both services and manufacturing. The rise in input prices in July was partly passed on in the form of higher output charges. At odds with other signals showing intensifying worries about trade wars, French firms’ outlook for the next 12 months improved in July. Overall, the French composite PMI remained above the crucial 50.0 mark and remains strong on an historical basis. PMI and national surveys are consistent with GDP growth of 0.3% q-o-q in Q2 and a slightly slower pace in Q3 if the level of July is maintained. Last but not least, Markit indicated that outside the two largest euro area countries, “growth was the weakest for 21 months, slipping lower in both manufacturing and services”. |

Germany and France Markit PMI, 2008 - 2018 |

Tags: euro area composite PMI,Euro area GDP growth,euro area PMIs,Featured,Macroview,newsletter