Summary: FOMC statement will not likely close door on September hike, though economists are more inclined for a December move. There is great uncertainty surrounding the BOJ’s outlook. We suspect odds favor tweaking assets being purchased rather than cutting rates further or dramatically increasing JPY80 trillion balance sheet expansion. European bank stress test results due at the end of the week. Contrary to...

Read More »Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. Swiss Franc Speculators reduced their long Swiss Franc position from 6.7K contracts to 4.7K contracts (against USD). The 2K was certainly smaller than the increase of 15K shorts in the euro (against USD) Euro The euro bears added to their gross short position for the fourth consecutive week and for...

Read More »FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

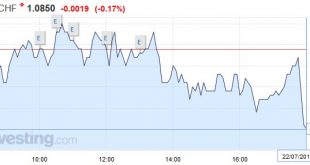

Swiss Franc The EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy Click to enlarge. FX Rates As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US...

Read More »FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Swiss Franc The Swiss trade balance was published today, and once again, it remained close to record-high. For us, the trade balance is the most important indicator if a currency is fairly valued. Over the long-term the Swiss trade surplus must adjust towards zero, while the currency must appreciate. The consequence of the stronger currency is a higher purchasing power which leads to more spending and finally more...

Read More »Draghi Does not Surprise and Euro Edges Away from $1.10

Summary: Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken. Draghi said nothing that surprised the...

Read More »FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

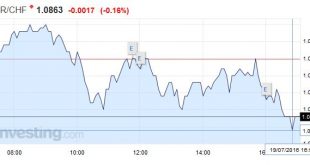

Swiss Franc Click to enlarge. FX Rates The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event....

Read More »Squaring the Circle: Can Article 7 be Used to Force Article 50?

Summary: Article 7 would suspend the UK’s EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what “is” means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not. Due to an unlikely string of events, the UK had sorted out its government more than two months...

Read More »FX Daily, July 11: Dollar Extends Gains

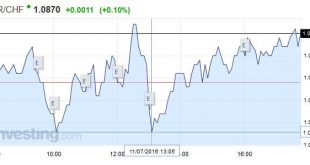

Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put...

Read More »New Wrinkle in European Bail-In Efforts

Summary: European Court of Justice could rule on July 19 that private investors do not have to be bailed in before public money can be used to recapitalize banks. Italy stands to gain the most, at least immediately, from such a judgment. Italian bank shares recovered after initial weakness. After the 2007-2008 bank recapitalization by governments, which means taxpayers’ money, Europe changed the rules. The...

Read More »FX Weekly Preview: Sources of Movement

Summary: Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins. Investors are under siege. A growing proportion of bonds in Europe and Japan offer negative yields. The German and Japanese curves are negative out 15-years, while one cannot find a positive yield among any tenor of Swiss government bonds. Despite a string of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org