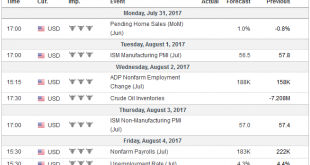

Swiss Franc The euro is up by 0.15% to 1.1385 CHF EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a respite from the recent selling, but its gains have been shallow, and will likely prove brief. The upticks have been concentrated in the recently high-flying dollar-bloc currencies, and sterling. The tone appears to be...

Read More »FX Weekly Preview: The Dollar may Need more than a Strong Employment Report

Summary: For the US jobs data to rally the dollar, it needs to increase the likelihood of a Fed hike in September, a high bar. The BOE will stand pat, a 6-2 vote would likely be accompanied by a hawkish inflation report. The RBA will also hold rates steady, and of course, it would prefer a weaker currency. The tide of sentiment has turned against the dollar. The enthusiasm seen in the second part of last year,...

Read More »Dollar View: Discipline or Stubbornness

Summary: Fundamental driver, divergence is still intact. The dollar’s losses have barely met the minimum retracements of a bull market. Sentiment may be exaggerating the positive developments in Europe and the negative developments in the US. The US dollar is sitting near multi-month lows against the major European currencies and the dollar bloc. Where does this leave our strategic view of the third...

Read More »Great Graphic: What Is the Swiss Franc Telling Us?

Summary: Swiss franc weakness is a function of the demand for euros. SNB indicates it will lag behind the other major central banks in normalization process. Easing of political anxiety in Europe is also negative for the franc. The Swiss franc is trading at its lowest level against the euro since the Swiss National Bank surprised the world by lifting the currency cap in early 2015. This week’s move has been...

Read More »FOMC Sticks to Script: Balance Sheet Unwind to Begin “Relatively Soon” and USD Retreats

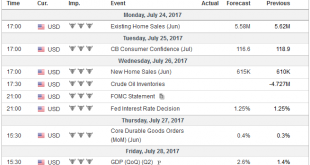

Summary: Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way. The FOMC statement reads very much like the June statement. There were some minor tweaks in the first paragraph that discusses the broad economic performance since the last FOMC statement. There...

Read More »FX Daily, July 26: Quiet Fed Day without Yellen

Swiss Franc The euro is up by 0.56% to 1.1152 CHF EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet...

Read More »FX Daily, July 25: Summer Markets Ahead of FOMC

Swiss Franc EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are subdued today; a dearth of fresh news and tomorrow’s FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European...

Read More »FX Daily, July 24: Euro Recovers from Softer Flash PMI

Swiss Franc The Euro has fallen by 0.17% to 1.1009 CHF. EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a...

Read More »FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

Summary: FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume. The US economy accelerated in Q2. The eurozone economy is enjoying steady growth, but the momentum appears to...

Read More »FX Daily, July 21: Dollar Licks Wounds as News Stream Doesn’t Improve

Swiss Franc The euro has depreciated by 0.13 to 1.1043 CHF. EUR/CHF and USD/CHF, July 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is very much unloved. The apparent stabilization of the political situation in Europe and sustained pace of above trend growth contrasts with the US where the political situation leaves much to be desired and the economy is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org