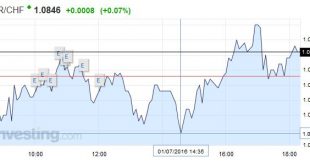

Swiss Franc Once again the SNB was heavily intervening and the pound fell against both euro and CHF.Thanks to SNB interventions, the Euro did not even dip under 1.08. Click to enlarge. Brexit What a difference a few days make. Many saw last week’s equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now....

Read More »FX Daily, July 05: Sterling Hammered to New Lows, Yen Pops, SNB intervenes

Swiss Franc and SNB interventions It was another day of heavy SNB interventions. The central bank kept the euro nearly stable. As we explained before, she recycled sterling inflows in CHF into euros. Based on the magnitude of the GBP decline against EUR (see below), we estimate 2 to 4 bn CHF interventions. Click to enlarge. Brexit The British pound has been hammered to fresh lows just above $1.3115. The euro is...

Read More »FX Daily, July 01: Markets Head Quietly into the Weekend

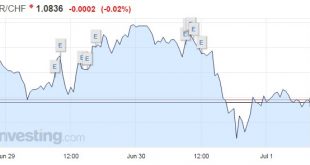

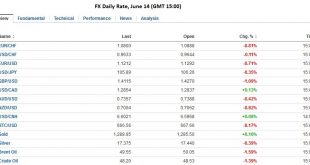

EUR/CHF stronger in Brexit week The EUR/CHF finished the week after Brexit with slight improvement of 0.18% (see the FX performance table below). The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney’s comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08. Click to...

Read More »FX Daily, June 30: Calm Continues, but Rot Below the Surface

Swiss Franc During the weak the Swiss Franc lost momentum. It could regain speed only on June 30. The stronger Franc was initiated by remarks by BoE governor Carney. Sterling stayed on the defensive on Friday after unambiguously dovish comments from the Bank of England abruptly ended a tentative recovery in the currency, while the euro wobbled on speculation of more stimulus in Europe. Still trying to get over...

Read More »FX Daily, June 29: Fragile Calm Ahead of Quarter-End

FX Rates No fundamental development can compare with the UK decision to leave the EU. It has set off a chain reaction whose outcome is still far from clear. Sterling is firm, alongside most of the major and emerging market currencies today. Sterling narrowly edged above yesterday’s highs to reach almost $1.3425 before encountering selling pressure. Click to enlarge. Equity fund managers may find themselves over...

Read More »How Exceptional are Conditions?

Summary If conditions are exceptional, isn’t BOJ intervention more likely? If conditions are exceptional, the ban on European government supporting banks might not be valid. Italy is leading the charge in Europe. How exceptional are market developments? Much rests on the answer. If these are extraordinary circumstances, then Japanese intervention becomes more likely. Of course, Japanese policymakers have been...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »How Germany Could Upset Europe before UK Referendum

The assassination of the Jo Cox has broken the powerful momentum in the markets. Investors recognize that the tragedy potentially injects a new element into consideration for the outcome of next week’s referendum. The campaigns will be resume over the weekend, and new polls will be available. Investors will place more weight on polls conducted after the assassination. The UK referendum is the big event next week. ...

Read More »FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

“The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%”. A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain. Core bond yields are 4-5 bp lower, which...

Read More »FX Daily, June 13: Brexit Dominates

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. See the Dukascopy Video FX Rates The risk that the UK votes to leave the EU next week is the dominant force in the capital markets. It is a continuation of what was seen at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org