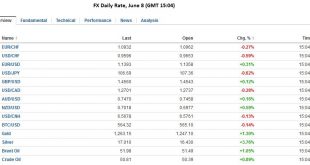

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

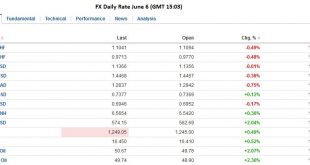

Read More »FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

Swiss Franc The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD. The ECB bond buying program has finally started. For us the main reason of the weaker Euro was, however, the bad US jobs report, that will delay also a normalization of rates in the euro zone. via Dukascopy FX Rates The US dollar is posting...

Read More »Greenback is Mostly Firmer, but Yen is Firmer Still

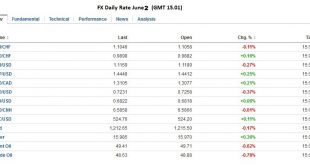

The US dollar is posting modest upticks against most of the European currencies and the Canadian and Australian dollars.However, it has fallen against the yen and taken out the recent low, leaving little between it and the May 3 low near JPY105.50. The New Zealand dollar though is the strongest of the major currencies; gaining 1.5% following the RBNZ’s decision to leave rates on hold, and signal of little urgency to...

Read More »FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk...

Read More »Cool Video: Bloomberg Television–All about the Periphery

Click to see the video. I am in Boston to attend the Fixed Income Leaders Summit and was invited to join Alix Steel, Joe Weisenthal, and Scarlet Fu on Bloomberg TV. We talked about the peripheral in Europe, especially Portugal, Italy and Spain. Each has a pressing issue. In Portugal, yields have not fallen as much as in other peripheral countries. In Italy, they are belatedly addressing the recapitalization of...

Read More »Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.Our weekly sight deposits report show the liabilities. They are measured in Swiss franc and therefore not subject to valuation effects. They are the only way to measure...

Read More »FAQ: ECB’s Corporate Bond Buying Program Starts

In March, the ECB decided to increase its asset purchases from 60 to 80 bln euros a month and to include corporate bonds. The corporate bond buying program begins this week. We use an FAQ format to discuss the key issues. What is the ECB doing? The ECB will buy euro-denominated, investment grade bonds from companies incorporated within the eurozone. What is the duration of the corporate bonds that the ECB will...

Read More »FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery...

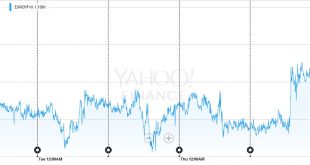

Read More »FX Weekly Review May 30 to June 3: Dollar’s Rally Ends with a Bang

EUR/CHF The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. Click to expand USD/CHF After a relatively steady week, the dollar lost 130 bips on Friday. Click to expand Continued by Marc Chandler:...

Read More »FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would have given back 50% of its rally off the May 3 low near JPY105.50. Below there, the JPY107.80 is the 61.8% retracement. The euro is north of $1.12 after having briefly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org