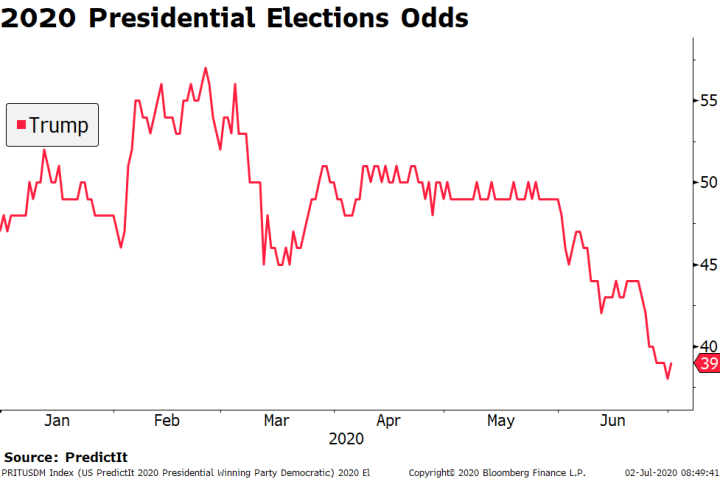

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates. AMERICAS Brazil reports May retail sales Wednesday. Sales are expected to contract -13.5% y/y vs. -16.8% in April. June IPCA inflation will be reported Friday, which is expected to rise 2.16% y/y vs. 1.88% in May. If so, it would be the first acceleration since December but still well below the 2.5-5.5% target range. COPOM delivered a 75 bp cut to 2.25% June 17 and left the door open to one last cut. Next policy meeting is August 5 and the CDI market is pricing in slight

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

![]() Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates.

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates.

AMERICAS

Brazil reports May retail sales Wednesday. Sales are expected to contract -13.5% y/y vs. -16.8% in April. June IPCA inflation will be reported Friday, which is expected to rise 2.16% y/y vs. 1.88% in May. If so, it would be the first acceleration since December but still well below the 2.5-5.5% target range. COPOM delivered a 75 bp cut to 2.25% June 17 and left the door open to one last cut. Next policy meeting is August 5 and the CDI market is pricing in slight odds of a 25 bp cut to 2.0%.

Chile reports June trade Tuesday. It then reports June CPI Wednesday, with headline inflation expected to fell to 2.7% y/y from 2.8% in May. If so, it would be the lowest since November and would remain in the bottom half of the 2-4% target range. The central bank kept rates steady at its last meeting June 16 but boosted its credit line for commercial banks to $16 bln in an effort to stimulus lending. It also pledged to do more if needed. Next policy meeting is July 15 and is likely to take a wait and see approach now to see how previous stimulus is working.

President Trump hosts Mexican President AMLO for a two-day visit beginning Wednesday. Mexico reports June CPI Thursday, while Banco de Mexico also releases its minutes that day. Inflation is expected at 3.20% vs. 2.84% in May. If so, this would be the highest since March and back in the top half of the 2-4% target range. Banco de Mexico just cut rates 50 bp to 5.0%. Next policy meeting is August 13 and another cut is expected. Minutes may yield clues to the pace and extent of further easing. May IP will be reported Friday and is expected to contract -26.3% y/y vs. -29.3% in April.

Peru central bank meets Thursday and is expected to keep rates steady at 0.25%. The bank last cut rates 100 bp to the current 0.25% back in April and left rates unchanged in May and June. At the June 11 meeting, the bank pledged to do more if needed but with rates at the effective lower bound, further stimulus would likely take the form of lending programs to firms. CPI rose 1.89% in May, below the 2% target but within the 1-3% target range.

EUROPE/MIDDLE EAST/AFRICA

Hungary reports May retail sales Monday. Sales are expected to contract -3.6% y/y vs. -10.2% in April. IP will be reported Tuesday and is expected to contract -24.3% y/y WAD vs. -36.6% in April. June CPI will be reported Wednesday, and inflation is expected to pick up to 3.0% y/y from 2.2% in May. If so, this would be the highest since March and back at the center of the 2-4% target range. The central bank also releases its minutes Wednesday. At the June 23 meeting, the bank unexpectedly cut rates 15 bp to 0.75% and so the minutes may provide some important clues. May trade data will be reported Thursday.

Bank of Israel meets Monday and is expected to keep rates steady at 0.10%. CPI fell -1.6% y/y in May, well below the 1-3% target range. The bank left policy steady at its last meeting May 25 and upgraded its outlook slightly. However, it warned that the strong shekel poses risks to the recovery and could prevent inflation from returning to the target range. Since that meeting, the shekel has appreciated nearly 2.5% and so stronger pushback may be seen this week. The bulk of any stimulus going forward is likely to come from the fiscal side, but the bank may have to support this by expanding its current QE program in H2.

Czech Republic reports May industrial and construction output and trade Tuesday. Retail sales will be reported Wednesday and are expected to contract -14.4% y/y vs. -21.2% in April. June CPI will be reported Friday, with inflation expected to remain steady at 2.9% y/y. If so, it would remain the top of its 1-3% target range. The bank last cut rates 75 bp to 0.25% in May but left policy steady in June. Next policy meeting is August 6 and no change is expected then.

Russia reports June CPI Wednesday. Inflation is expected to pick up to 3.2% y/y from 3.0% in May. If so, it would be the highest since November but still well below the 4% target. The central bank cut rates 100 bp to 4.5% at its last meeting June 19 and signaled potential for further cuts. Next policy meeting is July 24 and a 25 bp cut to 4.25% is expected. May trade data will be reported Friday.

South Africa reports April manufacturing production Thursday. It is expected to contract -46.6% y/y vs. -5.4% in March. SARB cut rates 50 bp to 3.75% at its last meeting May 21. Next policy meeting is July 23, and another cut then is likely. With the fiscal outlook deteriorating significantly, monetary policy will have to shoulder most of the burden in H2.

ASIA

Singapore advance Q2 GDP will be reported sometime this week. The economy is expected to contract -10.0% y/y (-34.0% SAAR) vs. -0.7% y/y (-4.7% SAAR) in Q1. The city-state holds general elections Friday. There is little doubt that the ruling People’s Action Party will extend its ruling streak since independence in 1965. Still, it’s worth keeping an eye on new opposition Singapore Progress Party, founded last year by former PPP Tan Cheng Bock and joined by Prime Minister Lee’s estranged brother. Elsewhere, main opposition Workers’ Party will be led by Pritam Singh for the first time.

Philippines reports June CPI Monday. Headline inflation is expected to rise to 2.2% y/y from 2.1% in May. If so, this would be the first acceleration since January, but inflation would still be near the bottom of the 2-4% target range. The central bank cut rates 50 bp to 2.25% at its last meeting June 25. Next policy meeting is August 20 and another cut is expected. May trade data will be reported Friday.

Bank Negara Malaysia meets Tuesday and is expected to cut rates 25 bp to 1.75%. However, the market is split. Of the 18 analysts polled by Bloomberg, 7 expect the bank to keep rates steady at 2.0%, 7 see a 25 bp cut, and 4 see a 50 bp cut. CPI fell -2.9% y/y in both April and May, the worst deflation on record. While Bank Negara does not have an inflation target, deflationary conditions suggest scope for a dovish surprise this week. May IP and manufacturing sales will be reported Friday, with IP expected to contract -27.0% y/y vs. -32.0% in April.

Taiwan reports June CPI and trade data Tuesday. Exports are expected to contract -3.3% y/y vs. -2.0% in May, while imports are expected to contract -6.8% y/y vs. -3.5% in May. Headline inflation is expected to fall -1.0% y/y vs. -1.19% in May. While the central bank does not have an inflation target, deflationary conditions suggest scope for further easing this year. The bank surprised markets by keeping rates steady at its quarterly policy meeting last month.

China reports June CPI and PPI Thursday. The former is expected to rise 2.5% y/y vs. 2.4% in May, while the latter is expected to fall -3.2% y/y vs. -3.7% in May. PBOC remains focused on boosting the economy and so inflation readings are likely to be a non-event.

Tags: Articles,Emerging Markets,Featured,newsletter