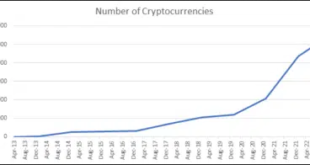

An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result. The cryptocurrency market has evolved at a rapid pace over the course of its short lifespan. With its community and users growing steadily. They offer the potential for new choices to be made in a field long dominated by government monopolies. They are a real financial alternative and might provide intense competition...

Read More »Weekly Market Pulse: The Real Reason The Fed Should Pause

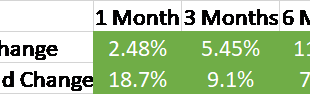

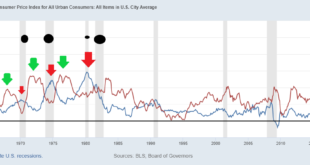

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to...

Read More »Market Currents: Don’t Listen to Buy and Hold Investing Advice

For decades a Buy and Hold strategy was a staple of financial advice. But should it be? Alhambra CEO separates myth and reality. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Markets,newsletter,Real Estate,stocks

Read More »Weekly Market Pulse (VIDEO)

Are investors at the point of maximum pessimism? Alhambra CEO Joe Calhoun talks about a horrible 3rd quarter, sentiment, and where investors can look right now. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Market Currents: Impact of Fed Tightening on Home Prices

What impact does Fed tightening really have on home prices? Doug Terry, Alhambra’s Head of Investment Research, explains. [embedded content] [embedded content] Tags: Alhambra Research,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Market Currents: Banks are Keeping Oil Prices High

Who is really keeping oil prices high? Alhambra CEO Joe Calhoun says it’s the banks. [embedded content] [embedded content] Tags: Alhambra Research,commodities,economy,Featured,Markets,newsletter

Read More »Market Currents – Is The Economy Contracting?

Is the economy contracting? Alhambra’s Steve Brennan poses that question to CEO Joe Calhoun. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Weekly Market Pulse: No News Is…

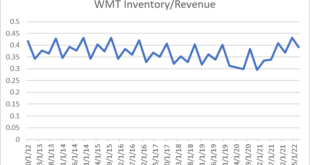

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a...

Read More »Powell’s White Whale

The lagged effect of inflation. “Just call me Ishmael,” Jay. . [embedded content] Tags: economy,Featured,Federal Reserve/Monetary Policy,newsletter

Read More »Goldilocks Calling

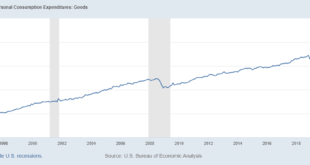

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now. There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: . Now, some of that, as we know, is due to inflation so if we correct for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org