Gold is doing what it is supposed to do! Equity markets are tumbling, “NASDAQ 100 Rout Erases $1.5 Trillion in Market Value in 3 Days” reads one Bloomberg headline. The big names such as Apple lost over US$225 billion, Microsoft almost US$200 billion, Amazon and Tesla each lost US$175 billion market value over the three trading days from May 4 to May 9. Bonds are also declining in value as yields are rising. The market selloff has been the most extreme in the tech...

Read More »US Stock Market: Conspicuous Similarities with 1929, 1987 and Japan in 1990

Stretched to the Limit There are good reasons to suspect that the bull market in US equities has been stretched to the limit. These include inter alia: high fundamental valuation levels, as e.g. illustrated by the Shiller P/E ratio (a.k.a. “CAPE”/ cyclically adjusted P/E); rising interest rates; and the maturity of the advance. Near the end of a bull market cycle there is always the question of when a decline will...

Read More »Global Asset Allocation Update: No Upside To Credit

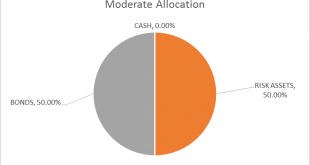

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

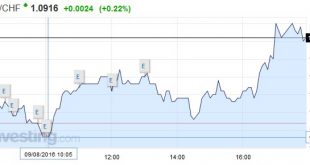

Read More »FX Daily, August 09: Sterling Slips to a Four-Week Low, EUR/CHF still trending up

Swiss Franc The upwards tendency of the euro against CHF continues.The 100 day EMA of 1.0901 has passed. Click to enlarge. FX Rates In an otherwise uneventful foreign exchange market, sterling’s slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area...

Read More »FX Daily, July 29: Kuroda Hesitates, Yen Advances, Focus Turns to Europe and North America

Prospects for the Swiss Economy Remain Favourable The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the...

Read More »Are Investors Idiots?

Ye olde tattered Crash Alert flag… should it be unfurled again? Image by fmh Black-and-Blue Crash Alert Flag Let us begin the week “on message.” The Diary is about money. Today, we’ll stick to the subject. Old friend Mark Hulbert has done some research on the likelihood of a crash in the stock market. Writing in Barron’s, he points out that the risk – or, more properly, the incidence – of crashes, historically, has been very small: “[…] consider that the 1987 and 1929 crashes were...

Read More »What Can Gold Do for Our Money?

One of the chief virtues of a gold standard is that it serves as a restraint on the growth of money and credit. It makes runaway government deficit spending and major monetary catastrophes such as hyperinflation practically impossible. Opponents of a gold standard can’t defend the political malpractices that are enabled by a fiat currency regime. So instead they spin a narrative about how gold supposedly hampers the economy. According to Keynesian economics, spending boosts the economy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org