Second Half Recovery Dented by “Resurgent Consumer” We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example. We’ll make an exception today though. Our friend...

Read More »The Great Stock Market Swindle

Short Circuited Feedback Loops Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven. Unfortunately, finding and filling gaps in the market is much easier...

Read More »Insanity, Oddities and Dark Clouds in Credit-Land

Insanity Rules Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller. Corporate and government debt have been soaring for years, but investor appetite for such debt has evidently grown even more. A huge mountain of interest-free risk has...

Read More »Trump’s Tax Plan, Clinton Corruption and Mainstream Media Propaganda

Fake Money, Fake Capital OUZILLY, France – Little change in the markets on Monday. We are in the middle of vacation season. Who wants to think too much about the stock market? Not us! Yesterday, Republican presidential candidate Donald Trump promised to reform the U.S. tax system. His proposals are nothing new – simplification, fewer brackets, eliminate loopholes for rich people. But he also targeted the “carried...

Read More »Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his...

Read More »US Economy – Something is not Right

Another Strong Payrolls Report – is it Meaningful? This morning the punters in the casino were cheered up by yet another strong payrolls report, the second in a row. Leaving aside the fact that it will be revised out of all recognition when all is said and done, does it actually mean the economy is strong? As we usually point out at this juncture: apart from the problem that US labor force participation has collapsed...

Read More »States Must Help Restore Sound Money in America

Control the money, and you control the people. Over the last hundred years, the federal government and the Federal Reserve, a privately owned bank cartel conceived of in secret, have waged a war on sound money in America. They’ve ended the free circulation of gold (and, for a time, criminalized its ownership), while imposing taxes on those who trade with it. They’ve replaced gold and silver coins and the promise of...

Read More »Trump is Right About Stocks

Right on the Money OUZILLY, France – It is not often that you get investment advice from a presidential candidate. It is even rarer that you get good advice But yesterday, Republican presidential candidate Donald Trump gave investors both good advice and good analysis. Bloomberg has the report: Donald Trump on Stocks Photo credit: Michael Nagle / Getty Images The Donald dispenses investment advice. “Better get out...

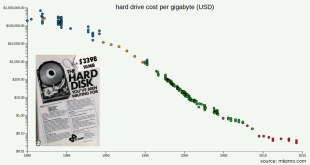

Read More »Deflation Is Always Good for the Economy

“Experts” Assert that Inflation is an Agent of Economic Growth For most experts, deflation, which they define as a general decline in prices of goods and services, is bad news since it generates expectations for a further decline in prices. As a result, they hold, consumers postpone their buying of goods at present since they expect to buy these goods at lower prices in the future. This weakens the overall flow of...

Read More »Jailing Banksters Will Not Resolve the Economic Crisis

Meet the Scapegoats Last week, an Irish court sentenced three prominent banksters for their roles in the 2008 financial crisis. Judge Martin Nolan, who pronounced judgment, said that the bansksters had committed “a very serious crime.” He continued: “The public is entitled to rely on the probity of blue chip firms. If we can’t rely on the probity of these banks we lose all hope or trust in institutions.”* Meet the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org