Second Half Recovery Dented by “Resurgent Consumer” We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example. We’ll make an exception today though. Our friend Michael Pollaro just sent us a chart update following today’s release of retail sales data. Apparently the data missed the consensus forecasts of economists by several light years. Michael prefaced the chart with “the consumer resurgence!” As our regular readers know, contrary to the mainstream view, we do not regard consumption to be a driver of economic growth. Rising consumption is a result of economic growth, not a cause of it. The causes of economic growth are saving and (wise) investment. The term investment has to be qualified by putting the word “wise” in front of it, because in an economy in which artificially induced credit booms are the norm, a lot of investment will regularly turn out to have been unwise. A recent example was provided by the oil industry, which was misled into making extremely bad investments due to price distortions largely caused by monetary pumping.

Topics:

Pater Tenebrarum considers the following as important: capital consumption, Debt and the Fallacies of Paper Money, Featured, Michael Pollaro, newsletter, On Economy, U.S. Nonfarm Payrolls, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Second Half Recovery Dented by “Resurgent Consumer”We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example. We’ll make an exception today though. Our friend Michael Pollaro just sent us a chart update following today’s release of retail sales data. Apparently the data missed the consensus forecasts of economists by several light years. Michael prefaced the chart with “the consumer resurgence!” As our regular readers know, contrary to the mainstream view, we do not regard consumption to be a driver of economic growth. Rising consumption is a result of economic growth, not a cause of it. The causes of economic growth are saving and (wise) investment. The term investment has to be qualified by putting the word “wise” in front of it, because in an economy in which artificially induced credit booms are the norm, a lot of investment will regularly turn out to have been unwise. A recent example was provided by the oil industry, which was misled into making extremely bad investments due to price distortions largely caused by monetary pumping. |

|

| Consumption growth is however influencing aggregate economic data reported by the government, such as GDP. In that sense, it can be said to affect “growth”. It should be added to this that in our centrally planned fiat money system, a lot of consumption is actually a symptom of capital consumption rather than a reflection of genuine growth.

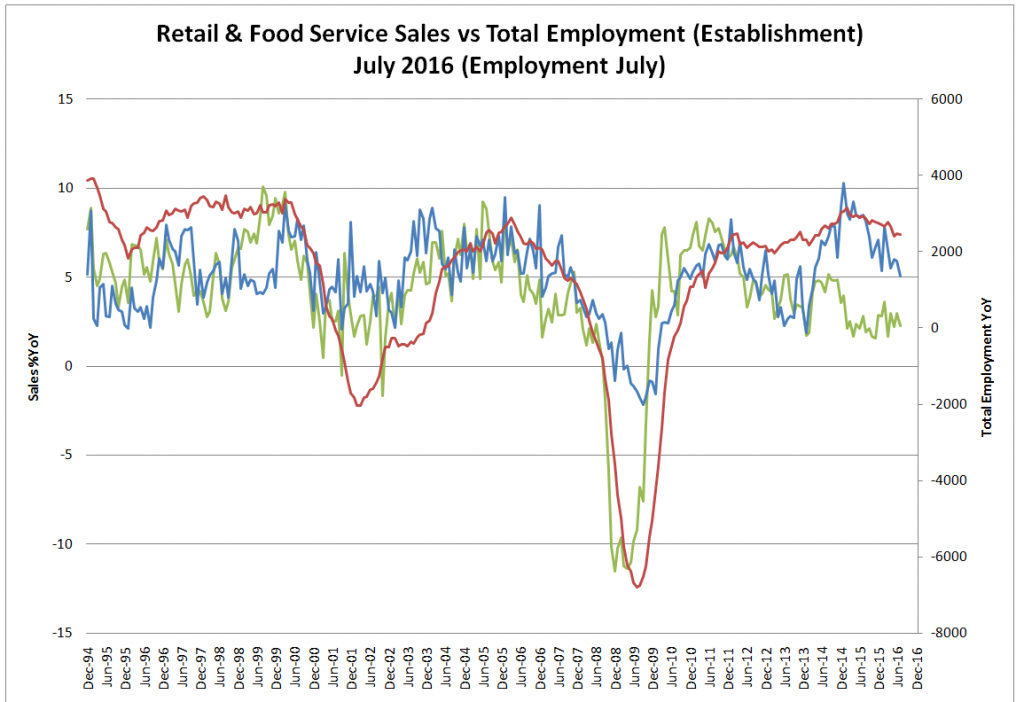

On to Michael’s chart and the reason why we decided to comment on this data release. It seems that this year the traditional “second half recovery” is already running into snags early on. The chart shows retail and food service sales growth and contrasts it with employment growth according to the establishment survey (a.k.a. non-farm payrolls). Restaurant sales growth (food and drinking places) is shown separately: |

|

| As the chart illustrates, similar to what we have seen with many other economic data, retail sales growth and employment growth have begun to drift apart rather noticeably. Historically they have been tightly correlated; wide gaps between them are a fairly rare occurrence.

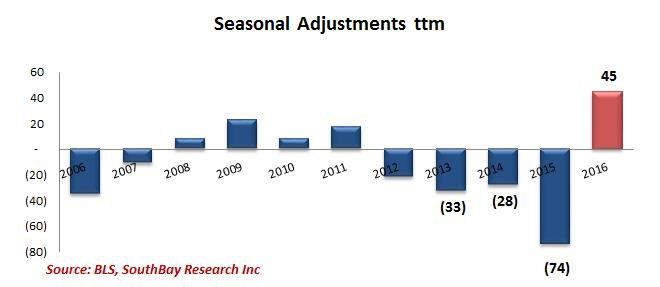

In toehr words, either the current gap is going to be closed one way or the other, or something is wrong with the data. We mention this because Michael also informs us that a number of pundits have immediately chosen to argue that weakness in retail sales growth should be ignored because payrolls growth is so strong. There is a big problem with this argument though (actually, there is more than just one problem with it, but we want to focus on a specific one). As Anthony B. Sanders informs us at the Wall Street Examiner, the July jobs report was largely the figment of a huge seasonal adjustment. What makes this adjustment particularly noteworthy is that it was quite different from the adjustments seen in previous years, as illustrated by the following chart: This probably explains why rate hike odds as reflected by the Fed Funds futures market didn’t change much on the “blow-out” jobs report. |

|

ConclusionIt could well be that we are approaching the point in the economic cycle described by Roger Garrison as follows:

If that is indeed the case, we should expect consensus forecasts to fall prey to a great many more “surprises” (readers may also want to take a look at our in-depth discussion of forced saving in this context). |

Addendum: Consumer Confidence

The current-conditions component of the index slipped 2.7% to 106.1. That was driven by “younger households who cited higher expenses than anticipated as well as somewhat smaller expected income gains,” Michigan’s survey director wrote in a release.

Charts by: Michael Pollaro, South Bay Research