Short Circuited Feedback Loops Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven. Unfortunately, finding and filling gaps in the market is much easier said than done. Even the most successful serial entrepreneurs fail more often than they succeed. What’s more, success in one endeavor doesn’t guarantee success in another. Anyone who has ever developed and marketed a new product from concept through sale knows how difficult it is to achieve profitability. For every good idea there must be a hundred bad ones. Yet the only way to really know the difference between a profit generating idea and a cash hemorrhaging fiasco is through trial and error. Success and failure provide real feedback. They deliver information – at a profit or loss – to businessmen and investors. What’s working? What isn’t? What adjustments can be made to help eke out a profit? These are the types of information that only the market can provide.

Topics:

MN Gordon considers the following as important: Charles Kindleberger, Dan Rather, Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Short Circuited Feedback LoopsFinding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven. Unfortunately, finding and filling gaps in the market is much easier said than done. Even the most successful serial entrepreneurs fail more often than they succeed. What’s more, success in one endeavor doesn’t guarantee success in another. Anyone who has ever developed and marketed a new product from concept through sale knows how difficult it is to achieve profitability. For every good idea there must be a hundred bad ones. Yet the only way to really know the difference between a profit generating idea and a cash hemorrhaging fiasco is through trial and error. Success and failure provide real feedback. They deliver information – at a profit or loss – to businessmen and investors. What’s working? What isn’t? What adjustments can be made to help eke out a profit? These are the types of information that only the market can provide. But what happens when the feedback loop is short circuited and a potential gap in the market is not really a gap after all? What if fraud and folderol turns a desert wasteland into a tropical oasis mirage? What happens is that otherwise intelligent investors are duped into throwing good money after bad. |

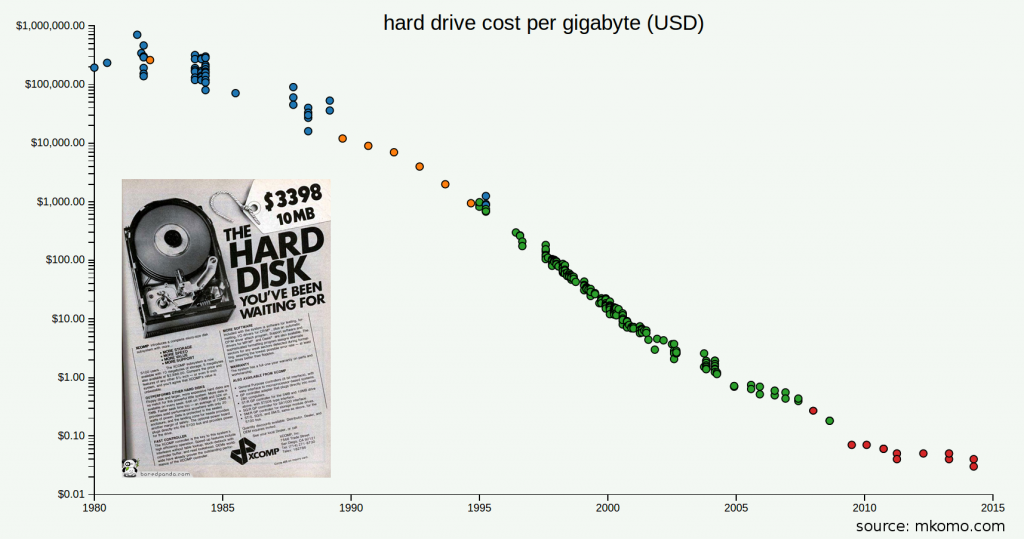

Example of a “commoditized” market – hard-drive storage costs per GB. This is actually the essence of economic progress; this price decline has benefited consumers immensely and vastly enriched their lives. This makes it all the more baffling that central bankers insist we absolutely need price inflation in order to have economic growth (in fact, it actually demonstrates what dangerous lunatics they are). |

Swindle and SpeculationIn his perennial classic Manias, Panics and Crashes, author Charles Kindleberger includes an entire chapter on the Emergence of Swindles. One of Kindleberger’s insights is that speculative booms, often resulting from the cheap credit provided by loose monetary policy, sow seeds of white collar crime and subsequent financial distress. Here we turn to Kindleberger for edification:

No doubt, sleight of hand, smoke and mirrors, trick plays, and the like, add a certain lighthearted delight to life. The fumblerooski. The melon drop. The kid that throws mud at your car half a block before his brother’s car wash. Cons and scams like these sharpen our wits. They prepare us for people and situations that aren’t quite as upright as they first appear. Specifically, they help protect our pocketbook from encounters with mutual fund brokers, Dan Rather, and charity fundraisers. Of course, large scale operations to separate fools from their money are no joke. The consequences can be ruinous. Victims may never recover. |

Charles Kindleberger’s famous tome on manias and crashes. The phenomenon that manias are as a rule accompanied by massive fraudulent activity that is only uncovered after their demise could be observed again and again, throughout history. |

The Great Stock Market SwindleLast week, a Bloomberg report (via Zerohedge) crossed our desk which exquisitely captures the symbiotic disharmony of swindle and speculation described by Kindleberger. Here’s a partial extract:

|

Indeed, one of the reigning hallmarks of our time is the abundance of deceptions that presently pass for standard practice. For example, not long ago, dividend recapitalization – using debt to pay stock dividends – was the sort of dubious practice reserved for private equity firms. These days, thanks to the incentive of the Fed’s ultra-low interest rates, using borrowed money to buy back shares or pay stock dividends is a practice commonly executed by many S&P 500 companies. Perhaps this is one reason why stock prices have gone up in the face of 15 months of declining earnings. Make of it what you will. From our vantage point it appears the entire stock market has turned into a great swindle. Caveat emptor – let the buyer beware. |

| Sometimes they don’t come back: A few famous market manias and crashes – only one of them (the DJIA) actually recovered from its losses, but it took 25 years and only one or two of the components of the average at the time of the crash are still part of it today. Many investors never lived to see the day when they would have theoretically reached breakeven in nominal terms – and very few of them saw the day when it finally recovered in real terms sometime in the mid 1980s. |

Charts by: mkomo.com, Elliott Wave International

Chart and image captions by PT