The coronavirus death toll is just over 900, exceeding the SARS epidemic; the dollar remains firm President Trump will unveil his budget proposal for FY2021 beginning October 1 today The faltering eurozone economy comes just as political uncertainty is picking up in Germany Norway inflation spiked in January; Turkish local rates spiked after regulators cut the FX swap limits for local banks Japan reported December current account data; China January CPI came in at...

Read More »Dollar Firm Ahead of US Jobs Report

The number of confirmed coronavirus cases and deaths continue to rise; the dollar continues to climb The January jobs data is the highlight for the week; Canada also reports jobs data The Fed submits its semiannual Monetary Policy Report to Congress today; Mexico and Brazil report January inflation data The downdraft in eurozone industrial data continues; Russia cut rates 25 bp to 6.0% and signaled more easing ahead RBA upbeat but Governor Lowe warns of “significant...

Read More »Dollar Firm as Markets Await Fresh Drivers

China cut tariffs on $75 bln of US imports by half, while the US said it could reciprocate in some way The dollar continues to climb; during the North American session, only minor data will be reported; Brazil cut rates 25 bp Germany reported very weak December factory orders; all is not well in the German state of Thuringia Czech expected to keep rates steady; Philippines cut 25 bp; India remained on hold Australia reported December trade and retail sales The dollar...

Read More »Tentative Stabilization

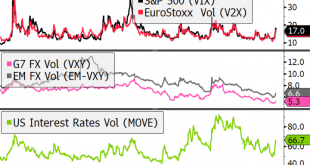

Risk-off continues in Asia, but moves have been less dramatic European market jittery but stable Implied rates now pricing in a full Fed cut by September The UK will announce its decision on Huawei’s access to the country’s 5G network The dollar is slightly stronger against most major currencies, so DXY continues on its very gradual grind higher. The index is up 1.6% since the start of the year. Of note, the Australian dollar is down 0.3% reaching at 3-month low at...

Read More »Sharp Sell-Off on Virus Concerns

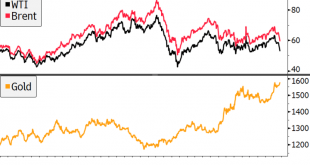

Global stocks lower on virus fears, yen appreciates, and yield curves flatten Oil prices continue to fall while gold rises Italian assets outperform on favorable election results for ruling coalition German IFO survey disappoints, trimming nascent green shoots The dollar is mixed against DM and broadly stronger against EM. On the former, the yen is outperforming (+0.4%), heading to the sixth day of consecutive appreciation, now back below the ¥109.0 level. AUD and...

Read More »Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus US steps up trade rhetoric against EU and pushes back against UK digital tax plan AUD stronger on solid Australian jobs report and pricing out of RBA easing CAD weaker on dovish BOC communication yesterday Norges Bank and Bank Indonesia keep rates on hold, as expected ECB meeting concludes shortly, markets await kickoff of strategic review The dollar is mixed against major currencies but mostly stronger...

Read More »Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight US President Trump and French president Macron agreed to take a step back from the digital tax dispute The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light The UK reported firm jobs data for November; BOJ kept policy steady, as expected Moody’s downgraded Hong Kong by a notch to Aa3 with stable outlook; data out of Asia suggest...

Read More »Dollar Soft Ahead of Retail Sales Data

There were no surprises in the US-China Phase One trade deal The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today Bank of England credit survey showed demand for loans fell in Q4 Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5% Japan reported November core machine orders and December PPI; China’s credit numbers for December showed no big change in lending...

Read More »Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction The North American session is quiet in terms of US data Mexico reports December CPI; Peru is expected to keep rates steady at 2.25% German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney Israel is expected to keep rates steady at 0.25% China reported December...

Read More »Risk Assets Rally as Major Tail Risks Ease

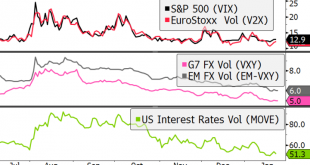

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off During the North American session, US November retail sales will be reported Russia central bank cut rates 25 bp to 6.25%, as expected Bank of Japan released a mixed Q4 Tankan report The dollar is broadly lower against the majors as tail risk evaporates. Nokkie and sterling are outperforming, while Aussie and yen are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org