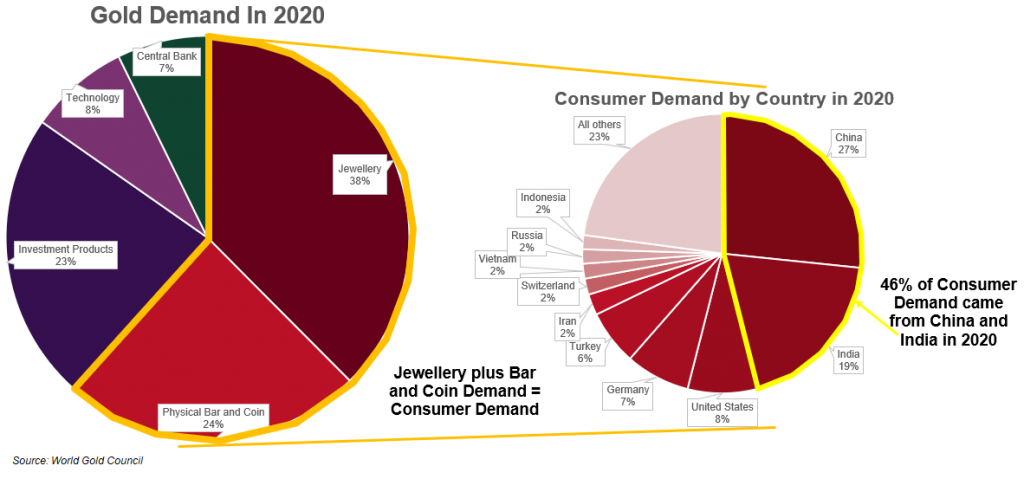

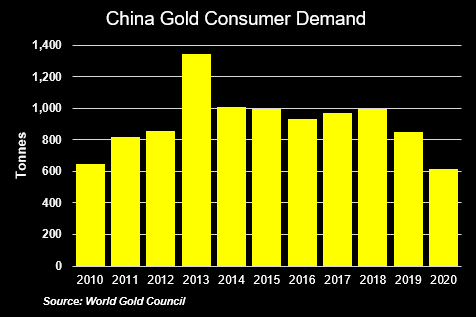

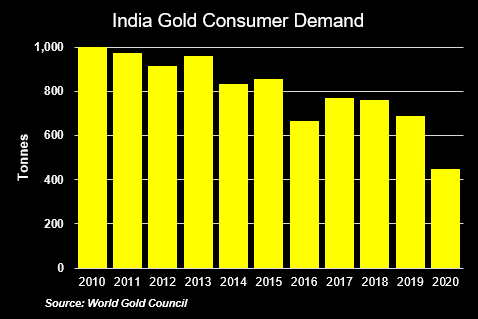

ETF gold demand from investors has soared over the past year. The unprecedented fiscal and monetary stimulus were rolled out to tackle the effects of Covid -19. However, consumer demand, particularly but not surprisingly, jewellery demand slumped. What’s in store for gold demand fundamentals for 2021? Increased consumer demand in China and India will help support the gold price in 2021. There is little doubt that investment demand – especially into Exchange Traded Funds (ETFs), the similar products was the main driver of the gold price higher in 2020. According to World Gold Council data, total ETF demand surged 120% from 398.3 tonnes in 2019 to a new record high in 877.1 tonnes in 2020. However, consumer demand, comprised of jewellery plus bar as coin demand

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, china gold consumer demand, china gold demand, chinese consumer demand for gold consumer demand by for gold by counttry, Commentary, consumer demand for gold, Daily Market Update, etf gold demand, Featured, gold demand, gold demand 2020, gold demand 2021, gold demand fundamentals, gold jewellery demand, India gold consumer demand, newsletter, World Gold Council

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Tags: china gold consumer demand,china gold demand,chinese consumer demand for gold consumer demand by for gold by counttry,Commentary,consumer demand for gold,Daily Market Update,etf gold demand,Featured,gold demand,gold demand 2020,gold demand 2021,gold demand fundamentals,gold jewellery demand,India gold consumer demand,newsletter,World Gold Council