Published on Independent Trustee Company (27/05/2020) ◆ With the current level of uncertainty in world markets we have received numerous requests for information on how self directed pension schemes (pre and post retirement) can hold gold and silver. It is accepted that if gold bullion is held via a gold certificates ( Perth Mint Certificates with GoldCore) or in Secure Storage in a variety of local or international locations with GoldCore, then it is not considered...

Read More »Pandemic, Lockdowns, Fake and Manipulated Markets – Gold and Silver Outlook

Watch Video Update (Live 12/05/2020 ◆ The massive global debt driven “Everything Bubble” is bursting due to the pandemic and more specifically the governments draconian economic lockdowns ◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion ◆ Wall Street has just been bailed out at the expense of Main Street and families and businesses in the U.S. and throughout most of the...

Read More »Trump Threatens China Seeking $160 Billion In “COVID-19 Reparations”after China Gold Exchange Calls For New Super Sovereign Currency

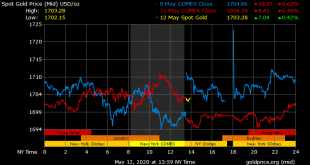

Gold in USD – 3 Days - Click to enlarge “Yes It Will. The Only Question Is When” – WATCH HERE [embedded content] You Might Also Like Gold Surges To New Record Highs in Euros at €1,581/oz and $1,726/oz in Dollars Gold prices surged to new all time record highs in euros and other digital fiat currencies today due to concerns about the outlook for risk assets and currencies in an era of unprecedented...

Read More »Gold Will Reach $3,000/oz: “Fed Can’t Print Gold” and Is “Ultimate Store Of Value” – Bank of America

Gold prices are 0.7% higher today after falling just 0.3% yesterday as traders sought refuge in safe haven gold as oil prices collapsed lower again. Oil slumped to nearly $15 a barrel, its lowest since 1999 as the economic fallout from government lockdowns and the shutting down of entire economies impacts risk assets and commodities dependent on economic growth. WTI crude is now down 81% and Brent crude down 71% so far in 2020. Gold price forecasts are being...

Read More »Gold Surges To New Record Highs in Euros at €1,581/oz and $1,726/oz in Dollars

◆ Gold prices surged to new all time record highs in euros and other digital fiat currencies today due to concerns about the outlook for risk assets and currencies in an era of unprecedented economic and monetary risk. ◆ Gold prices rose to a more than seven-year high in dollars today at $1,726/oz (see chart below) as mounting fears of a steeper global economic downturn due to draconian government lock downs increase and highlight gold bullion’s safe haven...

Read More »Global Supply of Gold and Silver Coins and Bars Evaporated In Safe Haven Rush

◆ GoldCore remain open for business unlike many dealers, mints and refineries (see News below) and we continue to buy bullion coins and bars and sell gold bars (1 kilo). The supply situation changes hour to hour. ◆ We, like the entire industry have experienced record demand in recent days and the global supply of gold and silver bullion coins (legal tender 1 oz) and gold bars (in 1 oz and 10 oz formats) has quickly evaporated. We continue to have gold bars (1 kilo)...

Read More »Don’t Panic – Prepare

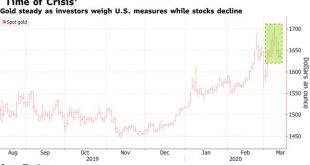

“Let’s Deal With The Facts Now” – Watch Interview Here ◆ Markets have collapsed around the world as we predicted as the ‘Giant Ponzi Everything Bubble’ meets the massive pin that is the coronavirus’ impact on already vulnerable indebted economies. ◆ Stocks have crashed and bond markets and banks may be next … “bank holidays”, bail-ins and currency resets are likely ◆ The virus is a final “snow flurry” which is unleashing the financial and economic avalanche. ◆...

Read More »Gold Hedging Stock Market Crash: Euro Stoxx -6%, FTSE -5.7% and DAX -5.6%

◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised. ◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground. ◆ The FTSE 100 is down 5.8% in early trade, while Frankfurt’s DAX 30 plunged 6.8% the CAC 40 tumbled 6.5% and Dublin’s ISEQ index collapsed another...

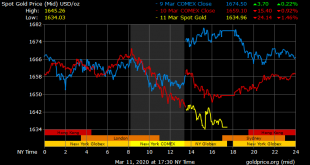

Read More »Gold Gains As Bank of England Slashes to Emergency Rate of 0.25percent and ECB Warns Of 2008 Style “Great Financial Crisis”

◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight. ◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy. Gold only saw a marginal gain of 0.45% in sterling to £1,285/oz but remains near all time record highs of...

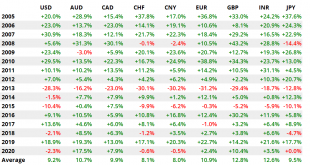

Read More »Gold Surges 3 percent After U.S. Fed’s First Emergency Rate Cut Since 2008

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table) ◆ G7 officials say there will be “appropriate” policy moves in a desperate attempt to prevent the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org