Markets have struggled to find a clear direction as they attempt to digest US election news, debate performance, the impact of increased Covid-19 restrictions in many countries and vaccine news. The charts of gold and silver reflect the battle for dominance between the Bulls and the Bears. Today’s silver chart is a bit more crowded and busy than usual. Silver has continued to close just above the major trend line support from the March lows. It is also trading below...

Read More »Heavy Metal Selling

Anxiety about an increase in Covid19 cases and fears of a second wave coupled with revelations of historic money laundering practices of major global banks weighed heavily on financial markets yesterday. Precious metals were not immune to the sell off which saw gold below $1,900 and silver off a whopping 12% during intraday trading. The following charts show the short term support that halted the rout in precious metals by the end of the day. With the negative news...

Read More »Gold is Looking Strong as it Tests Resistance

Since it’s sell-off from it’s early August high, gold has been stuck in an ever decreasing range. Having had a remarkable rally to an intra-day high of $2,078 on the 7th of August Gold has traded sideways and consolidated. This has been viewed by many market commentators as a healthy pause in gold’s bull rally as when markets go parabolic they tend to retrace just as fast. The underlying rationale for owning gold has not change over the last month and some would say...

Read More »Gold Will “Trend Toward $10,000 Per Ounce Or Higher” Over The Next Four Years

◆ Central Banks Are “Gold’s Greatest Ally” and They Will Push Gold Prices Much Higher Jim Rickards holds gold bar in Zurich vault You’re likely aware of the price action in gold lately. Gold has rallied from $1,591 per ounce on April 1 to $1,782 per ounce as of today. That’s a 12% gain in less than three months. My earlier forecast was that gold would hit $1,776 by the Fourth of July. I guess I was a bit early! Today’s price of $1,782 per ounce is the highest since...

Read More »Gold Outperforms All Assets In 2020 YTD as Enters Seasonal Sweet Spot of July, August and September

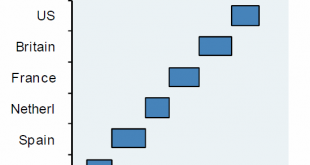

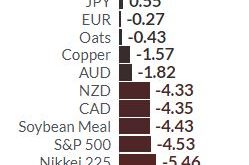

◆ Gold is the top performing asset in the world in the first half of 2020, outperforming all stock markets including the S&P 500 and the Nasdaq and outperforming “safe haven” U.S. government bonds (see table above). Gold had an 18% gain in dollars in the first half of 2020 as risk assets, especially stock markets, fell sharply with the S&P down 4.5% and other stock markets down more than 10% (see table). Gold gained 18.6% in euros and by 25% in British...

Read More »World’s Ultra Wealthy Urged By Financial Advisers and Largest Banks to “Hold More Gold”

◆ World’s wealthy are being urged by their financial advisers to hold more gold as they question the strength of the stock market rally and are concerned about the long-term impact of global central banks’ cash splurge. ZURICH /LONDON (via Reuters) – As stock markets roar back from the coronavirus led rout, advisers to the world’s wealthy are urging them to hold more gold, questioning the strength of the rally and the long-term impact of global central banks’ cash...

Read More »A Dollar Crash Is Coming

◆The world is having serious doubts about the once widely accepted presumption of American exceptionalism. The era of the U.S. dollar’s “exorbitant privilege” as the world’s primary reserve currency is coming to an end. In the 1960s French Finance Minister Valery Giscard d’Estaing coined that phrase largely out of frustration, bemoaning a United States that drew freely on the rest of the world to support its overextended standard of living. For almost 60 years, the...

Read More »Why Gold Is Safe Haven Money And Will Go Over $3,000/oz

James Rickards holds a gold bar in a vault near Zurich, Switzerland. The bar is a so-called LBMA “good delivery” bar which weigh 400 ounces (over 99.9% purity), and is worth about $700,000 at current market prices. In 1971 it was worth $14,000. ◆ WHY GOLD? That’s a question I’m asked frequently. It’s usually followed by a comment along the lines of, “I don’t get it. It’s just a shiny rock. People dig it out of the ground and then put it back in the ground. What’s the...

Read More »Global Silver Investment Demand To Surge While Supply Weak (World Silver Survey 2020)

◆ WORLD SILVER SURVEY 2020 from the SILVER INSTITUTE GLOBAL SILVER DEMAND EDGED HIGHER IN 2019, WITH INVESTMENT DEMAND UP 12%, WHILE SILVER MINE SUPPLY FELL FOR THE FOURTH CONSECUTIVE YEAR Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal. Favorable structural changes, such as vehicle electrification and a...

Read More »Pandemic, Economic Shutdowns, Debt Crisis and Gold At $5,000/oz

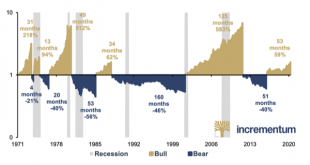

◆ GoldCore are delighted to publish the 14th edition of the annual “In Gold We Trust” report, “The Dawning of a Golden Decade” by by our friends Ronald-Peter Stoeferle & Mark J. Valek of Incrementum AG. Gold prices should rise to over $5,000/oz and may rise as high as $9,000/oz in the coming decade and by 2030, according to the respected report. Gold is “on everyone’s lips again” and “we are now in a new phase of the bull market”. The question that now occupies...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org