You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that? Last month, the Census Bureau reported that retail sales during the Christmas holiday were a disaster. It was Christmas...

Read More »Downturn Rising, German Industry

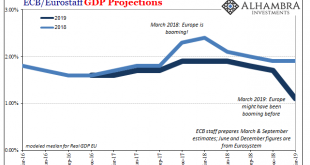

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were. If you read nothing other than Bloomberg, it’s as if some alien...

Read More »Not Buying The New Stimulus

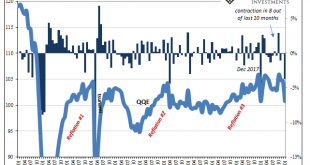

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates. The reaction to this new round was immediately negative: The euro and euro zone government bond yields fell sharply...

Read More »Limited upside for USD/JPY but significant downside

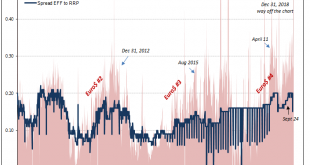

Our baseline scenario suggests limited upside potential for the dollar against the yen, given the current low stock market volatility environment.The Japanese yen has been weak recently, as volatility in the US stock market has receded. Indeed, the sharp increase in US stock market volatility at the end of last year favoured the yen through short-covering and repatriation flows, whereas the subsequent rebound in global risk appetite has penalised the defensive yen (see chart).This recent...

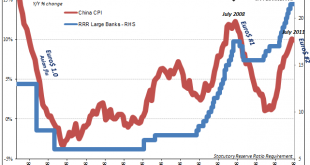

Read More »China Has No Choice

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China. This was amended in...

Read More »Meanwhile, Over In Asia

While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something. Therefore, Q4 US GDP wasn’t as bad as feared, cushioning...

Read More »No Surprise, Hysteria Wasn’t a Sound Basis For Interpretation

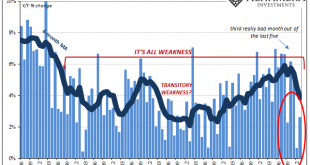

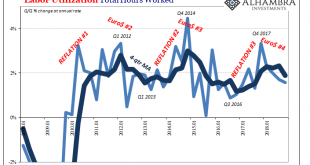

What gets them into trouble is how they just can’t help themselves. Go back one year, to early 2018. Last February it was all-but-assured (in mainstream coverage) that the US economy was going to take off. The bond market, meaning UST’s, was about to be massacred because the overheating boom would force a double shot down its throat. Not only would safety instruments like UST’s have to contend with the unemployment...

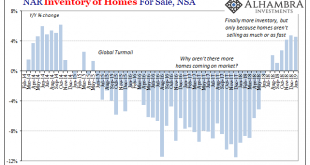

Read More »The Fate of Real Estate

For years, realtors have been waiting for more housing inventory. It had become an article of faith, what was restraining a full-blown recovery was the lack of units available. The level of resales like construction was up, but still way, way less than it was now fourteen years past the prior peak despite sufficient population growth to have absorbed the previous bubble’s overbuilding. All the way back in March 2017,...

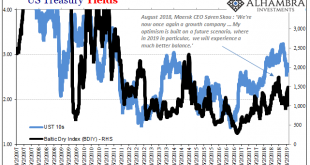

Read More »Sinking Shippers Signal Global Goods Troubles

It infects every boardroom across the world. Big business requires decent forecasting, yet time and again it seems they are deprived of what they desperately need. Instead, even after this last decade, the world’s largest companies continue to be surprised by weakness that is far more prevalent than strength. It has been the one constant. Central bankers declare their policies successful, ignoring mountains of...

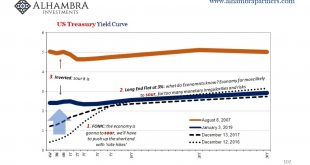

Read More »FOMC Minutes: The New Narrative Takes Shape

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances. Interpretations matter. Conventional wisdom seems settled...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org