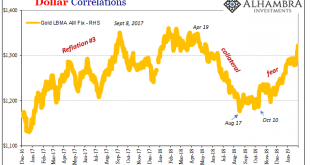

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way. Like 2017, when gold was last rising, there...

Read More »Monthly Macro Monitor – January 2019

A Return To Normalcy In the first two years after a newly elected President takes office he enacts a major tax cut that primarily benefits the wealthy and significantly raises tariffs on imports. His foreign policy is erratic but generally pulls the country back from foreign commitments. He also works to reduce immigration and roll back regulations enacted by his predecessor. This President is widely rumored to have...

Read More »The Strongest Season for Silver Has Only Just Begun

Commodities as an Alternative Our readers are presumably following commodity prices. Commodities often provide an alternative to investing in stocks – and they have clearly discernible seasonal characteristics. Thus heating oil tends to be cheaper in the summer than during the heating season in winter, and wheat is typically more expensive before the harvest then thereafter. Precious metals are also subject to seasonal...

Read More »2019 Outlook

A discussion of the outlook for 2019 in the markets and the economy by Alhambra CEO Joe Calhoun and the Head of Alhambra Global Investment Research Jeff Snider. [embedded content] Related posts: Euro Credit: 2019 Outlook Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC Core Euro Sovereign Bonds 2019 Outlook A Couple...

Read More »Living In The Present

The secret of health for both mind and body is not to mourn for the past, nor to worry about the future, but to live in the present moment wisely and earnestly. Buddha Review It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable...

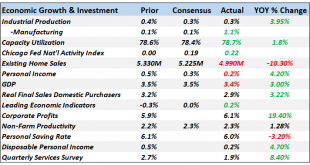

Read More »Monthly Macro Monitor – November 2018

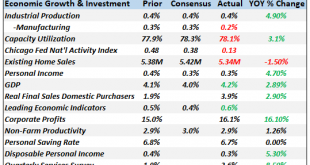

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

Read More »Weekly View – SHIFTING SCALES

The CIO office’s view of the week ahead.Oil is on a losing streak. 12 consecutive days of falling prices led to a rise in high yield spreads. Because this decline has been largely supply-, rather than demand-driven and on the front-end of the forward curve, we are not overly alarmed about the long-term prospects of the oil price at this point. However, as a result of these recent moves, US high yield has suffered in particular, putting pressure on financial conditions. This was followed by...

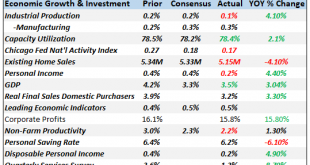

Read More »Monthly Macro Monitor – October 2018

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly. The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a...

Read More »How Dangerous is the Month of October?

A Month with a Bad Reputation A certain degree of nervousness tends to suffuse global financial markets when the month of October approaches. The memories of sharp slumps that happened in this month in the past – often wiping out the profits of an entire year in a single day – are apt to induce fear. However, if one disregards outliers such as 1987 or 2008, October generally delivers an acceptable performance....

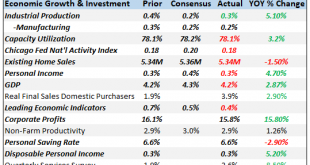

Read More »Monthly Macro Monitor – September

This has already been one of the longest economic expansions on record for the US and there is little in the data or markets to indicate that is about to come to an end. Current levels of the yield curve are comparable to late 2005 in the last cycle. It was almost two years later before we even had an inkling of a problem and even in the summer of 2008 – nearly three years later – there was still a robust debate about...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org